Becton, Dickinson and Company (BDX)

BDX Stock Gains Following Q4 Earnings Beat and Higher Margins

BD's overall topline in the fourth quarter of fiscal 2024 benefits from revenue growth in all segments.

Becton Dickinson (BDX) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

The headline numbers for Becton Dickinson (BDX) give insight into how the company performed in the quarter ended September 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Becton Dickinson (BDX) Q4 Earnings and Revenues Surpass Estimates

Becton Dickinson (BDX) came out with quarterly earnings of $3.81 per share, beating the Zacks Consensus Estimate of $3.77 per share. This compares to earnings of $3.42 per share a year ago.

Becton Dickinson beats quarterly estimates on strength in drug-delivery devices

Becton Dickinson surpassed analysts' expectations for fourth-quarter results on Thursday, helped by strong demand for its drug-delivery devices.

Can Sustained Product Demand Drive BDX Stock Before Q4 Earnings?

Continued solid uptake of BD's products is expected to have driven fiscal fourth-quarter revenues.

Insights Into Becton Dickinson (BDX) Q4: Wall Street Projections for Key Metrics

Get a deeper insight into the potential performance of Becton Dickinson (BDX) for the quarter ended September 2024 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

Becton, Dickinson And HP Among 13 Companies To Announce Annual Dividend Increases In First Half Of November

This is my latest article where I provide predictions of upcoming dividend increases from companies with long-term dividend growth histories. I expect 13 companies to announce their annual increases in the first half of November, including double-digit increases from Automatic Data Processing, Roper Technologies, and Snap-on. Investors saw good 10%+ increases from insurer Brown & Brown, payment processor Visa, and specialty chemical company RPM in October.

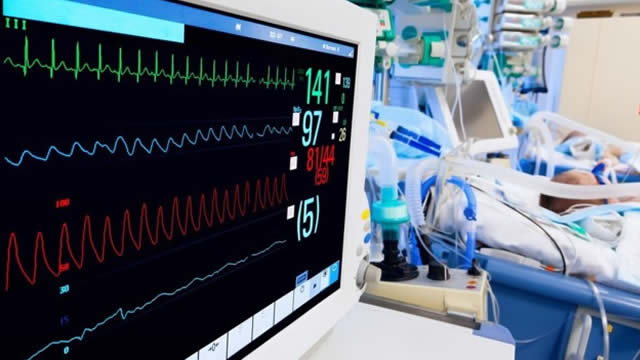

BDX Stock Declines Despite Launching BD IO Vascular Access System

BD announces the BD Intraosseous Vascular Access System to enable quick vascular access for critical care situations.

Becton Dickinson (BDX) Earnings Expected to Grow: Should You Buy?

Becton Dickinson (BDX) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Here's Why Becton Dickinson (BDX) is a Strong Value Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Here's Why Becton Dickinson (BDX) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

3 Reasons Why Becton Dickinson (BDX) Is a Great Growth Stock

Becton Dickinson (BDX) possesses solid growth attributes, which could help it handily outperform the market.