Barrick Mining Corporation (B)

Barrick Mining's Gold Sales Volumes Rebound: Will It Sustain in Q3?

Barrick Mining posts a rebound in gold sales on higher production, with stronger output expected in the second half.

Barrick Mining: Turnaround Thesis Remains Intact

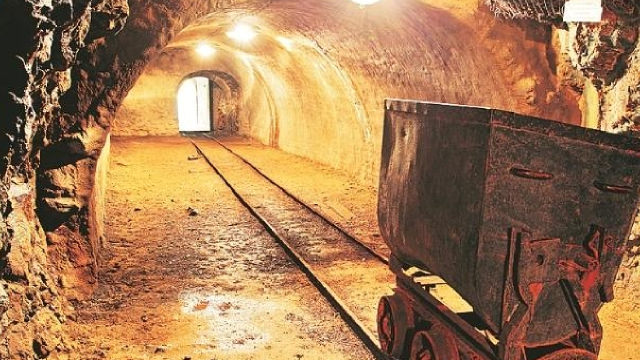

Barrick Mining Corporation put together put Q2 '25 results and should see a stronger H2'25, with free cash flow in H1'25 unfortunately affected by the temporary suspension of operations at Loulo-Gounkoto. And while operational setbacks and rising operating costs have weighed on sentiment heading into this year, but reserve replacement, exploration success & a strong growth profile support the long-term thesis. With negativity surrounding Mali already reflected in the stock and priced in, B stock remains the best catch-up trade among major gold producers, and any sharp pullbacks should provide buying opportunities.

Why Barrick Mining (B) is a Top Value Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Barrick Mining's Gold Output Rebounds: Can Momentum Build Ahead?

Barrick Mining's gold output rose 5% in Q2 to 797,000 ounces, with stronger gains expected in the second half of 2025.

Here's Why Barrick Mining (B) is a Strong Growth Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

What Makes Barrick Mining (B) a Strong Momentum Stock: Buy Now?

Does Barrick Mining (B) have what it takes to be a top stock pick for momentum investors? Let's find out.

Buy These 3 Stocks With Upgraded Broker Ratings for Solid Returns

Ralph Lauren, CommScope and Barrick Mining earn notable broker upgrades, signaling potential for strong returns.

Barrick Mining's Higher AISC a Drag: Time to Tighten Cost Discipline?

B's AISC rises 12% year over year in Q2 on higher cash costs and lower output, signaling a push for tighter cost control ahead.

Barrick Mining Q2 Earnings Meet Estimates, Sales Up on Higher Prices

B posts Q2 profit jump on higher gold prices. Affirms 2025 guidance.

Barrick Mining Corporation (B) Q2 2025 Earnings Call Transcript

Barrick Mining Corporation (NYSE:B ) Q2 2025 Earnings Conference Call August 11, 2025 11:00 AM ET Company Participants Dennis Mark Bristow - President, CEO, Member of International Advisory Board & Director Graham Patrick Shuttleworth - Senior EVP & CFO Conference Call Participants Anita Soni - CIBC Capital Markets, Research Division Daniel Edward Major - UBS Investment Bank, Research Division John Charles Tumazos - John Tumazos Very Independent Research, LLC Joshua Mark Wolfson - RBC Capital Markets, Research Division Martin Pradier - Veritas Investment Research Corporation Matthew Murphy - BMO Capital Markets Equity Research Operator Welcome to Barrick's Results Presentation for the Second Quarter of 2025. [Operator Instructions].

Barrick Mining (B) Q2 Earnings: How Key Metrics Compare to Wall Street Estimates

The headline numbers for Barrick Mining (B) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

3 Gold Mining Stocks Set to Pull Off a Beat This Earnings Season

Gold mining companies' Q2 results are expected to reflect the benefits of higher prices and efforts to reduce costs. B, FNV and ITRG look set to beat earnings estimates this season.