Global Partners L.P. (GLP)

How digital health companies are capitalizing on the GLP-1 boom

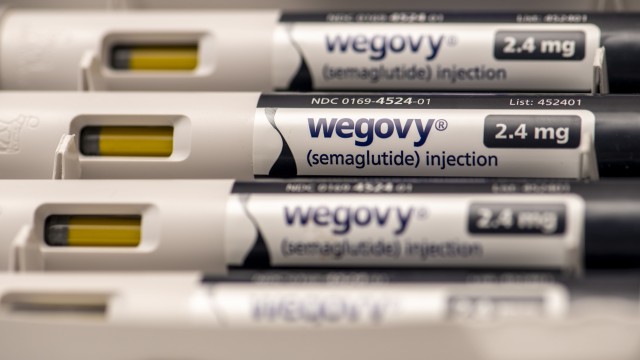

Some analysts estimate that anti-obesity medications could grow into a $100 billion industry by the end of the decade. Companies including Calibrate, Ro and WeightWatchers are looking to capitalize on the GLP-1 boom by launching weight loss programs around medications like Ozempic and Wegovy.

Amid ‘Ozempic babies' questions, women account for more than 75% of young adults taking GLP-1 drugs, study finds

More than three out of four young adults prescribed GLP-1 drugs last year were women, new research shows, raising questions about how societal views of women's weight may influence use of these medications and underscoring the need to better understand how the drugs may affect fertility, pregnancy, and longer-term health outcomes, researchers say.

Hims & Hers Health stock price nears record high on news that it will offer GLP-1 weight-loss drugs amid shortages

Hims & Hers Health got a shot in the arm this week that sent its share prices to near all-time highs.

Hims & Hers: Soaring On Access To Compounded GLP-1 Drugs, Further Volatility Ahead

Hims & Hers Health's share price increased by over 25% after announcing the availability of compounded GLP-1 agonist weight loss drugs at a fraction of the price of branded drugs. The company aims to capitalize on the shortages of the branded drugs Wegovy and Zepbound, which are expected to dominate a potential $100 billion industry. Hims & Hers' partnership with a manufacturer of generic and compounded medications allows it to offer these drugs without supply shortages, potentially generating significant revenue.

Nestle to launch Vital Pursuit frozen-food brand targeting GLP-1 users

Nestle's Vital Pursuit brand's initial lineup of 12 items will include frozen bowls with whole grains or protein pasta, sandwich melts and pizzas.

Hims & Hers Health Stock Jumps Nearly 28% on Plans to Offer GLP-1 Weight-Loss Drugs

Shares of Hims & Hers Health (HIMS) surged close to 28% Monday after the telehealth company said it would begin offering GLP-1 injections as part of its weight-loss package of drugs.

Hims & Hers rallies after announcing access to GLP-1 injections

Hims & Hers Health Inc shares rocketed 31% higher on Monday after announcing it will provide access to injectable GLP-1 medications. These injections serve as a more affordable alternative to branded versions such as Wegovy and Ozempic, said the telehealth company in a press statement.

Hims & Hers Health says it will offer compounded GLP-1 drugs, despite FDA warnings

Hims & Hers Health Inc.'s stock HIMS, +32.81% jumped more than 30% Monday morning after the health and wellness platform said it would offer compounded GLP-1 drugs — products that the Food and Drug Administration has warned against.

Hims & Hers Health adds compounded GLP-1 injections to weight loss program

The GLP-1 market has faced supply constraints in recent months as the drugs like Ozempic and Wegovy skyrocket in popularity.

