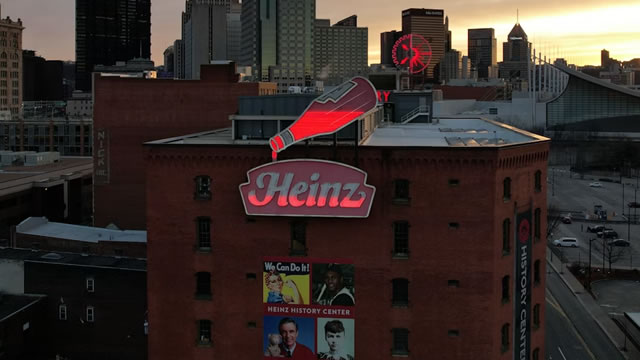

The Kraft Heinz Company (KHC)

The Kraft Heinz Company (KHC) Q4 2024 Earnings Call Transcript

The Kraft Heinz Company (NASDAQ:KHC ) Q4 2024 Earnings Conference Call February 12, 2025 9:00 AM ET Company Participants Anne-Marie Megela - Global Head, Investor Relations Carlos Abrams-Rivera - Chief Executive Officer Andre Maciel - Executive Vice President & Global Chief Financial Officer Conference Call Participants Andrew Lazar - Barclays Peter Galbo - Bank of America John Baumgartner - Mizuho Securities Ken Goldman - JPMorgan Leah Jordan - Goldman Sachs Tom Palmer - Citi Michael Lavery - Piper Sandler Chris Carey - Wells Fargo Securities Alexia Howard - Bernstein Operator Good morning, and welcome to The Kraft Heinz Company Quarter Four 2024 Earnings. At this time, all participants are in a listen-only mode.

Kraft Heinz (KHC) Surpasses Q4 Earnings Estimates

Kraft Heinz (KHC) came out with quarterly earnings of $0.84 per share, beating the Zacks Consensus Estimate of $0.78 per share. This compares to earnings of $0.78 per share a year ago.

The Kraft Heinz Company (KHC) Q4 2024 Earnings Call Transcript (Pre-Recorded)

The Kraft Heinz Company (NASDAQ:KHC ) Q4 2024 Earnings Conference Call (Pre-Recorded) February 12, 2025 8:00 AM ET Company Participants Anne-Marie Megela - Global Head, Investor Relations Carlos Abrams-Rivera - Chief Executive Officer Andre Maciel - Executive Vice President & Global Chief Financial Officer Conference Call Participants Anne-Marie Megela Hello. This is Anne-Marie Megela, Head of Global Investor Relations at The Kraft Heinz Company.

Kraft Heinz Earnings Up, Sales Slip

Kraft Heinz (KHC 2.14%), the global food and beverage company behind iconic brands like Kraft, Heinz, and Oscar Mayer, released its fourth-quarter results on February 12, 2025. The company reported adjusted earnings per share (EPS) of $0.84, exceeding the anticipated $0.78, thanks largely to unexpected tax benefits and a reduced number of outstanding shares.

Kraft Heinz wraps up ‘challenging' year with a profit warning

The company said it's “committed to making the necessary investments to drive top-line improvement, while remaining disciplined.”

Kraft Heinz forecasts annual profit below estimates

Kraft Heinz forecast annual profit below estimates on Wednesday, as the packaged food maker contends with sluggish demand for its higher-priced products including Lunchables and packaged meat.

Kraft Heinz Vs. Restaurant Brands: The Technical Showdown Ahead Of Q4 Earnings

It's a battle of the stocks as Kraft Heinz Co. KHC and Restaurant Brands International Inc. QSR prepare to release their fourth-quarter earnings on Wednesday.

What to Expect From The Kraft Heinz Company in Q4 Earnings Release?

KHC's Q4 results are likely to reflect the impacts of an inflationary landscape, while pricing is likely to offer respite.

Kraft Heinz (KHC) Q4 Earnings on the Horizon: Analysts' Insights on Key Performance Measures

Get a deeper insight into the potential performance of Kraft Heinz (KHC) for the quarter ended December 2024 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

Kraft Heinz (KHC) Reports Next Week: What Awaits?

Kraft Heinz (KHC) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Best Stock to Buy Right Now: Kraft Heinz vs Coca-Cola

Coca-Cola (KO -2.36%) is a better buy today than Kraft Heinz (KHC -2.02%). But the real story is why this is the case.

This Ridiculously Cheap Warren Buffett Stock Could Make You Richer

Warren Buffett's Berkshire Hathaway (BRK.A -0.03%) (BRK.B 0.13%) owns one of the world's most closely watched stock portfolios. Many investors follow Buffett's trades for investment ideas and to gauge the temperature of the broader market.