Cummins Inc. (CMI)

Cummins Inc. (CMI) Q2 2025 Earnings Conference Call Transcript

Cummins Inc. (NYSE:CMI ) Q2 2025 Earnings Call August 5, 2025 10:00 AM ET Company Participants Jennifer W. Rumsey - CEO & Chairman of the Board Mark A.

Cummins (CMI) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for Cummins (CMI) give a sense of how its business performed in the quarter ended June 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Cummins (CMI) Q2 Earnings and Revenues Beat Estimates

Cummins (CMI) came out with quarterly earnings of $6.43 per share, beating the Zacks Consensus Estimate of $4.99 per share. This compares to earnings of $5.26 per share a year ago.

Why Investors Need to Take Advantage of These 2 Auto, Tires and Trucks Stocks Now

Finding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP.

Curious about Cummins (CMI) Q2 Performance? Explore Wall Street Estimates for Key Metrics

Beyond analysts' top-and-bottom-line estimates for Cummins (CMI), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended June 2025.

Cummins (CMI) Expected to Beat Earnings Estimates: What to Know Ahead of Q2 Release

Cummins (CMI) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Why Investors Need to Take Advantage of These 2 Auto, Tires and Trucks Stocks Now

The Zacks Earnings ESP is a great way to find potential earnings surprises. Why investors should take advantage now.

Will Cummins (CMI) Beat Estimates Again in Its Next Earnings Report?

Cummins (CMI) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

These 2 Auto, Tires and Trucks Stocks Could Beat Earnings: Why They Should Be on Your Radar

Why investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates.

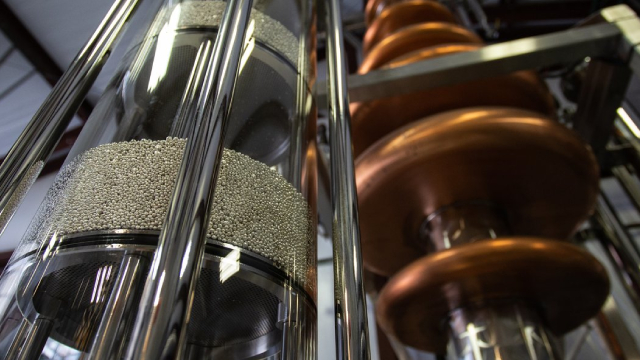

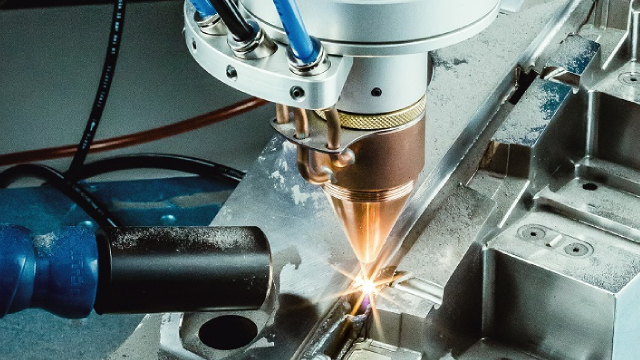

Cummins: Data Center Demand Will Help It, But I'm Not Looking To Invest Now

Cummins Inc. delivered strong Q1 results, driven by robust demand in Power Systems and Distribution, especially from data center growth. Despite operational strength, management withdrew full-year guidance due to tariff uncertainties, raising near-term risk and volatility. Data center and AI-related capex from big tech will be a major long-term growth driver for Cummins, supporting optimism for key segments.

Cummins (CMI) Up 8.8% Since Last Earnings Report: Can It Continue?

Cummins (CMI) reported earnings 30 days ago. What's next for the stock?

Cummins Q1 Earnings Surpass Expectations, Revenues Fall Y/Y

CMI reports better-than-expected first-quarter results, wherein revenues decline year over year.