Barrick Mining Corporation (B)

Here's Why You Should Avoid Investing in Barnes Stock Right Now

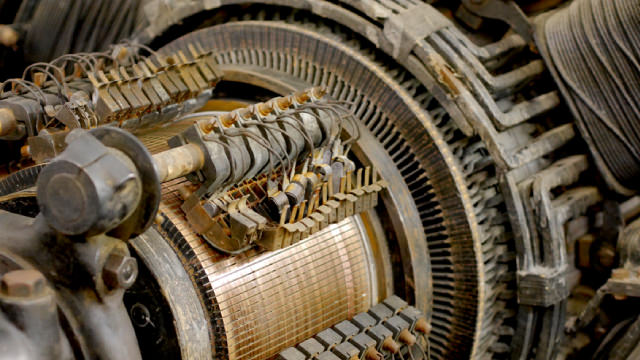

Weakness in the Industrial segment and increasing operating costs weigh on B. Unfavorable foreign currency movement is an added concern.

International Markets and Barnes Group (B): A Deep Dive for Investors

Evaluate Barnes Group's (B) reliance on international revenue to better understand the company's financial stability, growth prospects and potential stock price performance.

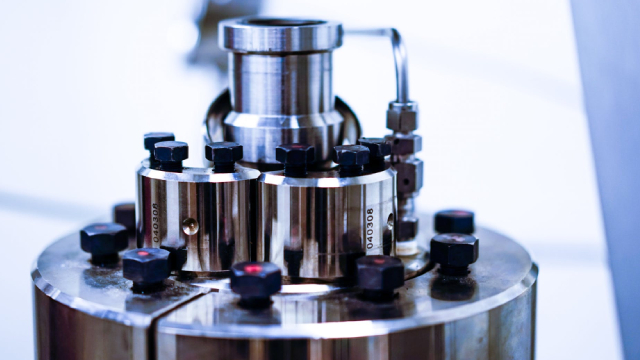

Barnes Group's Q3 Earnings Miss Estimates, Sales Rise Y/Y

B's third-quarter sales increase 7% year over year, driven by the impressive performance of its Aerospace segment.

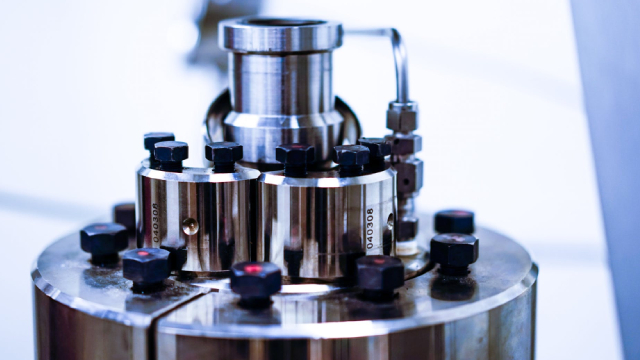

Barnes Group (B) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for Barnes Group (B) give a sense of how its business performed in the quarter ended September 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Barnes Group (B) Q3 Earnings Miss Estimates

Barnes Group (B) came out with quarterly earnings of $0.09 per share, missing the Zacks Consensus Estimate of $0.39 per share. This compares to earnings of $0.19 per share a year ago.

Barnes & Noble Education: Unlocking Potential Through First Day Programs

Barnes & Noble Education's First Day Complete program is driving growth, with the potential to significantly boost EBITDA through increased student adoption. Strengthened balance sheet supporting future expansion, with significant upside under new management. BNED's stock is undervalued, trading at

SHAREHOLDER INVESTIGATION: The M&A Class Action Firm Investigates the Merger of Barnes Group Inc. - B

NEW YORK, NY / ACCESSWIRE / October 8, 2024 / Monteverde & Associates PC (the "M&A Class Action Firm"), has recovered money for shareholders and is recognized as a Top 50 Firm in the 2018-2022 ISS Securities Class Action Services Report. We are headquartered at the Empire State Building in New York City and are investigating Barnes Group Inc. (NYSE:B) , relating to its proposed merger with Apollo Global Management, Inc. Under the terms of the agreement, all Barnes Group common stock will be converted into the right to receive $47.50 in cash.

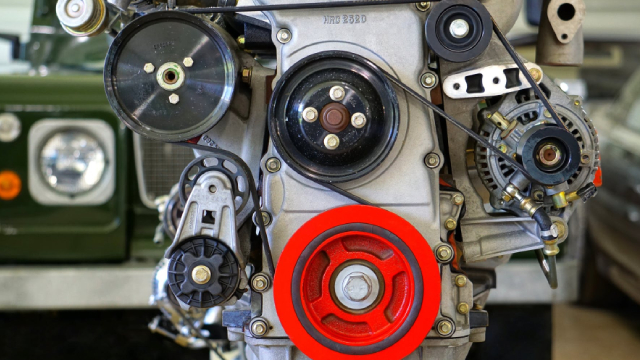

Barnes Set to be Acquired by Apollo Funds for $3.6 Billion

B is set to be acquired by Apollo Global in a $3.6 billion cash deal, offering $47.50 per share to shareholders.

Here's Why You Should Steer Clear of Barnes Stock Right Now

Weakness in the Industrial segment and increasing operating costs weigh on B. Unfavorable foreign currency movement is an added concern.

New Strong Sell Stocks for September 11th

B, CNMD and CHEOY have been added to the Zacks Rank #5 (Strong Sell) List on September 11, 2024.

Here's Why You Should Avoid Investing in Barnes Stock Now

Softness in the Industrial segment and increasing operating costs weigh on B. Unfavorable foreign currency movement is an added concern.

Why Barnes Group (B) International Revenue Trends Deserve Your Attention

Examine Barnes Group's (B) international revenue patterns and their implications on Wall Street's forecasts and the prospective trajectory of the stock.