Hims & Hers rallies after announcing access to GLP-1 injections

Hims & Hers Health Inc shares rocketed 31% higher on Monday after announcing it will provide access to injectable GLP-1 medications. These injections serve as a more affordable alternative to branded versions such as Wegovy and Ozempic, said the telehealth company in a press statement. "We are excited to offer a more affordable option for patients seeking effective weight loss solutions," said Andrew Dudum, chief executive of Hims & Hers. "Our compounded semaglutide injections are a testament to our commitment to providing accessible healthcare.” Hims & Hers plans to offer these injections through their telehealth platform, addressing the growing demand for weight loss treatments. “We know weight loss medications alone do not treat obesity effectively, so we’ve built a holistic weight management solution that supports customers as they combine powerful medications with healthy lifestyle habits, such as exercise, improved sleep, and eating nutritious foods,” said Patrick Carroll, chief medical officer of Hims & Hers. Shares were swapping for $19 with a market capitalisation of $4.1 billion on Monday. Nvidia Corp is set to dominate market discussions this week as it prepares to release its earnings report on Wednesday afternoon. The semiconductor giant, with a market cap of approximately $2.3 trillion, holds significant influence in the S&P 500. Its performance is expected to impact the technology sector and broader market indices. "As Nvidia goes, so go most of the semiconductor stocks and AI plays," is how Jay Woods, chief global strategist at Freedom Capital Markets (NASDAQ:FRHC), put it. He noted that the stock's average post-earnings move is plus 8.5%, making it a critical factor for market volatility. Analysts ratings, based on Bloomberg statistics, have the equivalent of 61 buys, 7 holds and 0 sells on the stock. The average analyst price target is $1018.45 which is less than a 10% upside from current levels. “While a disappointment could open the door for many potential downgrades, a beat should lead to a wave of price target upgrades,” said Woods. Beyond Nvidia, other major earnings include Lowe’s, Target, Toll Brothers, elf Beauty, and Macy’s. Zoom Video and Palo Alto Networks are also in focus, with their earnings reports potentially adding to market movements. Zoom Video, which has been struggling since its peak, needs to show sustained improvement while Palo Alto Networks aims to recover from recent declines despite a strong track record, according to Woods. On the macro front The week also features significant economic data releases. Existing Home Sales and FOMC minutes on Wednesday, Jobless Claims and New Home Sales on Thursday, and Durable Goods and Consumer Sentiment on Friday will provide insights into the economic landscape. The S&P 500 reached new highs last week, driven by a cooler-than-expected CPI number, which fueled optimism about potential Fed rate cuts. However, the 10-year yield remains stable above key technical levels, maintaining caution among traders. Freedom Capital Markets (NASDAQ:FRHC) notes the market's anticipation for the Fed minutes, which will reveal any divisions among committee members regarding future rate hikes or cuts. The consensus is no action in June, with possible rate cuts discussed for July or September. Click here to subscribe to future Freedom weekly newsletters by Jay Woods. Nvidia Corp is set to dominate market discussions this week as it prepares to release its earnings report on Wednesday afternoon. The semiconductor giant, with a market cap of approximately $2.3 trillion, holds significant influence in the S&P 500. Its performance is expected to impact the technology sector and broader market indices. "As Nvidia goes, so go most of the semiconductor stocks and AI plays," is how Jay Woods, chief global strategist at Freedom Capital Markets (NASDAQ:FRHC), put it. He noted that the stock's average post-earnings move is plus 8.5%, making it a critical factor for market volatility. Analysts ratings, based on Bloomberg statistics, have the equivalent of 61 buys, 7 holds and 0 sells on the stock. The average analyst price target is $1018.45 which is less than a 10% upside from current levels. “While a disappointment could open the door for many potential downgrades, a beat should lead to a wave of price target upgrades,” said Woods. Beyond Nvidia, other major earnings include Lowe’s, Target, Toll Brothers, elf Beauty, and Macy’s. Zoom Video and Palo Alto Networks are also in focus, with their earnings reports potentially adding to market movements. Zoom Video, which has been struggling since its peak, needs to show sustained improvement while Palo Alto Networks aims to recover from recent declines despite a strong track record, according to Woods. On the macro front The week also features significant economic data releases. Existing Home Sales and FOMC minutes on Wednesday, Jobless Claims and New Home Sales on Thursday, and Durable Goods and Consumer Sentiment on Friday will provide insights into the economic landscape. The S&P 500 reached new highs last week, driven by a cooler-than-expected CPI number, which fueled optimism about potential Fed rate cuts. However, the 10-year yield remains stable above key technical levels, maintaining caution among traders. Freedom Capital Markets (NASDAQ:FRHC) notes the market's anticipation for the Fed minutes, which will reveal any divisions among committee members regarding future rate hikes or cuts. The consensus is no action in June, with possible rate cuts discussed for July or September. Click here to subscribe to future Freedom weekly newsletters by Jay Woods.

GLP-1 Drug Development Market Pile-Up Continues

The mean weight loss in a Phase 1b trial of the GLP/GIP against CT-388 (once-a-week injection for 24 weeks) has just read out at 18.8%, with (apparently) no safety signals. Amgen sort-of-announced positive results on its candidate, MariTide.

Dosing Begins in Lexaria's Comprehensive GLP-1 Animal Study

Study WEIGHT-A24-1 will evaluate DehydraTECH-processed pure semaglutide and liraglutide Will DehydraTECH processing result in higher brain absorption of GLP-1 drugs? KELOWNA, BC / ACCESSWIRE / May 17, 2024 / Lexaria Bioscience Corp. (NASDAQ:LEXX)(NASDAQ:LEXXW) (the "Company" or "Lexaria"), a global innovator in drug delivery platforms announces that dosing has begun in the 12-week animal study WEIGHT-A24-1 (the "Study") to model diabetes treatment and weight loss effects of DehydraTECH™-processed glucagon-like peptide 1 ("GLP-1") drugs and DehydraTECH-processed cannabidiol ("CBD"), alone and in combination in diabetic preconditioned rats.