Chipotle Mexican Grill, Inc. (CMG)

Chipotle: Positioned For Continued Growth And Margin Expansion

Chipotle aims to expand from 3,750 to over 7,000 North American locations and is pursuing international growth despite uncertain global demand for Mexican cuisine. CMG is improving operational efficiency with new staff roles and kitchen technology, enhancing customer service speed and employee retention. The company is piloting catering services, which could significantly boost profitability if scaled successfully without disrupting core operations.

Chipotle Faces Tougher Competition: Is Its Brand Moat Still Strong?

CMG's brand moat faces fresh tests as rivals undercut on value, yet its innovation, loyalty and scale keep defenses strong.

Is Chipotle (CMG) a Buy as Wall Street Analysts Look Optimistic?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

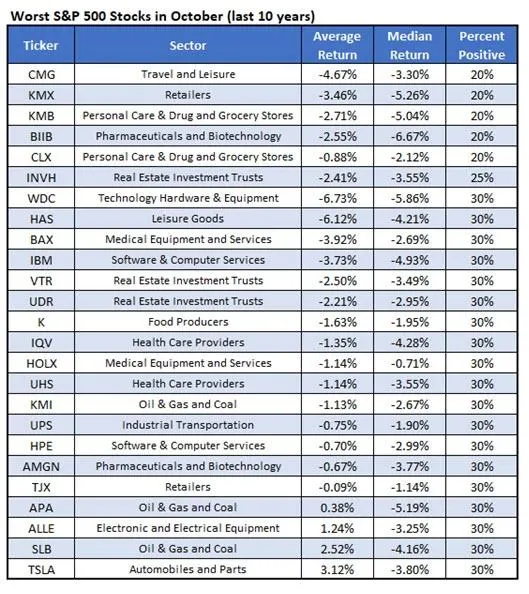

Avoid This Fast-Casual Food Stock In October

Schaeffer's Senior Quantitative Analyst Rocky White compiled a list of the worst 25 stocks to own in October, with data going back 10 years. Right at the top of the list is Chipotle Mexican Grill Inc (CMG), marking a monthly loss in eight of the past 10 Octobers.

Why Chipotle Mexican Grill (CMG) Dipped More Than Broader Market Today

Chipotle Mexican Grill (CMG) concluded the recent trading session at $40.95, signifying a -1.63% move from its prior day's close.

Chipotle's Inflection Is Finally Here (Rating Upgrade)

I am upgrading Chipotle to a “buy” with a $52 price target per share, implying 26% upside from current levels. Chipotle's Q2 FY25 results were disappointing, but management's focus on technology, menu innovation, and loyalty programs is expected to drive growth from Q3 onward. Plus, Chipotle has been improving its profitability driven by cost controls and menu pricing, with revenue and earnings growth expected to accelerate through FY27.

Can Chipotle Balance Expansion With Quality and Brand Strength?

CMG accelerates global expansion while investing in efficiency and brand strength to balance growth with food quality.

Chipotle Mexican Grill (CMG) Stock Sinks As Market Gains: Here's Why

Chipotle Mexican Grill (CMG) concluded the recent trading session at $39.19, signifying a -1.78% move from its prior day's close.

Chipotle Mexican Grill, Inc. (CMG) Is a Trending Stock: Facts to Know Before Betting on It

Chipotle (CMG) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

These 3 Stocks Boosting Buybacks Have Rallying Potential

Several key names are making notable moves when it comes to buyback authorizations. A detailed analysis indicates that the management teams of these large-cap stocks see value in their shares.

This Top Bill Ackman Stock Has Been Hammered. Time to Buy?

Chipotle Mexican Grill (CMG -1.24%) has been a core holding for Bill Ackman since Pershing Square first disclosed a nearly 10% stake in 2016, and the investment has paid off handsomely over the long run. More recently, Ackman has spotlighted Uber -- another top Pershing position -- which has delivered a standout year in 2025 as the ride-hailing leader's growth and cash generation accelerated.

Investors Heavily Search Chipotle Mexican Grill, Inc. (CMG): Here is What You Need to Know

Chipotle (CMG) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.