Freeport-McMoRan Inc. (FCX)

Freeport-McMoRan (FCX) Beats Stock Market Upswing: What Investors Need to Know

In the most recent trading session, Freeport-McMoRan (FCX) closed at $33.75, indicating a +1.2% shift from the previous trading day.

Freeport-McMoRan: Capitalizing On The Commodity Supercycle

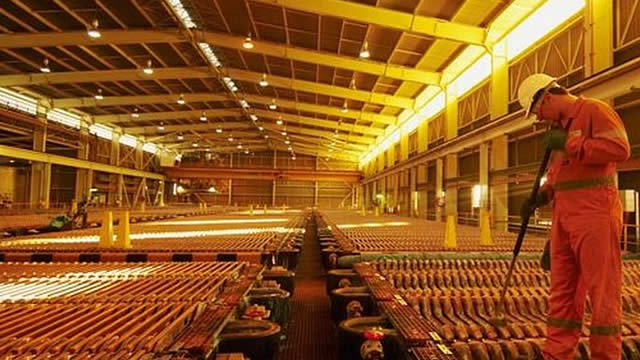

Freeport-McMoRan Inc. is poised to benefit from the ongoing gold and copper supercycles, driven by rising commodity prices and strong demand. Gold prices have surged from $2,700 to $3,200 per oz, with further growth expected, boosting Freeport-McMoRan's profitability. Copper demand is set to rise due to electrification, 5G, and AI trends, while supply constraints will drive prices higher.

Freeport-McMoRan (FCX) Moves 15.5% Higher: Will This Strength Last?

Freeport-McMoRan (FCX) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions could translate into further price increase in the near term.

Freeport-McMoRan (FCX) is a Top-Ranked Value Stock: Should You Buy?

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Freeport-McMoRan Stock Loses 25% in 3 Months: Should You Buy Now?

While FCX is poised to gain from progress in expansion activities and solid financial health, high production costs and falling copper prices warrant caution.

Fair trade deals are needed to avoid derailing momentum in tech, AI: Freeport McMoran's Adkerson

Richard Adkerson, Freeport McMoran chairman and former CEO, joins 'Money Movers' to discuss how recent news plays through to Freeport McMoran's business, what tariffs could do to copper, and much more.

3 No-Brainer Stocks With Long-Term Prospects to Buy With $100 Right Now

If you are reading this article and looking to invest just $100, then I'm going to guess you are a relatively new investor and/or someone looking to invest a little money in a long-term position in anticipation of stellar returns.

Here is What to Know Beyond Why Freeport-McMoRan Inc. (FCX) is a Trending Stock

Recently, Zacks.com users have been paying close attention to Freeport-McMoRan (FCX). This makes it worthwhile to examine what the stock has in store.

Freeport-McMoRan Issues First-Quarter Operational Update

FCX expects its consolidated average realized copper price for the first quarter of 2025 to be around $4.40 per pound.

Freeport-McMoRan (FCX) Stock Declines While Market Improves: Some Information for Investors

In the most recent trading session, Freeport-McMoRan (FCX) closed at $37.86, indicating a -1.46% shift from the previous trading day.

Freeport-McMoRan: The Market Teaches Copper Bulls A Lesson

Copper futures surged to new highs in March, but FCX stock has remained in its doldrums. FCX believes it can navigate the impending copper tariffs, but what about possible disruptions to the US economy? Analysts have already downgraded FCX's estimates, and its valuations have likely contemplated significant downside possibilities.

This Magnificent Mining Stock Is Down 37%. Buy It Before It Sets a New All-Time High.

Copper miner Freeport-McMoRan's (FCX -4.10%) stock is down 37% from its all-time high, yet the price of copper is almost at an all-time high. While the company's news hasn't been entirely positive over the last year, the share price performance and valuation disparity suggest that the stock looks great and is worth picking up in the general market downturn.