Crypto Company, Inc. (CRCW)

SEC Dismisses Lawsuit Against Coinbase, Promises Regulatory Framework for Crypto

The Securities and Exchange Commission (SEC) said Thursday (Feb. 27) that it dismissed its pending civil enforcement action against cryptocurrency exchange Coinbase.

2 Crypto-Linked Stocks in Freefall with Bitcoin

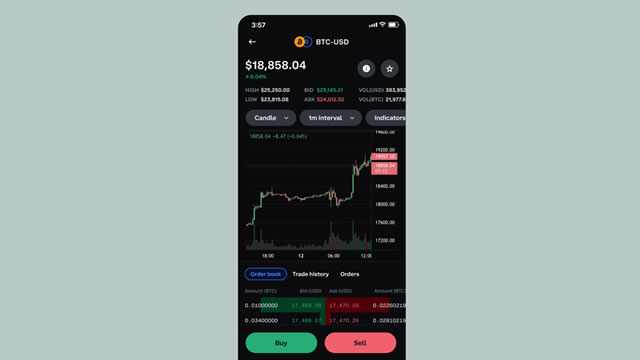

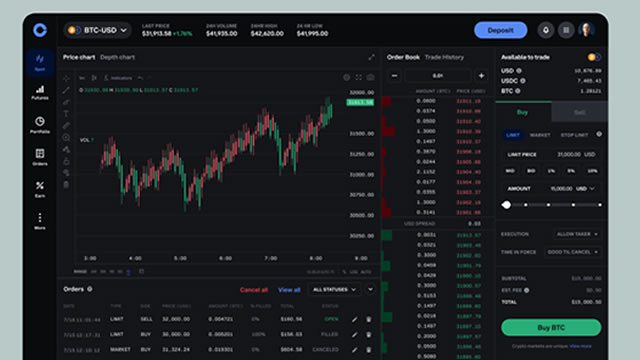

Bitcoin (BTC) began the year on a high note, nearly reaching the $110,000 mark.

Robinhood: SEC Calls Off Probe Into Crypto Business

Robinhood said a regulatory probe of its cryptocurrency unit ended without incident. The Securities and Exchange Commission (SEC) last year issued a Wells notice against the financial services platform, typically seen as a warning of pending enforcement action.

Robinhood Stock Pops as SEC Investigation Into Crypto Arm Wraps. Why That Matters.

Investors are cheering the latest sign of a less restrictive regulatory environment.

Crypto stocks plunge despite SEC dropping suit against Coinbase

CNBC's MacKenzie Sigalos joins 'Closing Bell' to report on the sell-off in the crypto market and fintech stocks.

3 Bitcoin-Centric Stocks to Buy Ahead of the Next Crypto Rally

Stocks like V, HOOD and IBKR are poised to benefit from the next Bitcoin rally.

Coinbase Says SEC Will Drop Lawsuit Against Crypto Exchange—Citing Change In ‘Political Leadership'

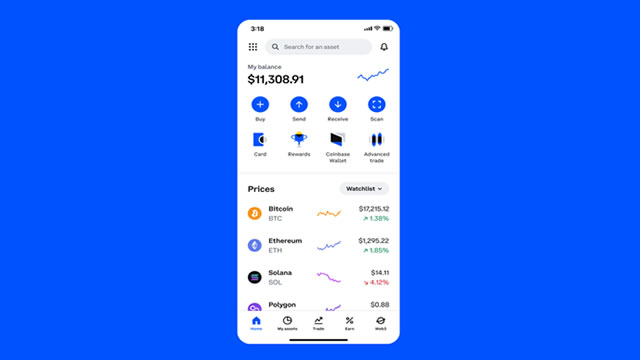

The Securities and Exchange Commission has agreed to drop its lawsuit against Coinbase, following what the crypto exchange said was a change in “political leadership” at the agency, which accused Coinbase of failing to register as a securities exchange under the Biden administration.

Coinbase Stock Rises. The SEC Is Giving Up Its Case Against the Crypto Exchange.

Coinbase says enforcers at the SEC will recommend dismissal of a two-year-old lawsuit that sought to regulate the company as a stock exchange.

Coinbase Says S.E.C. Will Drop Crypto Lawsuit

The end of a court fight with the largest U.S. crypto company would be a big win for an industry that financially backed President Trump.

Options Traders Target Crypto Stock Amid Bitcoin Buzz

Software stock MicroStrategy Inc (NASDAQ:MSTR) has spent recent weeks consolidating around the $320 region, holding its +10% year-to-date level since the start of the year.

Crypto ETFs: The Latest Wave of Filings

Some of the most interesting filings in the crypto ETF space are not necessarily new product filings. Potential approval of litecoin and XRP ETFs have stolen the headlines, in addition to some “creative” filings like dogecoin, Trump coin, and other meme coin ETFs.

Direxion's Crypto-Focused LMBO And REKT ETFs Offer Contrasting Ways To Play The Blockchain

One of the top reasons investors have gravitated toward cryptocurrency-related assets is the enormous upside potential. On the front-facing side of the blockchain ecosystem, the total value of all virtual currencies was around $1.99 trillion one year ago.