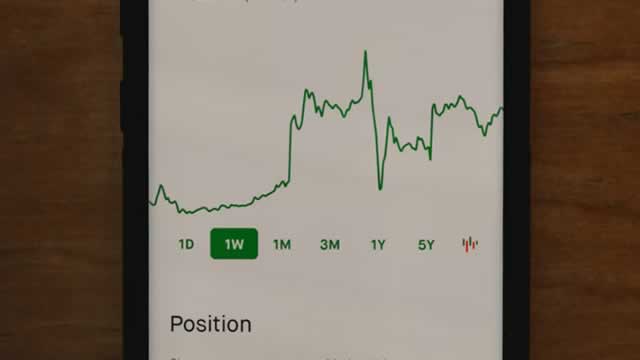

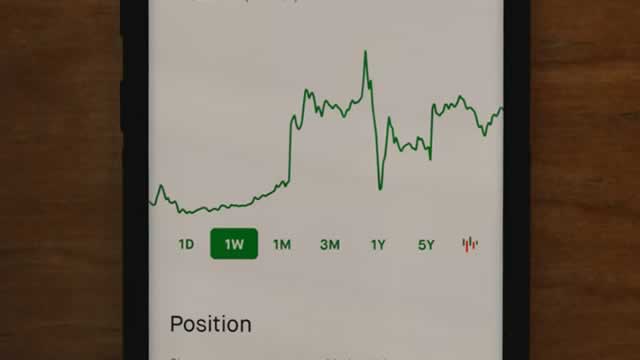

Robinhood Markets, Inc. (HOOD)

Wall Street sets Robinhood (HOOD) price target for next 12 months

The share price of Robinhood (NASDAQ: HOOD) is experiencing increased investor interest as markets react to its inclusion in the S&P 500.

Why Robinhood stock isn't worth buying despite S&P 500 inclusion

Robinhood Markets Inc (NASDAQ: HOOD) has pushed higher in recent sessions following news that it will replace Caesars Entertainment on the benchmark S&P 500 index on September 22nd.

Robinhood finally wins spot in S&P 500

CNBC's MacKenzie Sigalos joins "Fast Money" with the latest on the quarterly index reshuffle as Robinhood, AppLovin and Emcor prepare to join the S&P 500.

One Pick for a Narrow Bull Market

How to Find the Winners in a Narrow Bull Market NOTE: Our InvestorPlace offices will be closed on Monday in honor of Labor Day. If you need help from our Customer Service Department, they'll be happy to assist you on Tuesday when our offices reopen.

Robinhood Markets (HOOD) Up 0.6% Since Last Earnings Report: Can It Continue?

Robinhood Markets (HOOD) reported earnings 30 days ago. What's next for the stock?

Robinhood Markets, Inc. (HOOD) Is a Trending Stock: Facts to Know Before Betting on It

Robinhood Markets (HOOD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

3 Momentum Anomaly Stocks to Buy as Markets Sway Frantically

VRT, MTZ and HOOD stand out as momentum picks, combining strong yearly gains with recent pullbacks for potential entry points.

Robinhood Soars 405% in a Year: Sustainable Momentum or Market Froth?

HOOD's 405% rally is impossible to ignore. Is the stock in breakout mode or just flashing peak exuberance?

HOOW: Weekly Income May Be Weakly Supported

HOOW is not a traditional income fund; its distributions are short-term gains tied to Robinhood's weekly performance with 120% leverage. The ETF's yield is attractive in bullish markets, but its returns are highly cyclical and depend on positive sentiment and trading activity in HOOD. HOOD's current valuation is too high relative to its cyclical revenue growth, making HOOW unattractive for income investors and only suitable for total return seekers at lower prices.

Robinhood misses out on yet another S&P 500 rebalance. This fintech company will soon join instead.

Bad news for Robinhood is good news for this relatively obscure fintech company.

Robinhood: The Financial Super-App Is Flexing Its Success

Robinhood continues to benefit from surging trading activity in options and crypto, driving exceptional revenue and adjusted EBITDA growth in Q2. The company's innovation roadmap and international expansion position it to capture market share from traditional banks and brokerages. Robinhood's profitability is accelerating, with economies of scale and new product launches fueling strong deposit and engagement growth.

Is Robinhood Stock a Millionaire Maker?

Robinhood (HOOD 2.85%) has gone on a tear, with the stock surging 810% since the start of 2023. Its meteoric rise is eye-opening, considering the company's struggles just a few years back.