General Electric Company (GE)

Buy GE Aerospace (GE) Stock After Strong Q4 Earnings?

Able to crush Q4 earnings expectations last Thursday, let's see if it's time to buy GE Aerospace (GE) stock for more upside.

GE Aerospace Q4: Firing On All Cylinders; Upgrade To 'Strong Buy'

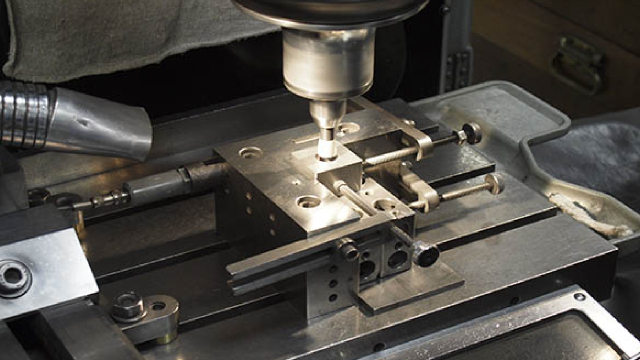

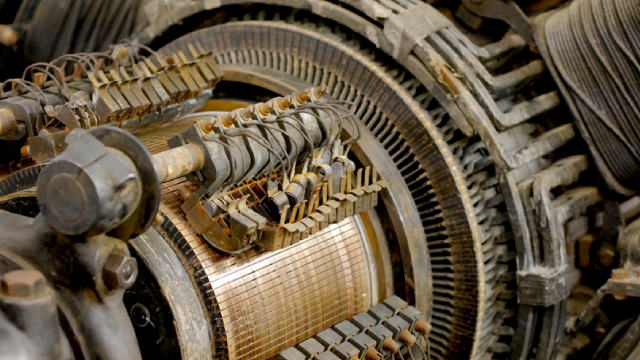

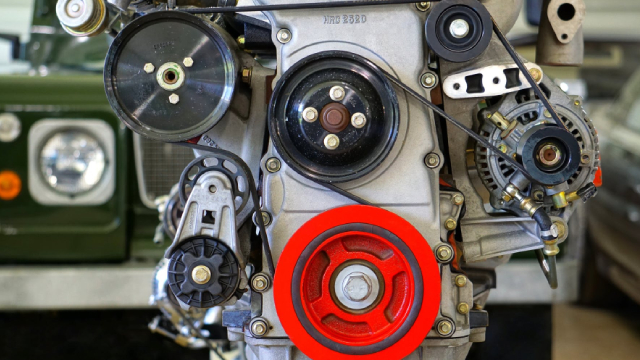

Upgraded GE Aerospace to 'Strong Buy' with a fair value of $250 per share due to robust order growth and strong FY25 guidance. Significant investments in the LEAP engine program and MRO facilities are key drivers of sustained growth in commercial engines and defense markets. FY25 revenue projected to grow by 12.5%, driven by Commercial Engines & Services and Defense & Propulsion Technologies segments.

GE: Why I Believe The Aerospace Powerhouse Stock Is Worth $239

GE Aerospace stock surged 6.6% to over $200, surpassing the $184 price target with a 21.1% return, far outpacing the S&P 500. Q4 earnings showed 16% revenue growth, 49% operating profit increase, and doubled EPS, with strong free cash flow and order growth. GE Aerospace guides for low double-digit growth in 2025, with significant increases in CES and DPT segments, and plans for stock repurchases and dividend hikes.

General Electric Company (GE) Q4 2024 Earnings Call Transcript

General Electric Company (NYSE:GE ) Q4 2024 Results Conference Call January 23, 2025 7:30 AM ET Company Participants Blaire Shoor - Head of Investor Relations Larry Culp - Chairman and Chief Executive Officer Rahul Ghai - Chief Financial Officer Conference Call Participants Scott Deuschle - Deutsche Bank Myles Walton - Wolfe Research Ron Epstein - Bank of America Sheila Kahyaoglu - Jefferies Doug Harned - Bernstein Robert Stallard - Vertical Research Seth Seifman - JPMorgan David Strauss - Barclays Jason Gursky - Citi Gavin Parsons - UBS Robert Spingarn - Melius Research Operator Good day, ladies and gentlemen, and welcome to the GE Aerospace Fourth Quarter 2024 Earnings Conference Call. At this time, all participants are in a listen-only mode.

Watch These GE Aerospace Price Levels as Stock Surges After Strong Earnings

GE Aerospace (GE) shares are likely to remain in focus after surging Thursday following better-than-expected fourth quarter results and an upbeat revenue outlook from the company.

GE Aerospace Beats Expectations Across The Board: Analyst Sees Upside In 2025 Guidance

Goldman Sachs analyst Noah Poponak expressed views on GE Aerospace‘s GE fourth-quarter FY24 results.

GE Aerospace Earnings Surpass Estimates in Q4, Surge 103% Y/Y

GE's fourth-quarter 2024 results reflect a 14% y/y increase in revenues, driven by the solid performances of its segments.

Why GE Aerospace Stock Is Flying High Today

GE Aerospace (GE 7.23%) beat analyst expectations in the fourth quarter and announced plans to boost returns to shareholders. Investors cheered, sending GE shares up 10% as of 10 a.m.

GE (GE) Q4 Earnings: Taking a Look at Key Metrics Versus Estimates

While the top- and bottom-line numbers for GE (GE) give a sense of how the business performed in the quarter ended December 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

US Stocks Mixed; GE Aerospace Posts Upbeat Earnings

U.S. stocks traded mixed this morning, with the Dow Jones index gaining around 50 points on Thursday.

GE Aerospace Crushes Q4 EPS Expectations

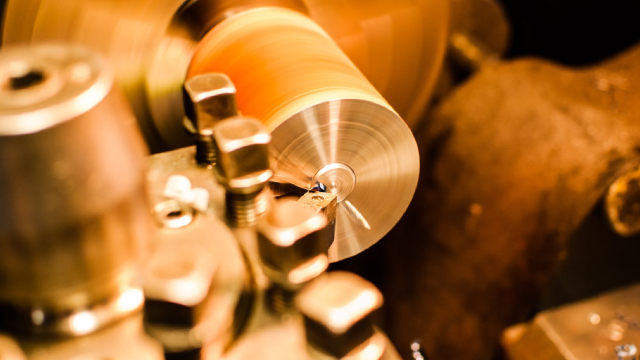

GE Aerospace (GE 0.46%), a global leader in the design and manufacture of jet engines, delivered a stellar performance in its Q4 2024 earnings release on Thursday, Jan. 23. The company's adjusted EPS of $1.32 far exceeded the analyst estimate of $1.04, marking a 103% increase from the prior year's quarter.

GE Aerospace gains altitude as bumper results see shareholder rewards hiked

Ge Aerospace surged on Thursday after the aircraft engine maker unveiled expectation-topping fourth-quarter figures and boosted shareholder rewards. Net income climbed by 49% to US$1.9 billion and trounced analysts' expectations for US$1.2 billion, as revenue also surpassed forecasts, up 14% at US$10.8 billion.