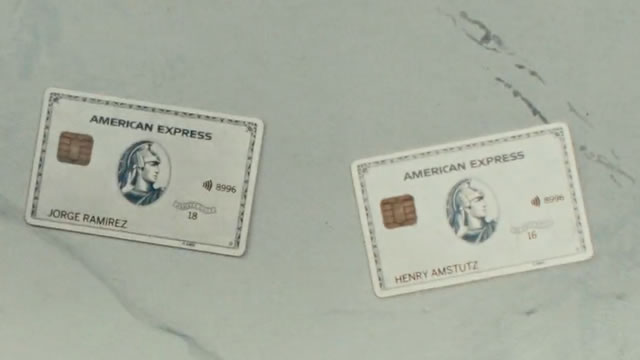

American Express Co. (AXP)

Warren Buffett Sold $133 Billion Worth of Stocks This Year: Here Are 2 He's Not Selling

Warren Buffett's Berkshire Hathaway (BRK.A 0.07%) (BRK.B -0.01%) has been selling stocks at a higher clip than usual this year. Through the first three quarters of 2024, Berkshire sold $133 billion worth of stocks.

Why American Express (AXP) is a Top Stock for the Long-Term

Finding strong, market-beating stocks with a positive earnings outlook becomes easier with the Focus List, a top feature of the Zacks Premium portfolio service.

3 No-Brainer Fintech Stocks to Buy Right Now for Less Than $1,000

Given that money -- and technology -- make the world go round, it's not surprising that the combination can make for some of the world's most rewarding investments. Here's a closer look at three fantastic fintech stocks you can buy in quantity, even if you've only got $1,000 to work with.

3 Dividend Stocks to Double Up on Right Now

Here are three payment stocks that are well-positioned to perform in strong or weak market cycles.

AmEx Stock Trades Near 52-Week High: What's Next for Investors?

AXP is expected to benefit from a loyal customer base and product enhancements. It is well-positioned to capture a higher market share and increase card acquisitions.

Earnings Growth & Price Strength Make American Express (AXP) a Stock to Watch

The Zacks Focus List offers investors a way to easily find top-rated stocks and build a winning investment portfolio. Here's why you should take advantage.

The Best Warren Buffett Stock to Invest $1,000 in Right Now

American Express deserves a spot in your long-term portfolio.

AXP or MCO: Which Is the Better Value Stock Right Now?

Investors interested in Financial - Miscellaneous Services stocks are likely familiar with American Express (AXP) and Moody's (MCO). But which of these two companies is the best option for those looking for undervalued stocks?

3 No-Brainer Warren Buffett Stocks to Buy Right Now

It's tough to compete with the success of Warren Buffett. Here are three investments from the Berkshire Hathaway portfolio that I love.

3 Rock-Solid Dividend Stocks You Can Buy and Hold Forever

In a frothy market starved for value, these three dividend stocks combine reasonable valuations with the proven ability to disrupt themselves.

Why You Should Be Buying This Warren Buffett Stock Hand Over Fist

Don't be swayed by the bears; this finance sector mainstay remains a world-beater.

Want to Grow a Passive Income Snowball? Buy These 7 Elite Dividend Growth Stocks.

These seven companies are transforming steady profits into rising passive income streams for investors.