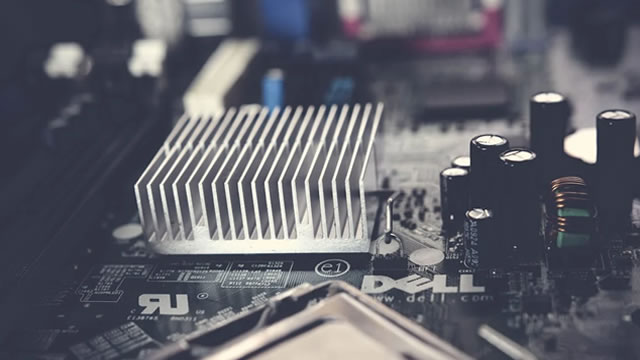

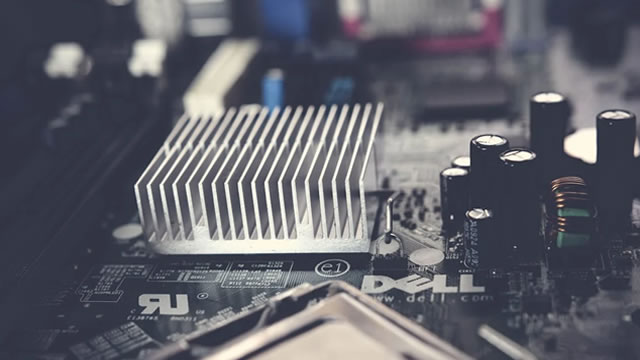

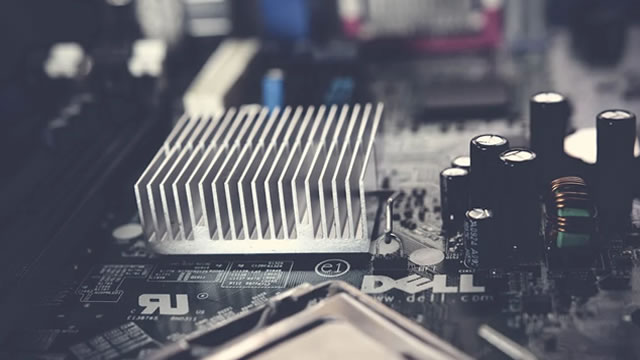

Dell Technologies Inc. (DELL)

Why the Market Dipped But Dell Technologies (DELL) Gained Today

In the latest trading session, Dell Technologies (DELL) closed at $103.10, marking a +1.79% move from the previous day.

Here's Why Dell Technologies (DELL) is a Strong Value Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Why Dell Technologies Stock Is Down 9% In A Day?

Dell Technologies Inc. (NYSE: DELL) suffered a 9% stock drop on Monday, January 27, amid concerns sparked by DeepSeek's affordable AI chatbot. This emerging technology has disrupted the industry, posing a significant threat to U.S. tech leaders and raising questions about the long-term viability of AI infrastructure investments.

2 Artificial Intelligence (AI) Stocks That Could Make You a Millionaire

Artificial intelligence (AI) is expected to impact the global economy in a big way in the long run, with market research firm IDC estimating that every dollar spent on AI-related business solutions and services will generate $4.60 in the global economy in 2030.

2 Stocks to Watch From the Challenging Computer Industry

The Computer - Micro Computers industry participants like Dell Technologies (DELL) and HP (HPQ) are benefiting from the strong demand for enterprise devices amid stiff macroeconomic challenges globally.

Final Trade: ET, DELL, KRE, BMY

The final trades of the day with CNBC's Melissa Lee and the Fast Money traders.

Dell: Future-Proofing Business Sets The Stage For Earnings Beat

Dell Technologies has faced recent volatility, falling 14% in the past 6 months due to a rocky earnings report in November. Despite a recent earnings miss, DELL's expansion into AI and its rapidly growing storage and server businesses position it for future growth. DELL's server and networking revenue surged 58%, and analysts project Total revenue of $96.3 billion for 2025, up 8% from 2024.

Dell Technologies (DELL) Beats Stock Market Upswing: What Investors Need to Know

The latest trading day saw Dell Technologies (DELL) settling at $111.55, representing a +1.74% change from its previous close.

Dell Technologies Inc. (DELL) Is a Trending Stock: Facts to Know Before Betting on It

Dell Technologies (DELL) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Dell Technologies: Buy The Dip Before The Next Refresh Cycle

Dell Technologies has multiple catalysts at play for eFY25, including AI server growth, traditional server & storage refresh cycles, and commercial PC sales with back-to-office trends. Analysts are expecting potential near-term challenges, revising EPS estimates down 19 times in the last 90 days. Dell aims for 3-4% annual top-line growth and 8% EPS growth, with plans to return over 80% of adjusted free cash flow to shareholders through dividend growth and share repurchases.

Why I Recently Increased My Dell Position

Dell's stock is a strong buy with a 12-month price target of $180, driven by its ultra-cheap valuation and significant AI potential. Dell's infrastructure solutions segment, including AI revenues, surged last quarter, indicating robust demand and potential for outperforming consensus estimates. Dell's forward P/E ratio is around 10, with a PEG ratio of 0.65, making it exceptionally inexpensive for a market leader with considerable growth potential.

This Might Be the Most Underrated Artificial Intelligence Stock to Own in 2025

Are you looking for a potentially underrated artificial intelligence (AI) stock to buy for 2025? While it may be tempting to simply invest in chipmaking giant Nvidia, given its hefty $3.3 trillion market capitalization, the returns from owning the stock this year may be limited from here.