Exelon Corporation (EXC)

D or EXC: Which Is a Better-Positioned Electric Power Stock?

D and EXC work efficiently and continue to provide reliable services to their expanding customer base.

Exelon (EXC) Could Be a Great Choice

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Exelon (EXC) have what it takes?

Are You Looking for a High-Growth Dividend Stock?

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Exelon (EXC) have what it takes?

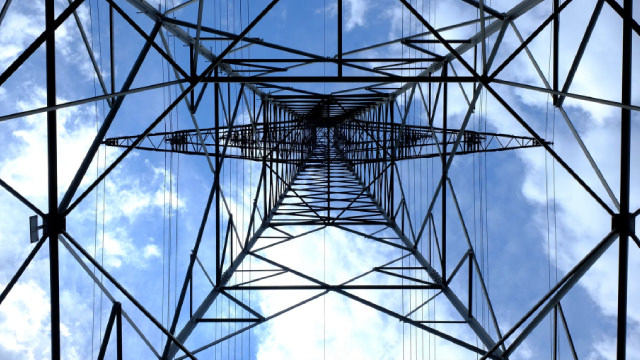

Exelon to Invest $38B in Infrastructure Amid Changing Usage Patterns

EXC is poised for growth courtesy of its long-term investment plans and rising demand in the service region.

Exelon (EXC) Could Be a Great Choice

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Exelon (EXC) have what it takes?

Exelon Corporation (EXC) Q2 2025 Earnings Call Transcript

Exelon Corporation (NASDAQ:EXC ) Q2 2025 Earnings Conference Call July 31, 2025 10:00 AM ET Company Participants Andrew C. Plenge - Vice President of Investor Relations Calvin G.

Exelon's Q2 Earnings Surpass Estimates, Sales Lag, Delivery Volume Up

EXC beats second-quarter earnings estimates, with delivery volume and infrastructure investments on the rise.

Why Exelon (EXC) is a Top Value Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Exelon (EXC) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for Exelon (EXC) give a sense of how its business performed in the quarter ended June 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Exelon (EXC) Beats Q2 Earnings Estimates

Exelon (EXC) came out with quarterly earnings of $0.39 per share, beating the Zacks Consensus Estimate of $0.37 per share. This compares to earnings of $0.47 per share a year ago.

Are You Looking for a High-Growth Dividend Stock?

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Exelon (EXC) have what it takes?

Exelon to Release Q2 Earnings: What's in Store for the Stock?

EXC's second-quarter 2025 results are expected to continue to benefit from decoupled revenues, new rates and rising demand from data centers.