Coinbase Global, Inc. (COIN)

Coinbase Analysts See 'Inherent Profitability' In Q4 Results

Shares of Coinbase Global Inc COIN were trading lower on Friday, even after the company reported upbeat fourth-quarter revenues.

ETFs to Buy on Coinbase's Blowout Q4 Earnings

Coinbase posts blowout earnings and logs the highest quarterly revenues in three years. Here are some ETFs to tap the growth.

Coinbase Q4 Was Strong, But Here Are 3 Reasons Not To Buy

Coinbase delivered strong Q4 results, beating revenue expectations and showing effective revenue diversification, but heavy reliance on crypto cycles remains a concern. Despite strong performance, I am not bullish on Coinbase due to competition, valuation concerns, and better historical returns from Bitcoin. The valuation appears attractive in optimistic scenarios, but cyclical fundamentals and competition risks make it less compelling.

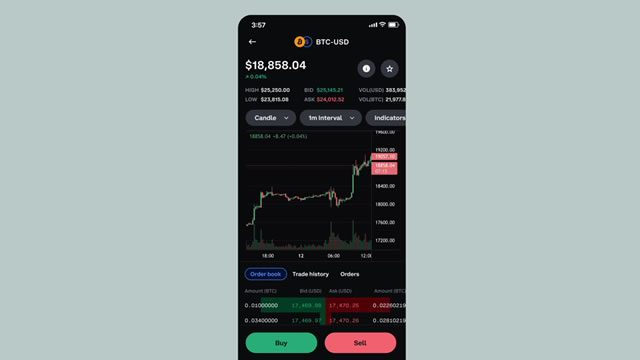

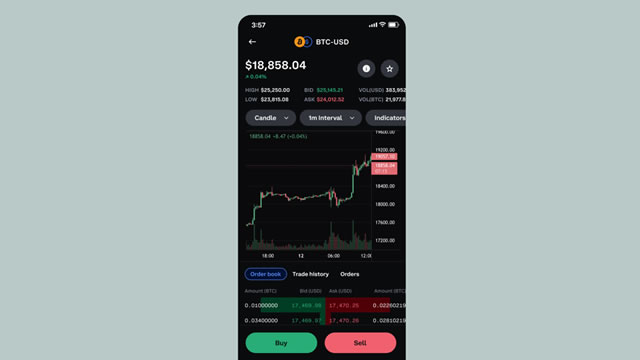

Coinbase Q4 Earnings Beat Estimates on Higher Trading Volume

COIN's Q4 results reflect higher consumer and institutional transaction revenues, higher crypto asset prices as well as improved adjusted EBITDA.

Coinbase Q4 Earnings: Into The World Of Certainty

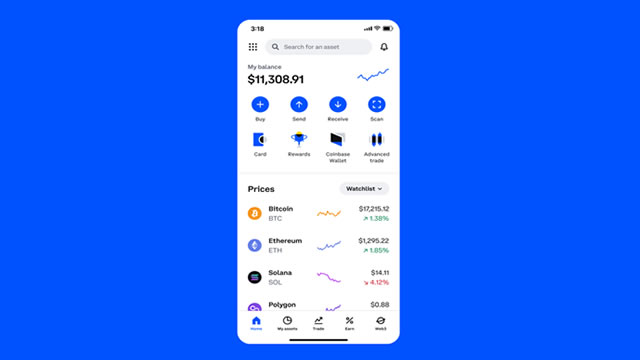

Coinbase's strong Q4 2024 results, driven by Trump's pro-crypto stance and crypto ETFs, have created a paradigm shift. Transaction revenue tripled in Q4, with significant growth in derivatives and Stablecoin products, showcasing Coinbase's adaptive platform. Future outlook is positive, with a strong Q1 2025 start and management's confidence in expanding TAM.

Coinbase Global (COIN) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

While the top- and bottom-line numbers for Coinbase Global (COIN) give a sense of how the business performed in the quarter ended December 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Coinbase Global, Inc. (COIN) Q4 2024 Earnings Conference Call Transcript

Coinbase Global, Inc. (NASDAQ:COIN ) Q4 2024 Earnings Conference Call February 13, 2025 5:30 PM ET Company Participants Anil Gupta - VP, IR Brian Armstrong - Co-Founder & CEO Alesia Haas - CFO Emilie Choi - President & COO Paul Grewal - Chief Legal Officer & Corporate Secretary Conference Call Participants Owen Lau - Oppenheimer Devin Ryan - Citizens JMP Benjamin Budish - Barclays Ken Worthington - JPMorgan Pete Christiansen - Citi Patrick Moley - Piper Sandler John Todaro - Needham Dan Dolev - Mizuho Bo Pei - U.S. Tiger Securities Alex Markgraff - KBCM Operator Good afternoon. My name is Sarah, and I will be your conference operator today.

Coinbase crushes Q4, analyst breaks down the results

Mizuho Americas Senior Financial Technology Analyst Dan Dolev joins Market Domination Overtime anchors Julie Hyman and Josh Lipton to analyze Coinbase's (COIN) fourth quarter results, which exceeded revenue and earnings expectations. While acknowledging that the cryptocurrency trading platform "crushed [in] Q4," Dolev explains the muted market reaction: "That doesn't really matter because the sell side typically is slower to update their numbers than the buy side.

Coinbase Global, Inc. (COIN) Q4 Earnings and Revenues Surpass Estimates

Coinbase Global, Inc. (COIN) came out with quarterly earnings of $3.39 per share, beating the Zacks Consensus Estimate of $1.94 per share. This compares to earnings of $1.04 per share a year ago.

Coinbase says crypto is seeing ‘dawn of a new era,' and Wall Street shares its optimism

“Crypto's voice was heard loud and clear in the U.S. elections,” company says.

Coinbase Q4 Earnings Highlights: Trading Platform Welcomes 'Dawn Of A New Era For Crypto'

Coinbase Global COIN reported fourth-quarter financial results after the market close Thursday.

Coinbase reports higher fourth-quarter profit on crypto rally

Crypto exchange Coinbase reported a steep rise in fourth quarter profit on Thursday, driven by higher trading volumes in bitcoin and other tokens following the U.S. election.