Flex Ltd. (FLEX)

FLEX LNG: Keep The 12% Yield, Hedge Dividend-Cut Fears With Covered Calls

FLEX LNG offers a compelling 12% dividend yield, supported by long-term charters and a young, modern LNG carrier fleet. Dividend coverage remains razor-thin, with recent payouts occasionally exceeding operating cash flow, but a large cash reserve and no near-term debt maturities provide a buffer. Risks include a significant LNG carrier orderbook and potential softening of spot charter rates if supply outpaces demand, though FLNG trades at a discount to estimated NAV.

Here's Why Flex (FLEX) is a Strong Value Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Will Flex (FLEX) Beat Estimates Again in Its Next Earnings Report?

Flex (FLEX) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Falcon Flex Drives Growth as CrowdStrike Bets on AI Security

CrowdStrike Holdings Inc. NASDAQ: CRWD stock is up 43% in 2025. That's about 3x the gains in the S&P 500, making the stock one of the best growth stories in the entire market.

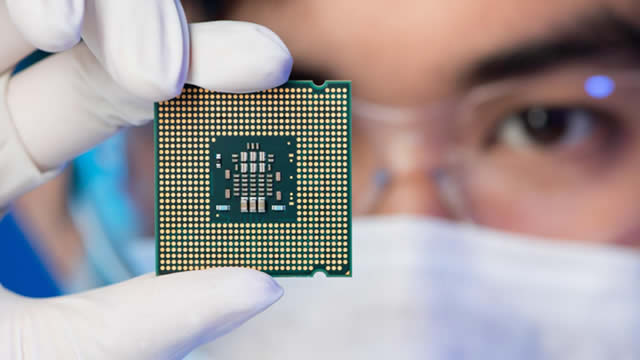

Flex Adds Modular Rack CDU for AI & Hyperscale to Cooling Portfolio

Flex debuts a modular rack-level cooling unit via JetCool, strengthening its vertically integrated data center strategy.

Why Flex (FLEX) is a Top Value Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Flex and Renesas Team Up for Advanced Power Management Solutions

FLEX teams with Renesas to deliver next-gen power modules, boosting data center efficiency and AI workload performance.

Flex Stock Surges 56% in the Past Year: Will the Uptrend Continue?

FLEX's strong data center growth, global scale and strategic acquisitions fuel momentum as fiscal 2026 outlook brightens.

Why Flex (FLEX) is a Top Growth Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Omega Flex: A Robust Business, But Fairly Valued

Omega Flex delivered solid H1 results, with stable revenues and strong free cash flow, fully covering its dividend payouts. The company boasts a fortress-like balance sheet, holding over $50 million in cash and zero debt, supporting financial stability. Despite a reasonable valuation and niche market strength, shares trade at about 20x earnings and a double-digit EV/EBITDA, limiting upside.

Why Flex (FLEX) is a Top Momentum Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Flex Q1 Earnings & Revenues Beat Estimates, Up Y/Y, Stock Down

FLEX beats Q1 forecasts and lifts FY26 outlook, but shares fall 7.7% despite robust data center and power gains.