Johnson & Johnson (JNJ)

Why Is Johnson & Johnson (JNJ) Up 1.7% Since Last Earnings Report?

Johnson & Johnson (JNJ) reported earnings 30 days ago. What's next for the stock?

Johnson & Johnson (JNJ) Presents at UBS Global Healthcare Conference 2025 Transcript

Johnson & Johnson ( JNJ ) UBS Global Healthcare Conference 2025 November 11, 2025 11:00 AM EST Company Participants Peter Menziuso Conference Call Participants Danielle Antalffy - UBS Investment Bank, Research Division Presentation Danielle Antalffy UBS Investment Bank, Research Division All right. Good morning, everyone.

Wall Street Analysts See Johnson & Johnson (JNJ) as a Buy: Should You Invest?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Johnson & Johnson: 2 Recent FDA Wins And Earnings Beat Warrant 'Buy' Rating

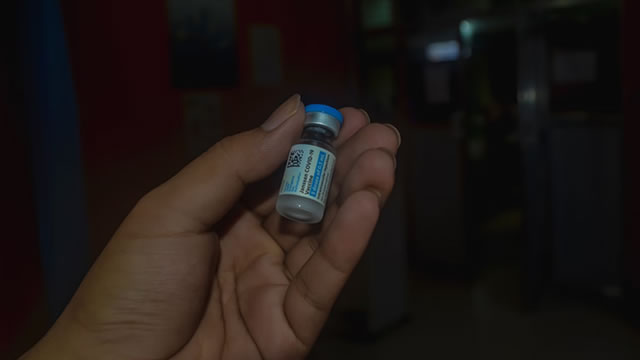

Johnson & Johnson remains a "buy" following strong Q3 2025 results, driven by robust sales growth and raised full-year 2025 revenue guidance. The company's acquisition of Intra-Cellular Therapies and FDA approval of CAPLYTA for major depressive disorder unlock a large, underserved market opportunity. Oncology portfolio strength is highlighted by DARZALEX FASPRO's expanded FDA indication and CARVYKTI's 83% year-over-year revenue growth.

Johnson & Johnson: Dividends Don't Lie

Johnson & Johnson's latest dividend declaration translates into an annual growth rate of 4.47%. This is the lowest level in at least 10 years, signaling ongoing growth pressures. Mixed Q3 earnings results and Q4 outlook suggest profit headwinds and rising payout ratios, further limiting room for future dividend increases.

Cramer's Mad Dash: Johnson & Johnson

Jim Cramer breaks down why he's keeping an eye on shares of Johnson & Johnson.

Johnson & Johnson (JNJ) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Johnson & Johnson (JNJ) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Here's Why Johnson & Johnson (JNJ) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Here's Why Johnson & Johnson (JNJ) is a Strong Momentum Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

I have invested in dividends for 20 years. These stocks are my top dividend compounders of all time

In the world of investing, dividends have long been a popular way to earn income alongside growth opportunities with stocks.

Johnson & Johnson Stock To $134?

Our machine-driven multifactor analysis suggests it may be time to sell JNJ stock, as we hold a pessimistic outlook with a potential target price of $134. The company's Moderate operating performance and financial health, combined with its High valuation, make the stock appear Unattractive.

Johnson & Johnson Targets Accelerated Growth Across Segments in 2026

J&J projects faster 2026 growth in Innovative Medicine and MedTech, topping consensus estimates on both revenues and EPS.