Empire Company Limited (EMLAF)

Gold price holding within striking distance of $3000 after Empire State Survey drops to -20

Neils Christensen has a diploma in journalism from Lethbridge College and has more than a decade of reporting experience working for news organizations throughout Canada. His experiences include covering territorial and federal politics in Nunavut, Canada.

Is Colgate-Palmolive Quietly Building The Next Pet Food Empire?

Colgate-Palmolive's premiumization strategy and pet nutrition expansion offer significant growth potential, with a price target of $115 per share, suggesting 26% upside. Despite high valuation metrics, CL's superior profitability, high margins, and exceptional cash flow justify its premium valuation and long-term investment appeal. The company's strong pricing power, particularly in premium oral care and pet food, positions it well against inflation and competitive pressures.

Empire Company Limited (EMLAF) Q3 2025 Earnings Call Transcript

Empire Company Limited (OTCPK:EMLAF) Q3 2025 Earnings Conference Call March 13, 2025 8:30 AM ET Company Participants Katie Brine - VP, IR Michael Medline - President and CEO Matt Reindel - CFO Pierre St-Laurent - COO Conference Call Participants Irene Nattel - RBC Capital Markets Chris Li - Desjardins Tamy Chen - BMO Capital Markets Vishal Shreedhar - National Bank Michael Van Aelst - TD Cowen Mark Petrie - CIBC John Zamparo - Scotiabank Operator Good morning, ladies and gentlemen. And welcome to the Empire Third Quarter 2025 Conference Call [Operator Instructions].

Early Fed rate cut could spark the next stage of the gold rally – FX Empire's Hyerczyk

Ernest Hoffman is a Crypto and Market Reporter for Kitco News. He has over 15 years of experience as a writer, editor, broadcaster and producer for media, educational and cultural organizations.

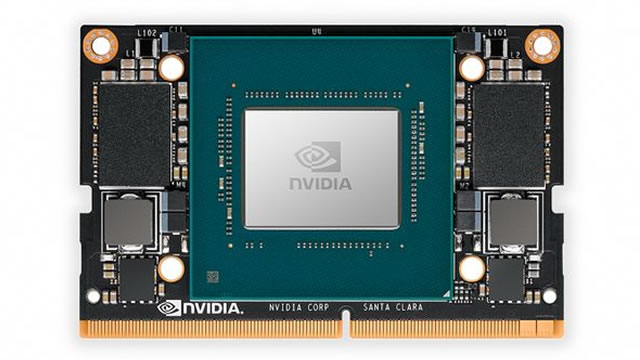

Nvidia's AI Empire Faces Its Toughest Battle

Nvidia Corporation expects $38.16B in Q4 revenue, but AI demand slowdown or margin contraction could signal pricing pressure and competition risks. DeepSeek's $5.6M AI training claim is unrealistic, likely subsidized, and raises concerns about China's strategic push for AI efficiency. China's demand for Nvidia's H20 remains high, with 1M units shipped in 2024, generating $12B despite DeepSeek's rise.

CATL's Expanding EV Battery Empire: Can It Overcome U.S. Scrutiny?

The electric vehicle (EV) industry has been evolving rapidly, and battery technology is at the heart of this transformation. One company leading the charge is China-based Contemporary Amperex Technology Co. Limited (CATL), the world's largest EV battery maker.

Leasing momentum in Manhattan is super strong, says Empire State Realty Trust CEO

Anthony Makin, Empire State Realty Trust chairman and CEO, joins 'The Exchange' to discuss the impact of congestion pricing in Manhattan, the return to office story, and insights behind the company's softer guidance.

Empire State Manufacturing Increase More Than Expected

Pre-market futures are starting a new holiday-shortened trading week higher, with all four major indexes currently riding in the green. The Dow is +81 points at this hour, the S&P 500 is +23, the Nasdaq +96 points and the small-cap Russell 2000 +9.

Equinor Secures NYPSC Approval for Empire Wind 1 Transmission Facilities

EQNR's Empire Wind 1 offshore wind project's transmission line extends approximately 17.5 miles from the boundary of New York State waters to an interconnection in Brooklyn.

Amazon looks to hire 2,000 new workers in Inland Empire

Amazon is gearing up for a hiring spree in California's Inland Empire.

Berkshire Hathaway: Buffett's Empire Is Stronger Than Ever

Berkshire Hathaway remains a BUY due to its strong, diversified portfolio and record cash pile, positioning it well for potential economic downturns. Despite potential short-term disappointments in the insurance business from hurricane impacts, long-term growth opportunities and resilience make Berkshire Hathaway an attractive investment. The firm's undervaluation compared to the broader market and its substantial investment portfolio, including tech exposure, enhance its appeal for long-term investors.

Rebuilding the Empire: Can Dollar General Rally in 2025?

Dollar General's NYSE: DG stock has taken a beating, leaving many investors wondering if the discount retailer has lost its way. With shares down over 50% from their 52-week high, a closer look reveals a company working through turbulent times but potentially has a brighter future.