DTE Energy Company (DTE)

Why DTE Energy (DTE) is a Top Growth Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

DTE Energy (DTE) Q1 Earnings: How Key Metrics Compare to Wall Street Estimates

Although the revenue and EPS for DTE Energy (DTE) give a sense of how its business performed in the quarter ended March 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

DTE Energy Company (DTE) Q1 2025 Earnings Call Transcript

DTE Energy Company (NYSE:DTE ) Q1 2025 Earnings Call May 1, 2025 9:00 AM ET Company Participants Matt Krupinski - Director, Investor Relations Jerry Norcia - Chairman and Chief Executive Officer Joi Harris - President and Chief Operating Officer Dave Ruud - Executive Vice President and Chief Financial Officer Conference Call Participants Nick Campanella - Barclays Durgesh Chopra - Evercore ISI Jeremy Tonet - JPMorgan David Arcaro - Morgan Stanley Sophie Karp - KeyBanc Michael Sullivan - Wolfe Research Andrew Weisel - Scotiabank Travis Miller - The Morningstar Paul Fremont - Ladenburg Operator Hello and thank you for standing by. My name is Bella and I will be your conference operator today.

DTE Energy's Q1 Earnings Surpass Estimates, Rise Year Over Year

DTE reports Q1 operating net income of $436 million compared with $346 million in the year-ago period.

DTE Energy: The Upside Appears To Be Limited From Here

DTE Energy Company serves customers in both the US and Canada. It is composed of two regulated utility business segments and two unregulated segments. DTE stock has risen just over 22% in the last 12 months, the stock is only up 31.4% in the last five years. The company has been improving margins and making solid investments for the future, but the current stock price seems to fully value its strengths.

Here's Why DTE Energy (DTE) is a Great Momentum Stock to Buy

Does DTE Energy (DTE) have what it takes to be a top stock pick for momentum investors? Let's find out.

DTE Energy (DTE) Earnings Expected to Grow: Should You Buy?

DTE Energy (DTE) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Is DTE Energy (DTE) Stock Outpacing Its Utilities Peers This Year?

Here is how DTE Energy (DTE) and New Jersey Resources (NJR) have performed compared to their sector so far this year.

Why DTE Energy (DTE) is Poised to Beat Earnings Estimates Again

DTE Energy (DTE) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

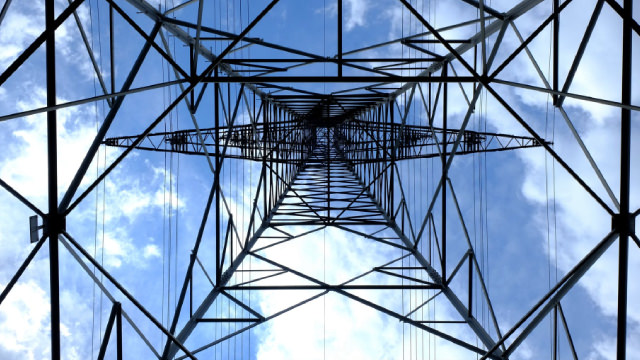

DTE Energy to Benefit From Investments & Clean Energy Generation

DTE is expected to gain from its systematic investment plan and renewable portfolio expansion. Yet, challenges in the energy trading business may hurt the company.

DTE Energy to Benefit From Investments Amid Poor Financials

DTE is projected to gain from its systematic investment plan and renewable portfolio expansion. Challenges in the energy trading business may hurt the company.

DTE Energy: This High-Quality Utility Remains A Buy Now

Since my previous article, shares of DTE Energy Company have significantly outperformed the S&P 500 index. The utility upped its five-year capital spending plan by 20% versus its previous plan. DTE Energy possesses a BBB credit rating from S&P on a stable outlook.