Cognex Corporation (CGNX)

Analysts Are Bullish on These 3 Laser Tech Companies

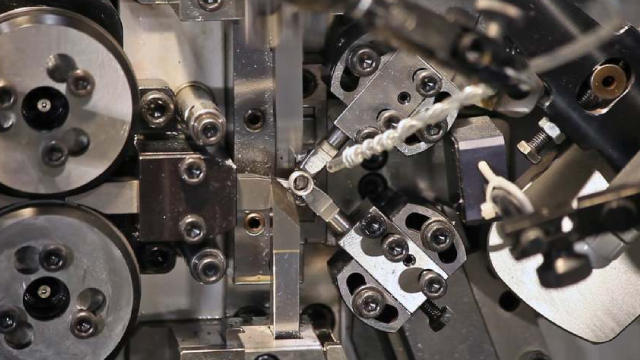

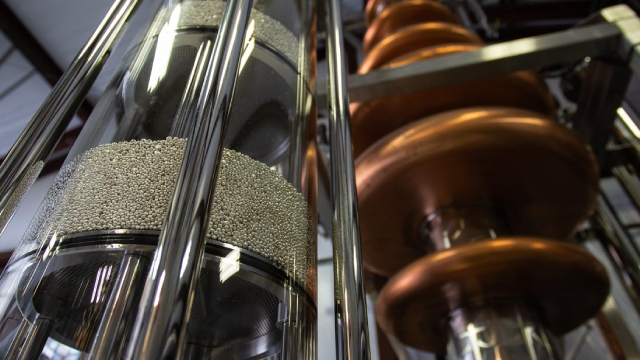

Lasers are an often-overlooked technology with a broad array of applications in medicine, industrial settings, electronics, and more. The global market for laser technology is small but growing rapidly; valued at about $24 billion in 2024, it is expected to climb at a compound annual growth rate of 8% over a five-year period to reach close to $30 billion by 2029.

Cognex: Attractively Priced Despite Near-Term Headwinds

Cognex's business continues to face a fairly soft demand environment. A situation that could be exacerbated by tariffs. Looking beyond this, the adoption of automation will continue to increase, supported in part by the rapidly increasing capabilities of AI. If tariffs remain in place, reshoring could also provide a boost as companies invest in infrastructure to support the restructuring of supply chains.

Cognex Corporation (CGNX) Q1 2025 Earnings Call Transcript

Cognex Corporation (NASDAQ:CGNX ) Q1 2025 Earnings Conference Call May 1, 2025 8:30 AM ET Company Participants Greer Aviv - Senior Investor Relations Consultant Matt Moschner - President and COO Robert Willett - Chief Executive Officer Dennis Fehr - Senior Vice President of Finance and Chief Financial Officer Conference Call Participants Joe Giordano - TD Cowen Damian Karas - UBS Tommy Moll - Stephens Inc. Andrew Buscaglia - BNP Paribas Asset Management Jamie Cook - Truist Securities Piyush Avasthy - Citi Jake Levinson - Melius Research Operator Greetings and welcome to the Cognex First Quarter 2025 Earnings Conference Call. At this time, all participants are in a listen-only mode.

Cognex Corporation (CGNX) Tops Q1 Earnings and Revenue Estimates

Cognex Corporation (CGNX) came out with quarterly earnings of $0.16 per share, beating the Zacks Consensus Estimate of $0.13 per share. This compares to earnings of $0.11 per share a year ago.

Prediction: Buying Cognex Today Will Set You Up for Life

I'm not going to sugarcoat this: Machine vision company Cognex (CGNX 0.27%) is heading for a tough year, and there's a substantial risk that management won't have great news for investors when it delivers its first-quarter earnings on April 30. On the other hand, the stock looks like an excellent value for long-term investors searching for a growth stock to buy and hold for decades to come.

Cognex Corporation (CGNX) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Cognex (CGNX) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2 Electronics Testing Stocks to Watch From a Challenging Industry

The Zacks Electronics - Testing Equipment industry players, such as CGNX and ITRI, are poised to benefit from the solid demand for testing instruments and 5G prospects.

Cognex Corporation (CGNX) Q4 2024 Earnings Call Transcript

Cognex Corporation (NASDAQ:CGNX ) Q4 2024 Earnings Conference Call February 13, 2025 8:30 AM ET Company Participants Nathan McCurren - Head of Investor Relations & Treasurer Rob Willett - President & Chief Executive Officer Dennis Fehr - Senior Vice President of Finance & Chief Financial Officer Conference Call Participants Damian Karas - UBS Tommy Moll - Stephens Andrew Buscaglia - BNP Paribas Jamie Cook - Truist Securities Piyush Avasthy - Citi Jacob Levinson - Melius Research Joe Ritchie - Goldman Sachs Katie Fleischer - KeyBanc Capital Markets Jairam Nathan - Daiwa Operator Greetings. And welcome to the Cognex Fourth Quarter and Full Year 2024 Earnings Conference Call.

Cognex Corporation (CGNX) Q4 Earnings and Revenues Surpass Estimates

Cognex Corporation (CGNX) came out with quarterly earnings of $0.20 per share, beating the Zacks Consensus Estimate of $0.15 per share. This compares to earnings of $0.11 per share a year ago.

Cognex Tops Expectations on Revenue, EPS

Cognex (CGNX -0.93%), a leader in machine vision technology, announced its fourth-quarter earnings on Feb. 12. The company delivered robust results, with notable revenue growth driven by its logistics and semiconductor segments.

Here Are My 3 Top Growth Stocks to Buy Now

These three stocks have game-changing megatrends behind them, which aren't always immediately apparent when first looking at the stocks. Here's the hidden growth potential in machine-vision company Cognex Corporation (CGNX 0.68%), positioning and workflow-technology company Trimble (TRMB 0.60%), and Delta Air Lines (DAL -0.26%), and why all three are great stocks to buy for 2025.

Cognex initiated with an Overweight at Cantor Fitzgerald

Cantor Fitzgerald initiated coverage of Cognex with an Overweight rating and $49 price target.