General Electric Company (GE)

Crude Oil Down 2%; GE Aerospace Earnings Top Views

U.S. stocks traded higher midway through trading, with the Nasdaq Composite gaining more than 100 points on Tuesday.

This Is Not Your Father's GE: GE Aerospace Keeps Hitting Home Runs

GE Aerospace is a pure-play aerospace company with strong financial performance and impressive growth in orders, profits, and margins. The company's aftermarket revenue, innovative programs, and streamlined operations position it for sustained success and elevated free cash flow. With guidance hikes and ambitious long-term targets, GE Aerospace is accelerating momentum and maintaining strong market dominance.

General Electric Company (GE) Q2 2024 Earnings Call Transcript

General Electric Company (NYSE:GE ) Q2 2024 Earnings Conference Call July 23, 2024 7:30 AM ET Company Participants Blaire Shoor - Director of Investor Relations Lawrence Culp - Chairman and Chief Executive Officer Rahul Ghai - Senior Vice President and Chief Financial Officer Conference Call Participants Robert Spingarn - Melius Research LLC Myles Walton - Wolfe Research Sheila Kahyaoglu - Jefferies LLC David Strauss - Barclays Bank PLC Seth Seifman - JPMorgan Chase & Co. Gautam Khanna - TD Cowen Scott Deuschle - Deutsche Bank Robert Stallard - Vertical Research Partners LLC Noah Poponak - Goldman Sachs Gavin Parsons - UBS Jason Gursky - Citigroup Inc. Matthew Akers - Wells Fargo Securities, LLC Operator Good day, ladies and gentlemen, and welcome to the GE Aerospace Second Quarter 2024 Earnings Conference Call. At this time all participants are in a listen-only mode.

GE Aerospace Stock Jumps on Earnings Beat, Guidance Boost

GE Aerospace (GE) shares jumped over 6% in early trading Tuesday after the company's second-quarter earnings exceeded expectations as orders surged.

GE Aerospace cashes in on jet supply problems

GE Aerospace said it is cashing in on a shortage of new civil jets currently as it raised its profits forecast for the current year. Shares rose 2.5% in premarket trading as the engineer said aircraft shortages and high travel demand are driving up maintenance expenses as airlines keep older planes flying.

GE Aerospace's stock jumps after earnings beat by wide margin, full-year outlook was raised

Shares of GE Aerospace GE, +2.28% climbed 2.6% toward a two-month high in premarket trading Tuesday, after the jet engines maker reported second-quarter profit and revenue that were well above forecasts, and lifted its full-year outlook. The results were the first for GE as an independent company, since the spinoff of the power business as GE Verona Inc. GEV, +2.09% took effect on April 2.

GE Aerospace lifts 2024 profit view on strong demand for engine parts, services

GE Aerospace raised its annual profit forecast on Tuesday on strong demand for its aftermarket services, including jet-engine parts, as a shortage of new planes prompted airlines to keep older ones in the air.

GE Aerospace Earnings Due. Will GE Increase The Dividend?

Strong GE Aerospace earnings underpin robust cash generation. The company increased the GE stock dividend in April.

GE Aerospace (GE) to Report Q2 Earnings: What to Expect?

GE Aerospace's (GE) second-quarter results are expected to benefit from strength across its businesses. High costs and expenses are likely to have been spoilsports.

GE Aerospace and 4 More Stocks That Haven't Been Moved by the Market Rotation

The brutal tech rotation has reminded investors it's a good idea to invest in multiple themes, instead of piling into any stock related to one, in this case the rise of artificial intelligence.

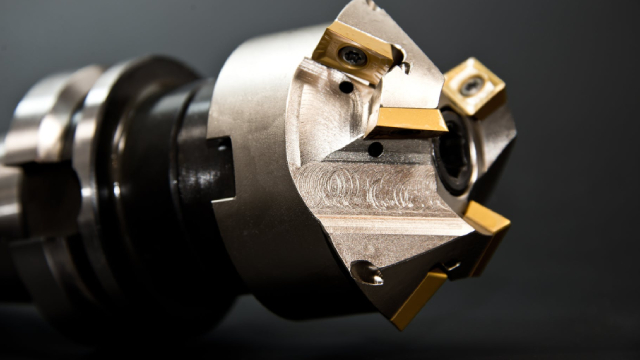

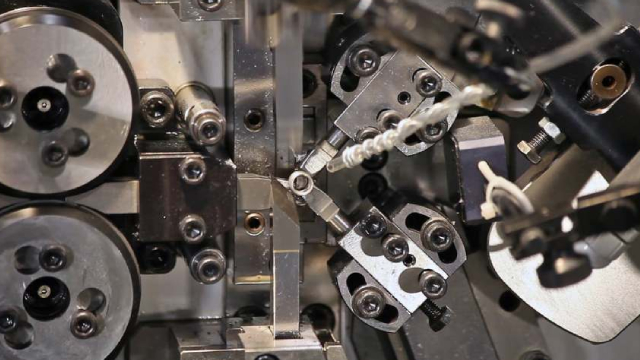

GE Aerospace to invest $1 billion on upgrades at its engine repair shops

GE Aerospace on Friday unveiled a plan to invest more than $1 billion over five years to expand its maintenance, repair, and overhaul (MRO) facilities worldwide and reduce turnaround times for its customers.

Vineyard Wind incident was not first time a GE Vernova wind turbine came apart

An incident at the Vineyard Wind offshore wind energy project this week that scattered shards of fiberglass across Massachusetts beaches was the latest in a series of failures involving wind turbines built by GE Vernova.