Illinois Tool Works Inc. (ITW)

Illinois Tool Works Inc. (ITW) Q3 2024 Earnings Conference Call Transcript

Illinois Tool Works Inc. (NYSE:ITW ) Q3 2024 Earnings Conference Call October 30, 2024 10:00 AM ET Company Participants Erin Linnihan - VP, IR Chris O'Hairlehy - President and CEO Michael Larsen - SVP and CFO Conference Call Participants Jeff Sprague - Vertical Research Partners Jamie Cook - Truist Securities Andy Kaplowitz - Citi Group Tami Zakaria - J.P. Morgan Joe O'Dea - Wells Fargo Sabrina Abrams - Bank of America Merrill Lynch Julian Mitchell - Barclays Adam Farley - Stifel Operator Good morning.

Illinois Tool's Q3 Earnings Surpass Estimates, Revenues Miss

ITW's third-quarter 2024 revenues decline 1.6% year over year, due to lackluster performance across most of its segments.

Illinois Tool Works (ITW) Q3 Earnings: How Key Metrics Compare to Wall Street Estimates

While the top- and bottom-line numbers for Illinois Tool Works (ITW) give a sense of how the business performed in the quarter ended September 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Illinois Tool Works (ITW) Tops Q3 Earnings Estimates

Illinois Tool Works (ITW) came out with quarterly earnings of $2.65 per share, beating the Zacks Consensus Estimate of $2.53 per share. This compares to earnings of $2.55 per share a year ago.

Illinois Tool Gears Up to Report Q3 Earnings: What to Expect

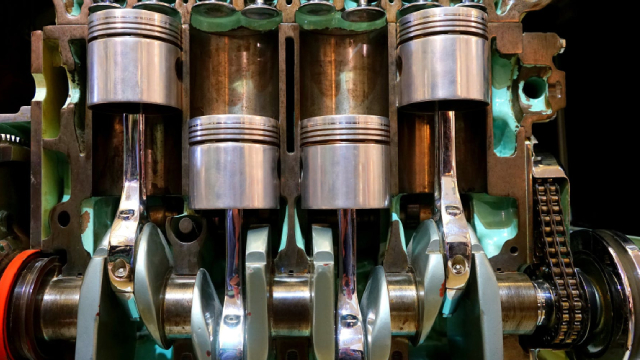

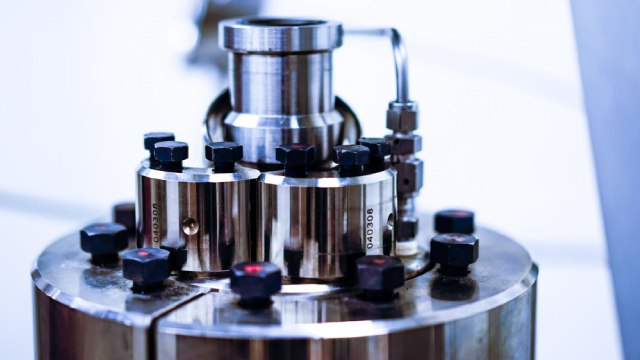

ITW's third-quarter results are likely to gain from strength across the Automotive OEM and Specialty Products units. Softness in the Welding segment is expected to weigh on results.

Illinois Tool Works (ITW) Q3 Earnings Preview: What You Should Know Beyond the Headline Estimates

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Illinois Tool Works (ITW), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended September 2024.

Earnings Preview: Illinois Tool Works (ITW) Q3 Earnings Expected to Decline

Illinois Tool Works (ITW) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Here's Why You Should Avoid Investing in Illinois Tool Stock Now

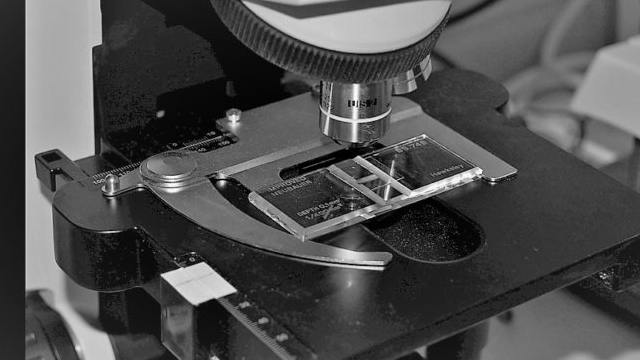

Weakness in the consumer electronics, semiconductor and general industrial end markets and increasing operating costs weigh on ITW. Unfavorable foreign currency movement is an added concern.

Breaking Down Common Investing Strategies

Income investors seek steady payouts, growth investors seek companies expected to grow at an above-average pace, and value investors seek deals hidden in plain sight.

Worried About a Stock Market Sell-Off? Consider Coca-Cola, Pepsi, and These 3 Safe Dividend Kings for Decades of Passive Income.

Coca-Cola and Pepsi are two proven and reliable dividend stocks. Kenvue's high yield and established portfolio of consumer health brands make it a passive income powerhouse.

Here's Why You Should Hold Illinois Tool Stock in Your Portfolio Now

ITW gains from strength in its businesses, enterprise initiatives and shareholder-friendly moves. Softness in semiconductor-related business persists.

Don't Be Fooled by the Dip -- This Dividend King Is a Buy in August

Illinois Tool Works showcases the advantages of the conglomerate business model. Management is executing despite a difficult operating environment.