Fastenal Company (FAST)

Fastenal's October Daily Sales Increase 2.8%, Stock Up

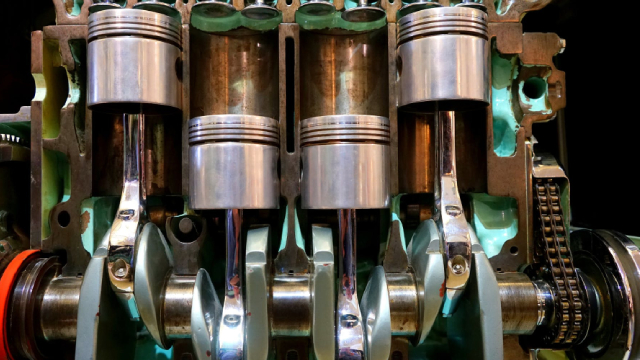

FAST's average daily sales growth rate moderated sequentially in October, with improving heavy manufacturing end markets though declines in non-residential markets returned.

Why Fastenal Stock Could Hit New Highs After Strong Q3 Results

Fastenal FAST stock has increased more than 250% since 2016 due to customer growth, the growing number of Onsite locations, deepening service penetration, and improving business metrics. The rally in stock prices can continue because those factors continue to drive results.

Fastenal (FAST) International Revenue Performance Explored

Review Fastenal's (FAST) international revenue performance and how it affects the predictions of financial analysts on Wall Street and the future prospects for the stock.

High-Quality Dividend Stock Universe: Fastenal Company - In Need Of A Moderate Pullback

Fastenal reported better than expected Q3 earnings, resulting in a 10% jump in stock price. Fastenal has returned more than 51,000% since inception, equating to a CAGR of almost 20%. Earlier this year, the company achieved dividend champion status, but the rising payout ratio is something investors should monitor.

Why Fastenal Stock Could Hit New Highs After Strong Q3 Results

Fastenal NASDAQ: FAST stock has increased more than 250% since 2016 due to customer growth, the growing number of Onsite locations, deepening service penetration, and improving business metrics. The rally in stock prices can continue because those factors continue to drive results.

Fastenal Shares Jump After Revenue Rose Despite Hurricane Helene Disruption

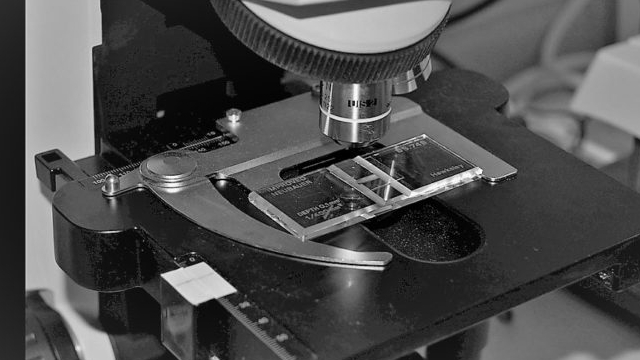

Fastenal (FAST) shares were the top gainer in the S&P 500 Friday after the maker of fasteners and other industrial supplies reported increased revenue even as disruptions caused by Hurricane Helene cut into sales.

Fastenal Company (FAST) Q3 2024 Earnings Call Transcript

Fastenal Company (NASDAQ:FAST ) Q3 2024 Earnings Call Transcript October 11, 2024 10:00 AM ET Company Participants Taylor Ranta - Accounting Manager Dan Florness - CEO Holden Lewis - CFO Conference Call Participants Ryan Merkel - William Blair Ken Newman - KeyBanc Capital Markets Tommy Moll - Stephens Stephen Volkmann - Jefferies Nigel Coe - Wolfe Research Chris Snyder - Morgan Stanley Operator Hello, and welcome to the Fastenal 2024 Q3 Earnings Results Conference Call. At this time, all participants are in a listen-only mode.

Fastenal's Q3 Earnings Meet Estimates, Sales Miss, Stock Up

FAST's third-quarter 2024 results reflect an increase in unit sales driven by growth with larger customers, offset by unfavorable customer and product mix.

Fastenal (FAST) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for Fastenal (FAST) give a sense of how its business performed in the quarter ended September 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Nuts And Bolts: This Economic Indicator Nails A Breakout

Fastenal scored enough of an Q3 beat to trigger an early breakout. But the more interesting news is in the report's details.

Fastenal (FAST) Matches Q3 Earnings Estimates

Fastenal (FAST) came out with quarterly earnings of $0.52 per share, in line with the Zacks Consensus Estimate. This compares to earnings of $0.52 per share a year ago.

Fastenal Stock Is Jumping After Earnings Beat. The Quarter Finished Strong.

As the first industrial company to report earnings, its numbers could indicate the strength of the economy.