Freeport-McMoRan Inc. (FCX)

Freeport-McMoRan: China Stimulus Is A Big Deal

Freeport-McMoRan's shares remain stable due to strong long-term copper demand, driven by China's economic recovery and AI-driven infrastructure projects. China's aggressive stimulus measures and focus on AI and automation will likely boost copper demand, benefiting Freeport-McMoRan significantly. Despite short-term market fluctuations, Freeport-McMoRan's strong balance sheet and future market prospects make it a solid buy for long-term growth.

US-Listed Casino and Copper Stocks Surge Following Chinese Stimulus Measures

Since China launched a series of stimulus measures, US-listed casino and copper stocks have performed exceptionally well. A research company is suggesting investors consider buying these stocks.

Freeport-McMoRan (FCX) Sees a More Significant Dip Than Broader Market: Some Facts to Know

In the latest trading session, Freeport-McMoRan (FCX) closed at $51.34, marking a -1.1% move from the previous day.

Trade School: China exposure

Stephanie Link, CIO at Hightower, joins CNBC's "Halftime Report" to break down the China Trade and share some of the moves she's making in her portfolio.

China stimulus: top 3 commodities stocks to consider

China announced several measures, including lowering the amount of cash that banks must have in reserve, to resurrect its housing market and the broader economy this week.

2 Copper Stocks To Watch Ahead of October 2024

Copper stocks to check out in the stock market today.

Top 4 Materials Stocks That May Implode In Q3

As of Sept. 27, 2024, four stocks in the materials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

Why Shares in This Hot Copper Mining Stock Soared This Week

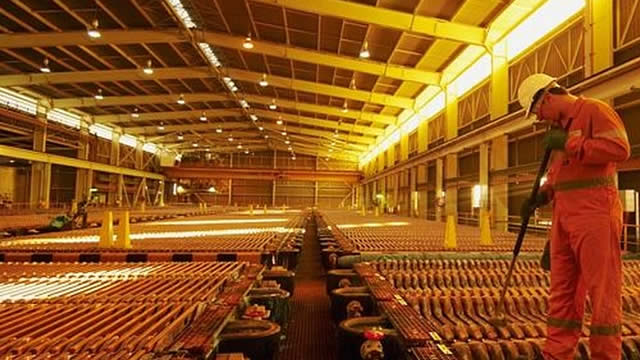

China is injecting liquidity into its banking system to encourage economic growth, particularly in its real estate and construction sectors. Copper is a critical metal in the clean energy transition.

Investors Heavily Search Freeport-McMoRan Inc. (FCX): Here is What You Need to Know

Zacks.com users have recently been watching Freeport-McMoRan (FCX) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Freeport-McMoRan (FCX) Moves 7.9% Higher: Will This Strength Last?

Freeport-McMoRan (FCX) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

S&P 500 Gains and Losses Today: Economic Stimulus Boosts China-Facing Stocks

Major U.S. equities indexes ticked higher on Tuesday, shaking off a report that revealed a steeper-than-expected drop in consumer confidence this month.

Freeport-McMoRan Stock Soars as Copper and Gold Prices Rise

Freeport-McMoRan (FCX) shares surged on Tuesday amid an increase in the prices of copper and gold, two of the main commodities produced by the mining giant.