International Business Machines Corporation (IBM)

IBM shares surge 10% on earnings beat

IBM reported fourth-quarter earnings on Wednesday that topped Wall Street expectations for earnings and revenue. The shares rose in extended trading.

IBM profits beat expectations, and stock rallies

Shares of International Business Machines Inc. rallied after hours on Wednesday after the tech-infrastructure provider reported a quarterly per-share profit that beat expectations.

IBM beats profit estimates as software business surges, shares rise

IBM surpassed analysts' estimates for fourth-quarter profit on Wednesday, driven by demand in its high-margin software unit as businesses ramped up IT spending, sending its shares soaring about 10% in extended trading.

IBM Bulls In Control: Will Q4 Earnings Keep The Rally Alive?

International Business Machines Corp IBM will be reporting its fourth-quarter earnings on Wednesday. Wall Street expects $3.75 in EPS and $17.54 billion in revenues as the company reports after market hours.

Will Higher Software Revenues Boost IBM's Earnings in Q4?

IBM is likely to have gained from the Software segment backed by product innovation, strategic acquisition and healthy AI traction.

Will Solid Consulting Revenues Boost IBM's Q4 Earnings?

IBM is expected to report higher revenues from the Consulting segment backed by innovative product launches and healthy demand trends.

Should You Buy IBM Stock Before Jan. 29?

International Business Machines (IBM -0.19%) is set to report its fourth-quarter results after the market closes on Wednesday, Jan. 29. IBM stock has surged 65% over the past three years as the company spun off a big low-growth business and settled into a strategy focused on hybrid-cloud and AI platforms.

IBM Earnings Preview: 7% Free Cash Flow Yield As EPS Estimates Creep Higher

IBM is scheduled to report their Q4 '24 earnings on Wednesday, January 29th, 2025. Sell-side consensus is expecting $3.75 in earnings per share on $17.45 billion in revenue for an expected y-o-y decline of 3% in EPS on flat or zero revenue growth y-o-y. The company is also expecting $4.29 billion in operating income, which would actually be 14% y-o-y growth for that key metric.

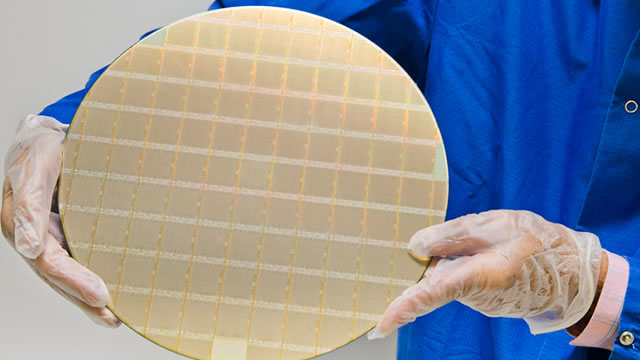

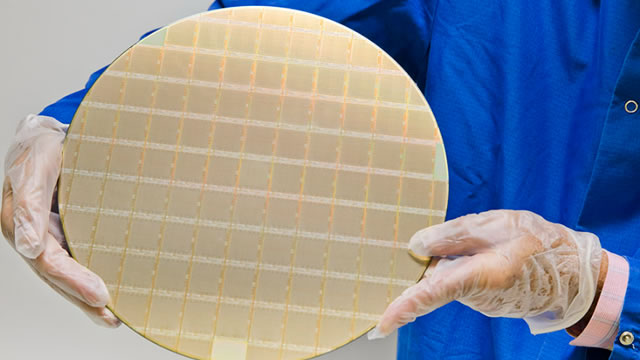

Should I Buy IBM Stock for Its Quantum Computing Capabilities?

International Business Machines (IBM -0.55%) has redefined itself as a cloud and artificial intelligence (AI) company. Its role in fostering a hybrid cloud and its watsonx AI have again made it a company to watch in the technology space.

Will IBM (IBM) Beat Estimates Again in Its Next Earnings Report?

IBM (IBM) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

IBM Partners With e& to Launch Multi-Model AI Platform: Stock to Gain?

IBM collaborates with e& to launch a cutting-edge, end-to-end, multi-model Generative AI governance solution.

IBM Stock Before Q4 Earnings: A Smart Buy or Risky Investment?

With declining earnings estimates, IBM is witnessing a negative investor perception and it might be prudent to avoid the stock at the moment.