Emerson Electric Co. (EMR)

Summary

EMR Chart

Why Emerson Electric (EMR) Dipped More Than Broader Market Today

Emerson Electric (EMR) concluded the recent trading session at $131.64, signifying a -1.83% move from its prior day's close.

Here is What to Know Beyond Why Emerson Electric Co. (EMR) is a Trending Stock

Emerson Electric (EMR) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Emerson Electric (EMR) Beats Stock Market Upswing: What Investors Need to Know

Emerson Electric (EMR) concluded the recent trading session at $139.57, signifying a +1.87% move from its prior day's close.

Emerson Electric Co. (EMR) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has Emerson Electric Co. ever had a stock split?

Emerson Electric Co. Profile

| Machinery Industry | Industrials Sector | Surendralal Lanca Karsanbhai CEO | XMEX Exchange | US2910111044 ISIN |

| US Country | 73,000 Employees | - Last Dividend | 12 Dec 2006 Last Split | 1 Jun 1972 IPO Date |

Overview

Emerson Electric Co. stands as a pivotal technology and software entity, catering to a diverse array of needs across industrial, commercial, and consumer markets globally, including the Americas, Asia, the Middle East, Africa, and Europe. Established in 1890 and based in Saint Louis, Missouri, Emerson's operations span six critical segments: Final Control, Control Systems & Software, Measurement & Analytical, AspenTech, Discrete Automation, and Safety & Productivity. This structure allows Emerson to offer comprehensive solutions that enhance efficiency, safety, and innovation for their clients.

Products and Services

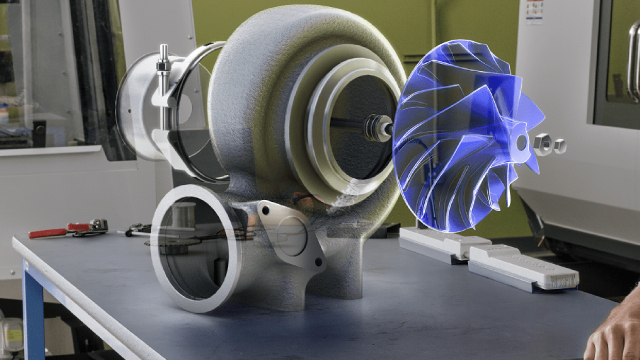

- Final Control: Offers a variety of critical components like control, isolation, shutoff, pressure relief, and safety valves, in addition to actuators and regulators. These products are indispensable for process and hybrid industries, ensuring precise control and safety in operations.

- Measurement & Analytical: This segment delivers intelligent instrumentation that measures liquid or gas properties such as pressure, temperature, level, flow, and more. Instruments include acoustics, corrosion, pH, conductivity, water quality monitors, toxic gases, and flame detectors, vital for accurate analysis and monitoring.

- Discrete Automation: Provides solenoid and pneumatic valves, valve position indicators, pneumatic cylinders, air preparation equipment, and electric linear motion solutions. It also offers programmable automation control systems and electrical distribution equipment, essential for manufacturing and automation industries.

- Safety & Productivity: Features tools designed for both professionals and homeowners, encompassing pipe-working tools like pipe wrenches and cutters, threading and grooving equipment, battery hydraulic tools, and a variety of electrical tools, underpinning numerous professions and DIY projects.

- Control Systems & Software: Offers a range of systems and software solutions including distributed control systems, safety instrumented systems, SCADA systems, application software, and cybersecurity services. These are geared towards optimizing operations' safety and efficiency through digital innovation.

- AspenTech: Provides asset optimization software which assists industrial manufacturers in designing, operating, and maintaining their operations efficiently. It combines modeling, simulation, and optimization capabilities gathered over decades, driving performance enhancement.