Capcom Co., Ltd. ADR (CCOEY)

Summary

Capcom: Record First-Half Profitability, Sector-Low Valuation, And 40% Upside (Rating Upgrade)

Capcom reported record first-half profitability, driven by digital content and strong amusement equipment results. Catalog unit sales rose 20.6% year over year, supporting a 62.9% segment operating margin. Operating cash flow declined due to front-loaded development and capital expenditures ahead of major 2026 releases.

Capcom Vs. Bandai Namco: Both Buys, But Bandai Namco Wins On Value And Upside

Capcom compounds through digital scale, high margins, strong free cash flow, and low reinvestment needs. Bandai Namco trades near 12.4x EV/EBITDA versus a 20.3x peer median despite global IP like Elden Ring, Gundam, and Dragon Ball. Twelve-month upside estimates: 13.5% for Capcom and 36.7% for Bandai Namco based on forward EBITDA growth and reasonable multiples.

Capcom (CCOEY) is on the Move, Here's Why the Trend Could be Sustainable

If you are looking for stocks that are well positioned to maintain their recent uptrend, Capcom (CCOEY) could be a great choice. It is one of the several stocks that passed through our "Recent Price Strength" screen.

Capcom Co., Ltd. ADR (CCOEY) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

Has Capcom Co., Ltd. ADR ever had a stock split?

Capcom Co., Ltd. ADR Profile

| Electronic Equipment, Instruments & Components Industry | Information Technology Sector | Mr. Kenzo Tsujimoto CEO | OTC PINK Exchange | 13916V107 CUSIP |

| JP Country | 3,531 Employees | 29 Nov 2019 Last Dividend | 5 Apr 2024 Last Split | - IPO Date |

Overview

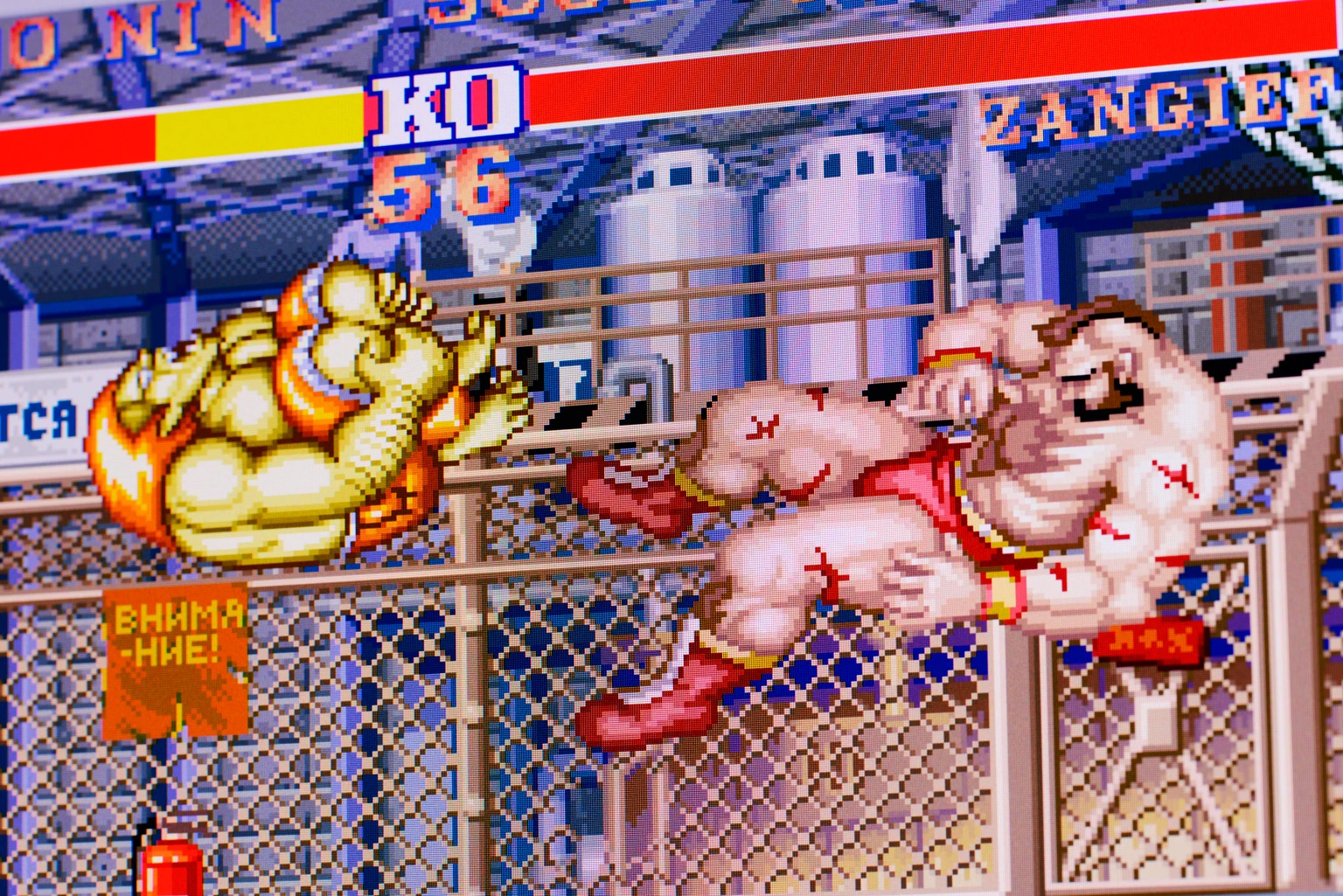

Capcom Co., Ltd., established in 1979 and based in Osaka, Japan, is a widely recognized entity in the gaming industry, engaging in the planning, development, manufacturing, sales, and distribution of a diverse portfolio of gaming products. These products span several major categories including home video games, online games, mobile games, and arcade games, with operations extending both domestically within Japan and internationally. Capcom's business operations are organized into four main segments: Digital Contents, Arcade Operations, Amusement Equipments, and Other Businesses, each contributing to its stature in the global gaming market. Additionally, Capcom ventures into multimedia entertainment, adapting its game content for movies, animated TV programs, and merchandise, and invests in the growing esports sector.

Products and Services

Capcom Co., Ltd. offers a wide range of products and services through its diversified operational segments, each tailored to meet the demands of the evolving gaming and entertainment industry:

- Digital Contents: This segment is dedicated to the development and sales of digital gaming content, targeting consumers on home video game platforms. It also covers the production of mobile content and PC online games, focusing on delivering immersive gaming experiences through digital channels.

- Arcade Operations: Under this segment, Capcom operates Plaza Capcom amusement facilities, situated primarily in commercial complexes. These facilities offer a variety of gaming and entertainment experiences, accompanied by hosting various events aimed at engaging the gaming community and promoting Capcom's titles.

- Amusement Equipments: This segment specializes in the development, manufacture, and sale of a broad array of amusement equipment. It includes software for gaming machines, as well as hardware components such as frames and LCD devices, provisioning the arcade and amusement park industry with high-quality entertainment solutions.

- Other Businesses: Capcom's engagement extends beyond traditional gaming, adapting its game content for different forms of media and entertainment such as movies, animated television programs, music CDs, and merchandise. This segment also underscores Capcom's commitment to esports, allocating resources to support competitive gaming events and initiatives.