The Gorman-Rupp Company (GRC)

3 Reasons Why Gorman-Rupp (GRC) Is a Great Growth Stock

Gorman-Rupp (GRC) could produce exceptional returns because of its solid growth attributes.

GRC vs. TRMB: Which Stock Is the Better Value Option?

Investors interested in stocks from the Manufacturing - General Industrial sector have probably already heard of Gorman-Rupp (GRC) and Trimble Navigation (TRMB). But which of these two stocks is more attractive to value investors?

Gorman-Rupp (GRC) Tops Q1 Earnings Estimates

Gorman-Rupp (GRC) came out with quarterly earnings of $0.46 per share, beating the Zacks Consensus Estimate of $0.44 per share. This compares to earnings of $0.30 per share a year ago.

Gorman-Rupp (GRC) Q4 Earnings and Revenues Lag Estimates

Gorman-Rupp (GRC) came out with quarterly earnings of $0.42 per share, missing the Zacks Consensus Estimate of $0.45 per share. This compares to earnings of $0.34 per share a year ago.

Dividend King Gorman-Rupp: Double-Digit EPS Growth Ahead

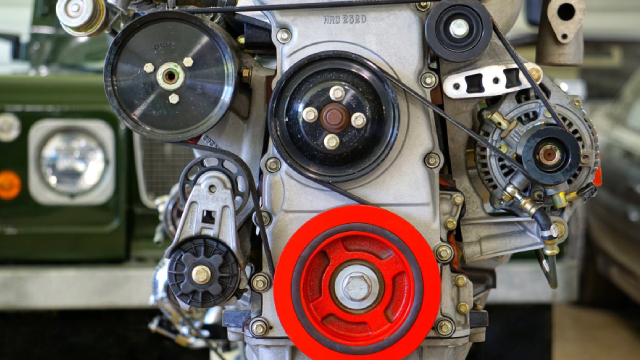

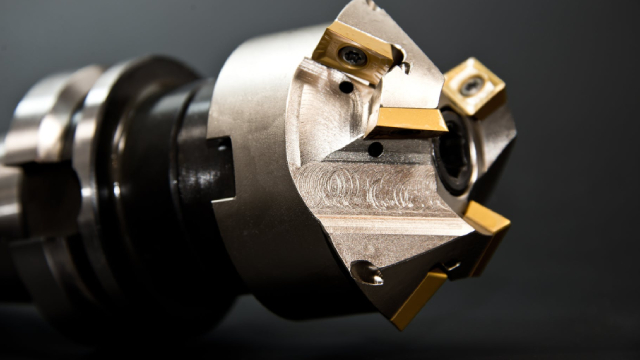

Gorman-Rupp should deliver double-digit earnings growth through 2026, leading to a Buy rating and a one-year price target of $43.30. The company designs and markets pumps and pumping systems, which it sells globally. Q3-2024 results showed a 0.4% sales increase, improved margins, and reduced debt, highlighting management's effective cost controls and operational efficiency.

Buy These 4 Stocks With New Dividend Hikes Amid Market Volatility

Stocks like GRC, KTB, WST and SXI recently announced dividend hikes.

Gorman-Rupp (GRC) Lags Q3 Earnings and Revenue Estimates

Gorman-Rupp (GRC) came out with quarterly earnings of $0.49 per share, missing the Zacks Consensus Estimate of $0.55 per share. This compares to earnings of $0.34 per share a year ago.

GRC or IR: Which Is the Better Value Stock Right Now?

Investors with an interest in Manufacturing - General Industrial stocks have likely encountered both Gorman-Rupp (GRC) and Ingersoll Rand (IR). But which of these two stocks is more attractive to value investors?

Is GormanRupp (GRC) Outperforming Other Industrial Products Stocks This Year?

Here is how Gorman-Rupp (GRC) and Zurn Water (ZWS) have performed compared to their sector so far this year.

Why Gorman-Rupp (GRC) is a Great Dividend Stock Right Now

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Gorman-Rupp (GRC) have what it takes?

GRC vs. IR: Which Stock Is the Better Value Option?

Investors with an interest in Manufacturing - General Industrial stocks have likely encountered both Gorman-Rupp (GRC) and Ingersoll Rand (IR). But which of these two stocks offers value investors a better bang for their buck right now?

Are Industrial Products Stocks Lagging GormanRupp (GRC) This Year?

Here is how Gorman-Rupp (GRC) and Halma (HLMAF) have performed compared to their sector so far this year.