Crane NXT Co. (CR)

Crane NXT: A Great Play On An Ambitious Growth Plan

Crane NXT is a fascinating company in the payments industry, with a long history and a great growth plan for the future. Recent financial performance has been disappointing, but management expects this picture to change moving forward. While shares aren't the cheapest, they are attractively priced when thinking about the future.

Crane (CR) Q2 Earnings and Revenues Top Estimates

Crane (CR) came out with quarterly earnings of $1.30 per share, beating the Zacks Consensus Estimate of $1.24 per share. This compares to earnings of $1.10 per share a year ago.

Crane (CR) Earnings Expected to Grow: Should You Buy?

Crane (CR) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Crane (CR) is a Great Momentum Stock: Should You Buy?

Does Crane (CR) have what it takes to be a top stock pick for momentum investors? Let's find out.

Crane (CR) Surges 3.1%: Is This an Indication of Further Gains?

Crane (CR) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock suggests that there could be more strength down the road.

Will Crane (CR) Beat Estimates Again in Its Next Earnings Report?

Crane (CR) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

All Systems Go For Crane, As Execution And A Growth Pivot Drive A Major Re-Rating

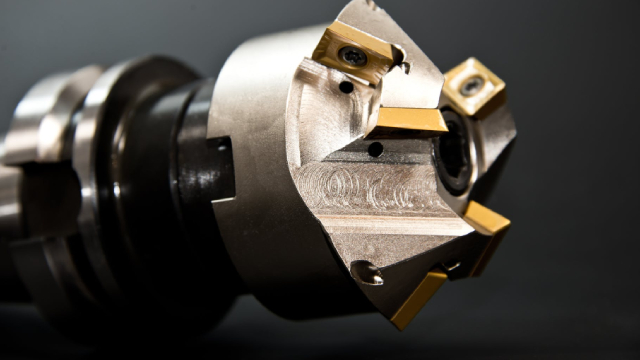

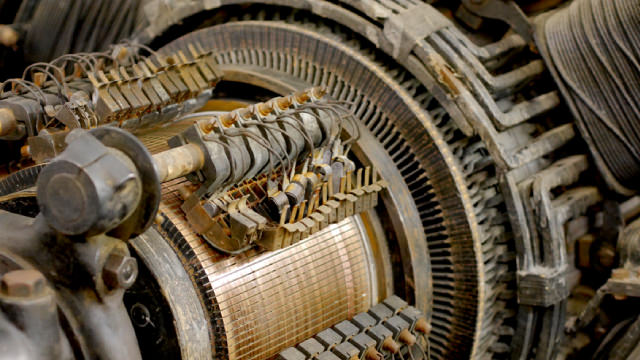

Crane's strategic pivot has gotten Wall Street's attention, with strong price performance since the fall of 2023. Management is repositioning the Process Flow business toward higher-growth opportunities in markets like LNG, hydrogen, pharma, and automation, while using price and mix to drive better margins. Crane's platform-agnostic design philosophy gives it operating flexibility without compromising strong leverage to commercial and defense growth over the next decade.

Oldies Are Goldies: Buy These 5 Surging Old Economy Stocks

We have narrowed our search to five old economy stocks that have provided handsome returns year to date. These are: GS, WFC, IR, CR, WMT.

3 Industrial Stocks Cashing In on the Onshoring Trend

On-shoring trends are gaining significant momentum as the government looks to companies to build more resilient supply chains closer to home. With this in mind, I think it is a good time to invest in industrial stocks before this trend accelerates more.