Coinbase Global, Inc. (COIN)

Trade Tracker: Bill Baruch buys more Coinbase

Bill Baruch, Founder and president at Blue Line Capital, joins CNBC's “Halftime Report” to explain why he's buying more Coinbase.

Can Coinbase Stock Crash?

Over the past week, Coinbase Global (COIN) stock has declined by 10%, and it is presently priced at $309.14.

Coinbase Launches Platform for Digital Token Offerings

Blockchain startup Monad will be the first project to sell its token on the new platform.

Will Coinbase Global (COIN) Stock Blast Through $400?

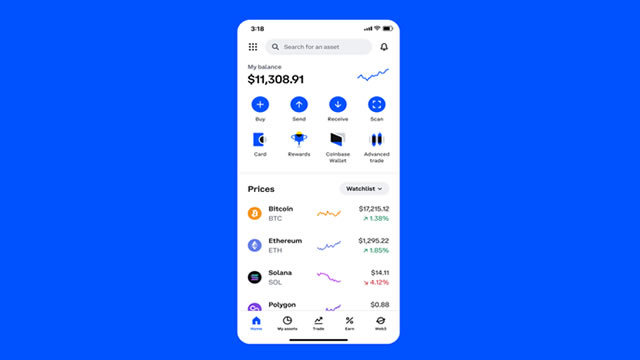

Many people buy and sell Bitcoin (CRYPTO:BTC) and other cryptocurrencies on the Coinbase Global (NASDAQ:COIN) trading platform.

Is Most-Watched Stock Coinbase Global, Inc. (COIN) Worth Betting on Now?

Coinbase Global (COIN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

ETFs in Spotlight as Coinbase Shares Slip Despite Upbeat Q3 Earnings

COIN's strong Q3 results and Deribit acquisition boost performance, putting ETFs with heavy exposure to Coinbase, like CRPT and IBLC, in investor focus.

Coinbase in Late Stage Talks on $2 Billion BVNK Deal

Coinbase is reportedly closer to acquiring stablecoin infrastructure startup BVNK. The cryptocurrency exchange is in late-stage discussions on the approximately $2 billion purchase, Bloomberg news reported Friday (Oct. 31), citing sources familiar with the matter.

Coinbase Q3 Earnings and Revenues Beat Estimates, Volumes Rise Y/Y

Coinbase posts a strong Q3 with earnings and revenue beats, soaring trading volumes and robust growth in subscriptions and services.

Coinbase beats Q3 estimates on strong trading and subscription growth

Coinbase Global Inc (NASDAQ:COIN) shares jumped around 3.5% at Friday's open after it topped Wall Street estimates for third-quarter earnings on Thursday, driven by robust trading activity and steady growth in subscription and services revenue. The largest US cryptocurrency exchange reported total revenue of $1.87 billion, above analysts' expectations of $1.8 billion, while earnings per share came in at $1.50, beating the consensus forecast of $1.21.

Key Takeaways From Q3 2025 Coinbase Earnings

Coinbase remains a 'buy' after strong Q3-25 results, with net revenue up 83% year-over-year and robust institutional transaction growth. COIN's acquisition of Deribit has made it a dominant player in crypto derivatives, boosting institutional transaction margins significantly last quarter. Base network showed mixed user growth but led speed-focused peers in stablecoin transfer volume, outpacing Solana and even Ethereum in recent months.

Coinbase holds edge in US crypto race even as rivals' public listings reshape landscape

Coinbase's first-mover advantage as the only publicly traded crypto exchange helped it top earnings estimates again, but competition is looming from clearer rules and newly listed companies, Wall Street analysts said on Friday.

Coinbase Global, Inc. (COIN) Q3 2025 Earnings Call Transcript

Coinbase Global, Inc. ( COIN ) Q3 2025 Earnings Call October 30, 2025 5:30 PM EDT Company Participants Anil Gupta - Vice President of Investor Relations Brian Armstrong - Co-Founder, Chairman & CEO Alesia Haas - Chief Financial Officer Emilie Choi - President & COO Conference Call Participants Craig Siegenthaler - BofA Securities, Research Division Kenneth Worthington - JPMorgan Chase & Co, Research Division Peter Christiansen - Citigroup Inc., Research Division Benjamin Budish - Barclays Bank PLC, Research Division Owen Lau - Clear Street LLC Devin Ryan - Citizens JMP Securities, LLC, Research Division Patrick Moley - Piper Sandler & Co., Research Division James Yaro - Goldman Sachs Group, Inc., Research Division Andrew Jeffrey - William Blair & Company L.L.C., Research Division Bo Pei - Tiger Brokers (NZ) Limited, Research Division Alexander Markgraff - KeyBanc Capital Markets Inc., Research Division Dan Dolev - Mizuho Securities USA LLC, Research Division Edward Engel - Compass Point Research & Trading, LLC, Research Division Zachary Gunn - Financial Technology Partners LP Joseph Vafi - Canaccord Genuity Corp., Research Division Gustavo Gala - Monness, Crespi, Hardt & Co., Inc., Research Division Presentation Anil Gupta Vice President of Investor Relations Good afternoon, and welcome to the Coinbase Third Quarter 2025 Earnings Call.