Coinbase Global, Inc. (COIN)

Coinbase CEO Brian Armstrong says Congress should allow stablecoin companies to pay users interest

Coinbase CEO Brian Armstrong says stablecoins should be able to pay interest to consumers, and that banks and crypto companies should be able to do the same. Language in the current proposed stablecoin legislation, both the House's STABLE Act and the Senate's GENIUS Act, specifies stablecoin issuers may not pay interest to users.

This stock narrowly missed S&P inclusion, but a 90% spike likely coming; Time to buy?

During the March 2025 rebalancing of the S&P 500 index, it was highly anticipated that the stock of cryptocurrency exchange Coinbase (NASDAQ: COIN) would join the list.

Coinbase Global, Inc. (COIN) Stock Slides as Market Rises: Facts to Know Before You Trade

In the latest trading session, Coinbase Global, Inc. (COIN) closed at $172.23, marking a -0.98% move from the previous day.

Coinbase: A Solid Case For Buying The Dip (Rating Upgrade)

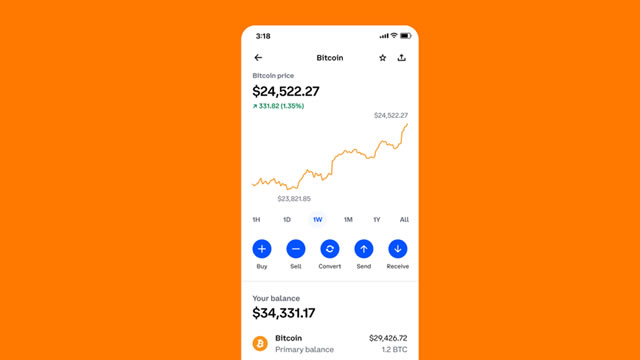

Despite recent market turmoil, Coinbase's valuation has dropped significantly, making it a compelling dip to buy. I'm upgrading the stock to a buy rating. Altcoin prices have shown resilience relative to Bitcoin's sharper drop, which may mean Coinbase's trading revenue won't fall as much as feared. Continued innovation, such as Coinbase One Premium at $300/month and Bitcoin-backed loans, is driving growth in non-transactional recurring revenue streams.

Despite Volume Drop, Coinbase Analyst Highlights Stablecoin Momentum, Competitive Edge

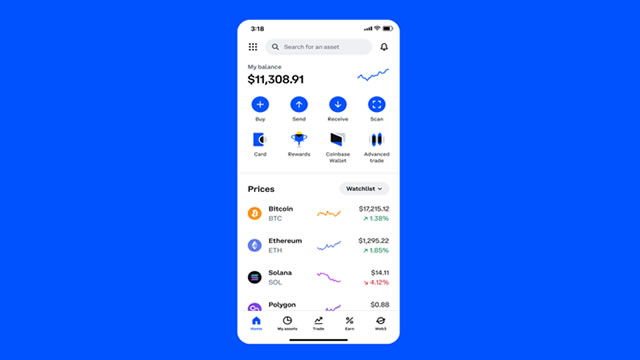

While Coinbase Global Inc.'s COIN trading volumes have decelerated significantly, investors seem to be underestimating the potential of the company's non-trading revenue streams, according to Rosenblatt Securities.

Coinbase Global, Inc. (COIN) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Coinbase Global (COIN). This makes it worthwhile to examine what the stock has in store.

What next for Coinbase stock after the $38 billion wipeout?

Coinbase stock price has crashed into a bear market this year as the crypto industry remains on edge, with most coins crashing. COIN shares plunged to a low of $176 this month, down by almost 50% from the year-to-date high.

Coinbase Global, Inc. (COIN) Advances While Market Declines: Some Information for Investors

Coinbase Global, Inc. (COIN) closed the most recent trading day at $190.38, moving +0.33% from the previous trading session.

Coinbase Analyst 'Cautiously Optimistic' On Stock With Balanced Risk/Reward, Says Regulatory Environment Is Positive And Negative

A Coinbase Global Inc. COIN analyst views the stock as a balanced risk/reward opportunity for investors and long-term growth winner in the cryptocurrency sector.

How Coinbase (COIN) Stock Stands Out in a Strong Industry

Coinbase (COIN) has seen solid earnings estimate revision activity over the past month, and belongs to a strong industry as well.

Why Coinbase, Mara Holdings, and Solana Crashed This Week

The crypto market had either a great week or a terrible week depending on how you look at it. From a policy perspective, it looks like the U.S. continues to embrace crypto and that's good news.

Coinbase to Operate in India Again: Time to Buy the Stock?

COIN to serve in India again, a part of its international expansion strategy.