JPMorgan Chase & Co. (JPM)

JPMorgan Chase & Co. (JPM) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to JPMorgan Chase & Co. (JPM). This makes it worthwhile to examine what the stock has in store.

JPM to Open Pune Office: A Renewed Push Toward India to Boost Growth?

JPMorgan plans to open a Pune branch after RBI approval, its first India expansion in a decade, as global banks chase growth in an active market.

How AI Is Impacting Productivity at JPM, BAC, C & Others

AI is driving productivity gains at JPMorgan, Citigroup, Bank of America, WFC and PNC, reshaping workflows, budgets, and potentially, bank staffing.

3 Finance Stocks to Buy on Rising 10-Year Treasury Rates

The Federal Reserve gave investors an early Christmas present by lowering interest rates by 25 basis points (i.e., 0.25%) marking its third rate cut this year.

JPMorgan Leveraging Unparalleled Strength To Build Future Growth

JPMorgan commands a premium valuation due to unmatched operating performance and aggressive reinvestment, despite appearing fully valued by traditional banking metrics. JPM's 2025 opex is set to rise 9%, outpacing peers, as it invests heavily in IT, branch expansion, and service integration to widen its competitive moat. Management targets retail deposit share growth from 11% to 15% and aims to leverage cross-selling and technology to enhance commercial and asset management businesses.

Why JPMorgan Chase & Co. (JPM) is a Top Stock for the Long-Term

Finding strong, market-beating stocks with a positive earnings outlook becomes easier with the Focus List, a top feature of the Zacks Premium portfolio service.

Will JPMorgan Continue To Outperform?

JPMorgan stock (NYSE: JPM) has increased by approximately 29% year-to-date, significantly surpassing the 17% gain in the S&P 500 index during the same timeframe. Thus, the question is clear: why is JPMorgan continuing to excel—and can this momentum be sustained?

JPMorgan Chase & Co. (JPM) Beats Stock Market Upswing: What Investors Need to Know

The latest trading day saw JPMorgan Chase & Co. (JPM) settling at $317.26, representing a +2.31% change from its previous close.

Which Bank's AI Bet Will Drive Greater Productivity: JPM or WFC?

Is Wells Fargo's AI push, with ROI-driven tech bets fueling stronger profit growth than JPMorgan? Let's decode.

JPMorgan Chase & Co. (JPM) Soars 3.2%: Is Further Upside Left in the Stock?

JPMorgan Chase & Co. (JPM) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock suggests that there could be more strength down the road.

JPMorgan Stock Slides on Warning of Steep 2026 Expense Growth

JPM shares slide after the bank warns that 2026 expenses may surge more than $9B on growth spending, tech investments and inflation pressures.

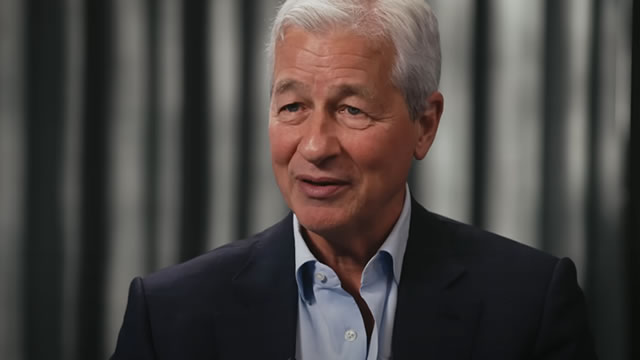

Top JPMorgan executive Marianne Lake, a possible Jamie Dimon successor, warns of higher costs for 2026

One of the execs considered a possible successor to Jamie Dimon as JPMorgan's CEO warned Tuesday that the bank expects to spend a higher-than-expected $105 billion next year, sending shares lower.