CMS Energy Corporation (CMS)

CMS Energy (CMS) Earnings Expected to Grow: Should You Buy?

CMS Energy (CMS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

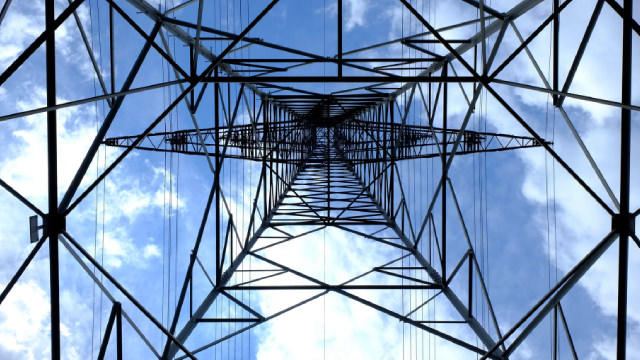

CMS Energy to Gain From Key Investments & Renewable Expansion

CMS is set to benefit from its strategic investment plan of $20 billion through 2029 while retiring coal units, and expanding solar and wind capacity.

CMS Energy Thrives on Strategic Investments & Renewable Growth

CMS is expected to benefit from its strategic investment plan and expansion of renewable generation despite coal ash disposal costs and high debt levels.

Here's Why CMS Energy (CMS) is a Strong Growth Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

CMS Energy Corporation (CMS) Q1 2025 Earnings Call Transcript

CMS Energy Corporation (NYSE:CMS ) Q1 2025 Earnings Conference Call April 24, 2025 9:30 AM ET Company Participants Jason Shore - Treasurer and Vice President-Investor Relations Garrick Rochow - President and Chief Executive Officer Rejji Hayes - Executive Vice President and Chief Financial Officer Conference Call Participants Durgesh Chopra - Evercore ISI Constantine Lednev - Guggenheim Partners Jeremy Tonet - JPMorgan Julien Smith - Jefferies Michael Sullivan - Wolfe Research Alex Lerman - Morgan Stanley Travis Miller - Morningstar Gregg Orrill - UBS Andrew Weisel - Scotiabank Sophie Karp - KeyBanc Operator Good morning, everyone, and welcome to the CMS Energy 2025 First Quarter Results. The earnings news release issued earlier today and the presentation used in this webcast are available on CMS Energy's website in the Investor Relations section.

CMS Energy Q1 Earnings Miss Estimates, Revenue Increase Y/Y

CMS' first-quarter earnings miss the Zacks Consensus Estimate by 2.9%. However, its top line increases 12.5% from the year-ago quarter.

CMS Energy (CMS) Q1 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for CMS Energy (CMS) give a sense of how its business performed in the quarter ended March 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

CMS Energy (CMS) Misses Q1 Earnings Estimates

CMS Energy (CMS) came out with quarterly earnings of $1.02 per share, missing the Zacks Consensus Estimate of $1.05 per share. This compares to earnings of $0.97 per share a year ago.

CMS Energy: Fairly Valued, But The Stock Has Potential As A Safe-Haven Play

CMS Energy, a regulated utility in Michigan, has shown resilience in volatile markets, with a 9.93% YTD gain, outperforming the U.S. Utilities Index and S&P 500. Despite a mixed long-term performance, CMS Energy's strong year-to-date results and 2.94% dividend yield make it a potential safe haven during market turbulence. The company's growth prospects are bolstered by Michigan's improving demographics, potential data center developments, and a $20 billion capital investment plan through 2029.

CMS Energy Set to Report Q1 Earnings: What's in Store for the Stock?

CMS' Q1 earnings are likely to have benefited from below-normal weather patterns and cost-reduction initiatives amid higher restoration expenses.

Wall Street's Insights Into Key Metrics Ahead of CMS Energy (CMS) Q1 Earnings

Besides Wall Street's top -and-bottom-line estimates for CMS Energy (CMS), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended March 2025.

Are Utilities Stocks Lagging CMS Energy (CMS) This Year?

Here is how CMS Energy (CMS) and Exelon (EXC) have performed compared to their sector so far this year.