Global Technologies Ltd. (GTLL)

Why Nu Holdings Stands Out Among Global Fintechs

The fintech opportunity outside the US - particularly in LatAm and CIS countries - seems to be massive. There are a few names to monitor: NU, MELI, Kaspi, and T-Technologies. Nu Holdings dominates LatAm digital banking with 123M customers, delivering 40% revenue growth and 28% ROE, while trading at an attractive 18x 2026 P/E. Unlike peers SoFi, MercadoLibre, and Kaspi, Nu offers pure-play digital banking exposure with superior growth rates and a reasonable valuation for patient investors.

Global Stock Markets Mostly Rise After S&P 500, Nasdaq Hit Record Highs

Investors now await consumer price data later to provide clues to the pace of rate cuts through end-year.

Telix Pharmaceuticals Limited (TLX) Presents At H.C. Wainwright 27th Annual Global Investment Conference Transcript

Telix Pharmaceuticals Limited (NASDAQ:TLX ) H.C. Wainwright 27th Annual Global Investment Conference September 9, 2025 12:00 PM EDT Company Participants Christian Behrenbruch - Co-Founder, MD, Group CEO & Executive Director Conference Call Participants Robert Burns - H.C.

Dick's Bets On Foot Locker To Kick Start Global Growth Across Brands

When Dick's Sporting Goods announced in May that it would acquire U.S. sports giant Foot Locker for $2.4 billion, it caught the attention of both Wall Street and sneakerheads.

S&P Global expects crude prices to hit $55 per barrel by year end

An S&P Global executive said he expects dated Brent crude prices to fall to around $55 per barrel by year end, at the Asia Pacific Petroleum Conference on Monday.

Disney Experiences Shines Bright: Will Global Growth Unlock More Value?

DIS' Experiences hits $9B in Q3 revenues, with global expansions and cruise growth fueling long-term momentum.

Descartes Q2 Earnings Lag, Top Line Up Y/Y Despite Global Trade Woes

DSGX posts 10% revenue growth and record EBITDA in fiscal Q2 2026, fueled by acquisitions and strong recurring services momentum.

Aardvark Therapeutics, Inc. (AARD) Presents At Cantor Fitzgerald Global Healthcare Conference 2025 Transcript

Aardvark Therapeutics, Inc. (NASDAQ:AARD ) Cantor Fitzgerald Global Healthcare Conference 2025 September 3, 2025 11:30 AM EDT Company Participants Tien-Li Lee - CEO, Secretary & Director Conference Call Participants Joshua Schimmer - Cantor Fitzgerald & Co., Research Division Presentation Joshua Schimmer Biotech Equity Research Analyst All right. I think we're ready to get started with our next session.

Can BigBear.ai's AI Platform Ride the $1.4T Global AI Wave?

BBAI eyes global AI expansion with $391M cash, defense deals, and rising demand despite short-term revenue dips.

LuxExperience B.V. (LUXE) Presents At Goldman Sachs 32nd Annual Global Retailing Conference 2025 Transcript

LuxExperience B.V. (NYSE:LUXE ) Goldman Sachs 32nd Annual Global Retailing Conference 2025 September 3, 2025 11:00 AM EDT Company Participants Martin Beer - CFO & Member of Management Board Presentation Unknown Analyst Good morning.

WiseTech Global: Growth Re-Acceleration In Sight

I recommend a Buy rating, driven by strong revenue growth and expanding margins in the latest quarter. The company's robust product pipeline and successful market expansion strategies underpin my positive outlook. Management's guidance for the next fiscal year is conservative, suggesting potential for earnings outperformance.

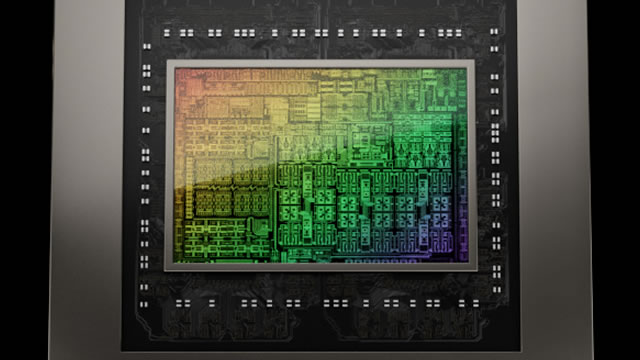

Global markets are mixed after U.S. stocks surged following Nvidia's earnings report

World shares were mixed Thursday after modest gains on Wall Street lifted the S&P 500 to another all-time high ahead of computer chipmaker Nvidia's highly anticipated earnings report.The future for S&P 500 rose 0.1% while that for the Dow Jones Industrial Average added 0.3%. Meanwhile, oil prices declined.In early European trading, Germany's DAX climbed 0.4% to 24,144.65 while Britain's FTSE 100 slipped 0.2% to 9,240.75.