General Electric Company (GE)

GE Aerospace Set to Post Q4 Earnings: What Lies Ahead for the Stock?

GE's fourth-quarter results are likely to benefit from strength across its commercial and defense end markets. High costs and expenses are likely to have been spoilsports.

What Analysts Think of GE Aerospace Stock Ahead of Earnings

GE Aerospace (GE) is slated to report fourth-quarter results Thursday morning, and analysts are bullish on the maker of airplane engines and other parts.

GE Aerospace stock price forms a risky pattern ahead of earnings

The GE Aerospace stock price recovered modestly this year ahead of the upcoming fourth-quarter earnings. It rose to a high of $182.85, its highest swing since November last year.

GE Soars: Why I'm Betting Big On This Aerospace Powerhouse

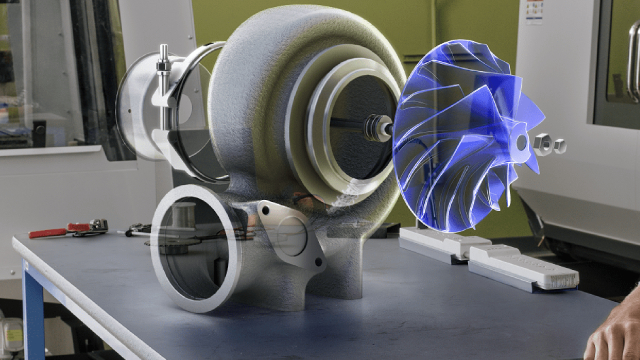

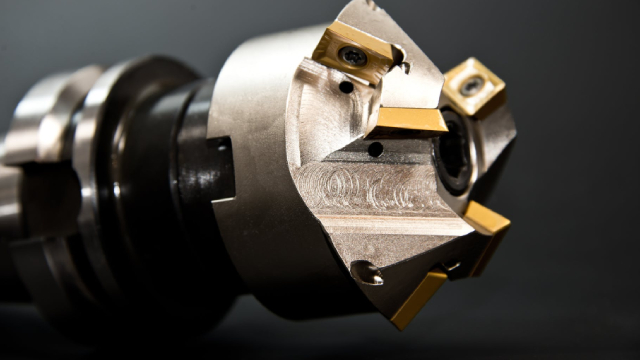

GE Aerospace's transformation into a pure-play aerospace leader has unlocked tremendous growth potential, driven by strong secular trends in commercial and defense aviation. The company boasts a dominant market position, with GE engines powering 75% of commercial flights and a robust aftermarket revenue model. GE's FLIGHT DECK strategy and MRO investments have boosted efficiency and profitability, positioning it well for long-term growth and dividend increases.

GE Aerospace Clinches Deal to Supply T700 Engines in Poland

GE clinches a deal to supply 210 T700 engines for the Polish Armed Forces' Boeing AH-64E Apache Guardian helicopters.

Here's Why GE Aerospace Stock Crushed the Market in 2024

Shares in GE Aerospace (GE 0.34%) rose by more than 63% in 2024 after adjusting for the spinoff of GE Vernova in April, according to data provided by S&P Global Market Intelligence . The move comes as the commercial aerospace industry and GE, in particular, helped dispel fears of a slowdown in original equipment (OE) sales due to both Boeing and Airbus falling short of airplane production expectations and ongoing supply chain and parts availability issues at suppliers like GE.

GE Aerospace: Buy, Sell, or Hold?

GE Aerospace (GE -1.04%) has had an excellent beginning as an independent company. The market has quickly responded by assigning it a premium rating, driven by strong operational performance and the promise of a long-term revenue stream from services related to its aircraft engines installed in airline fleets.

Analysts Urge Clients To Buy 10 Stocks Before Year's End

Not sure which S&P 500 stocks to buy before the year's up? Just ask the analysts — they'll tell you.

GE Aerospace: Surging Free Cash Flow Makes This A Top Stock, And I Am Buying

GE Aerospace stock has declined nearly 9% due to concerns over potential government spending cuts, but the company has low defense exposure. EBITDA estimates show minor downward revisions, with annual growth expected at 8.3%, an improvement from earlier estimates. Free cash flow projections have been slightly reduced, but still indicate strong shareholder returns through dividends and share repurchases.

GE Vernova: Valued Like The Magnificent 7, Delivering Like An Industrial

GE Vernova's valuation is excessively high, trading at ~3x revenue, despite modest revenue growth and low profit margins, making it overvalued compared to peers. The wind turbine segment struggles with profitability and faces intense competition, particularly from low-cost Chinese manufacturers, casting doubt on future margins. Medium-term prospects are supported by strong order intake and a growing backlog, especially in gas power for AI data centers, but long-term headwinds are expected.

GE Vernova CEO Scott Strazik on electricity demand: We're very well positioned to serve this market

GE Vernova CEO Scott Strazik joins 'Squawk on the Street' to discuss the surge in company stock since its spin-off from General Electric, state of the electricity market, demand outlook, data centers & nuclear power, and more.

GE Vernova Projects Growth But Notes Challenges In Wind Segment

On Tuesday, GE Vernova GEV hosted its 2024 Investor Update event to present its multi-year financial outlook and frame its capital allocation strategy.