Credo Technology Group Holding Ltd. (CRDO)

Credo's Pullback: How It Became AI's Nerve System

Credo reported record Q1 FY2026 revenue of $223.1 million, up 274% year-over-year, with non-GAAP gross margins expanding to 67.6%. Despite a recent pullback, Credo remains positioned for 40% operating margins, zero debt, and potential $1 billion annualized revenue run rate. The Arm Total Design alliance integrates Credo's SerDes and DSP chiplets into Arm's Neoverse platform, unlocking high-margin IP licensing opportunities.

Credo: Cheap Or Expensive For The AI Opportunity?

Credo Technology Group Holding Ltd shares have been taking a beating for the past month and crashed 8% on Friday. We see a window to load up. Credo's AEC product line is gaining traction with hyperscalers due to the better signal integrity and a smaller form factor needed as we see more rackable solutions. Customer concentration risk is not really an issue anymore, with revenue diversification expected to strengthen as Credo hosts as many as six hyperscaler customers during FY26.

CRDO Surges 289% in Six Months: Is it Still a Buying Opportunity?

Credo Technology Group Holding Ltd CRDO has been one of the top gainers in the semiconductor space. The stock has surged 289.3% in the past six months, outperforming the Electronic-Semiconductors and the broader Computer and Technology sector's growth of 77.6% and 47.2%, respectively.

Credo Acquires Hyperlume, Taps MicroLED Tech for AI Data Centers

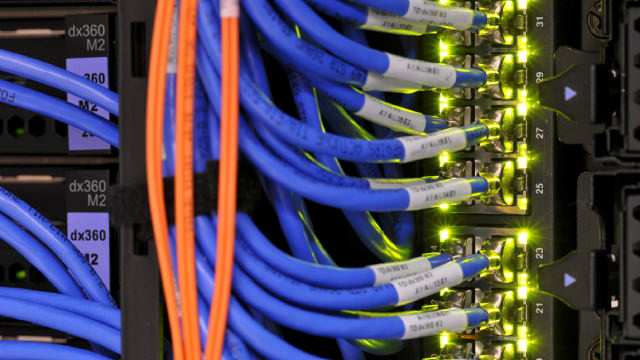

CRDO's Hyperlume acquisition brings cutting-edge microLED optical interconnects to strengthen AI and data center connectivity solutions.

Credo: Continue Riding The Wave

Credo Technology Group delivered record Q1 results, with revenues up 273.6% and significant margin expansion, driven by strong AI connectivity demand. CRDO's innovation edge was highlighted by the Bluebird 1.6T Optical DSP launch, reinforcing its competitive advantage and pricing power in the AI infrastructure market. Despite analyst concerns about EPS growth slowdown, Q2 guidance remains robust, with continued efficiency improvements and top-line growth outpacing expenses.

CRDO Deepens Ties With Hyperscalers: Key to Next Growth Phase?

Credo's hyperscaler partnerships drove 274% revenue growth, fueling AEC adoption and deeper inroads into next-gen AI data centers.

Credo Technology Group Holding Ltd (CRDO) Presents At Goldman Sachs Communacopia + Technology Conference 2025 Transcript

Credo Technology Group Holding Ltd (NASDAQ:CRDO ) Goldman Sachs Communacopia + Technology Conference 2025 September 10, 2025 6:45 PM EDT Company Participants William Brennan - President, CEO & Chairman Daniel Fleming - Chief Financial Officer Conference Call Participants James Schneider - Goldman Sachs Group, Inc., Research Division Presentation James Schneider Senior Research Analyst Good afternoon, everybody. Welcome to the Goldman Sachs Communacopia Technology Conference.

Credo Technology: AI Hype Nearing Its Peak - Double-Digits Correction Likely

CRDO's triple-digits rally since the April 2025 bottom may be attributed to the expanding hyperscaler partnership & bottom-line inflection arising from higher pricing power/ improving operational scale. Much of the tailwinds are attributed to the growing adoption of its AEC offerings, with it already driving improved reliability and lower power consumption during the ongoing data-center boom. This is significantly aided by the richer balance sheet and the inherent lack of debt, thanks to the growing cash flows despite the higher capex trends.

Credo Technology: Hold And Watch

Credo Technology's revenue growth hit an inflection point a few quarters ago, and so did the company's execution. Strong top- and bottom-line growth was driven by increased demand across the expanding customer base. Customer concentration risk is improving, with Amazon's share of quarterly revenues declining and with two more hyperscaler customers exceeding the 10% of revenue threshold in fiscal Q1 2026.

Credo's Q1 Earnings and Sales Surpass Estimates, Rise Y/Y, Stock Up

CRDO posts a 273.6% revenue surge and EPS beat, driving shares up 13% on strong product growth and hyperscaler partnerships.

Credo Technology Group Holding Ltd. (CRDO) Surpasses Q1 Earnings and Revenue Estimates

Credo Technology Group Holding Ltd. (CRDO) came out with quarterly earnings of $0.52 per share, beating the Zacks Consensus Estimate of $0.35 per share.

How Does Credo's System-Level Strategy Provide an Edge in the AI Era?

CRDO is fueling AI-era data centers with a system-level strategy, driving growth across AECs, DSPs and retimers.