Ingersoll-Rand Inc. (IR)

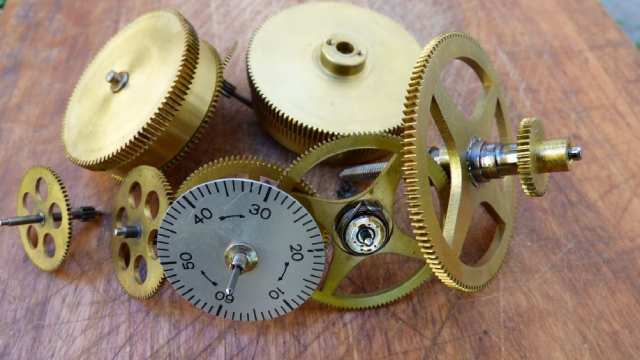

IR Gears Up to Post Q1 Earnings: What Lies Ahead for the Stock?

Ingersoll Rand's first-quarter results are likely to gain from strength across the Industrial Technologies & Services and Precision and Science Technologies segments.

Ahead of Ingersoll (IR) Q1 Earnings: Get Ready With Wall Street Estimates for Key Metrics

Besides Wall Street's top -and-bottom-line estimates for Ingersoll (IR), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended March 2025.

Ingersoll (IR) Soars 9.8%: Is Further Upside Left in the Stock?

Ingersoll (IR) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

Ingersoll Rand Stock Boasts Strong Prospects Despite Headwinds

IR gains from solid momentum across its segments, accretive acquisitions and shareholder-friendly policies. However, high costs and forex woes remain a concern.

Ingersoll Rand: Downgrade Based On Current Valuation And Slower Growth Prospects

Flexibility in investment philosophy is crucial; recent cautiousness with growth stocks has led to downgrading Ingersoll Rand from 'buy' to 'hold'. Ingersoll Rand's Q4 2024 financial performance missed expectations, with revenue and earnings per share falling short, and slower growth forecasted for 2025. The Industrial Technologies and Services segment showed minimal growth, while Precision and Science Technologies grew due to acquisitions, not organic growth.

Ingersoll Rand Inc. (IR) Q4 2024 Earnings Call Transcript

Ingersoll Rand Inc. (NYSE:IR ) Q4 2024 Earnings Conference Call February 14, 2025 8:00 AM ET Company Participants Matthew Fort - VP, IR Vicente Reynal - Chairman & CEO Vik Kini - CFO Conference Call Participants Michael Halloran - Baird Julian Mitchell - Barclays Jeff Sprague - Vertical Research Partners Rob Wertheimer - Melius Research Andy Kaplowitz - Citigroup Stephen Volkmann - Jefferies Chris Snyder - Morgan Stanley Nicole DeBlase - Deutsche Bank Nigel Coe - Wolfe Research Nathan Jones - Stifel David Raso - Evercore ISI Andrew Buscaglia - BNP Paribas Operator Hello, and welcome to the Ingersoll Rand 2024 Fourth Quarter Earnings Call. All lines have been placed on mute to prevent any background noise.

Ingersoll Rand's Q4 Earnings Meet Estimates, Revenues Miss

IR's fourth-quarter 2024 adjusted earnings of 84 cents per share decrease 2.3% year over year.

Ingersoll (IR) Q4 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for Ingersoll (IR) give a sense of how its business performed in the quarter ended December 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Ingersoll Rand (IR) Meets Q4 Earnings Estimates

Ingersoll Rand (IR) came out with quarterly earnings of $0.84 per share, in line with the Zacks Consensus Estimate. This compares to earnings of $0.86 per share a year ago.

IR Gears Up to Post Q4 Earnings: What Lies Ahead for the Stock?

Ingersoll Rand's fourth-quarter results are likely to gain from strength across the Industrial Technologies & Services and Precision and Science Technologies segments.

Countdown to Ingersoll (IR) Q4 Earnings: Wall Street Forecasts for Key Metrics

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Ingersoll (IR), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended December 2024.

Earnings Preview: Ingersoll Rand (IR) Q4 Earnings Expected to Decline

Ingersoll (IR) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.