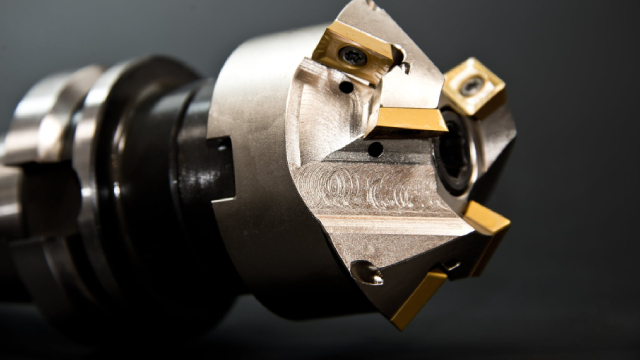

Kennametal Inc. (KMT)

Kennametal (KMT) Matches Q2 Earnings Estimates

Kennametal (KMT) came out with quarterly earnings of $0.25 per share, in line with the Zacks Consensus Estimate. This compares to earnings of $0.30 per share a year ago.

Here's Why Investors Should Retain Kennametal Stock Right Now

KMT benefits from strength in the Infrastructure unit, diversified product portfolio and shareholder-friendly policies. However, softness in the Metal Cutting segment remains concerning.

Here's Why You Should Retain Kennametal Stock in Your Portfolio

KMT is set to benefit from strong momentum in the Infrastructure segment. The company's measures to reward its shareholders are also encouraging.

Why Is Kennametal (KMT) Down 5% Since Last Earnings Report?

Kennametal (KMT) reported earnings 30 days ago. What's next for the stock?

Kennametal Stock Exhibits Strong Prospects Despite Headwinds

KMT is set to benefit from strong momentum in the Infrastructure segment. However, increasing costs and expenses remain a concern.

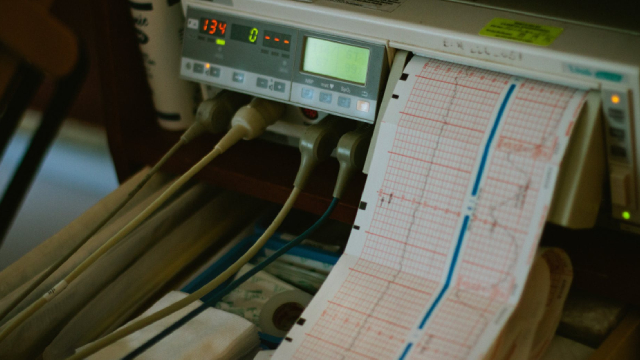

Syndax: Fall On NPM1m AML Data Of Revumenib Creates Buy Opportunity

Primary endpoint of pivotal phase 2 study met with statistical significance in using Revumenib for the treatment of relapsed/refractory mNPM1 AML patients; sNDA expected 1st half 2025. PDUFA action date of December 26th of 2024 deployed for FDA to decide if Revumenib should be approved for the treatment of relapsed/refractory KMT2Ar Acute leukemia patients. The global acute myeloid leukemia market is expected to reach $5.86 billion by 2030; About 10% of patients have KMT2Ar AML and then 30% have mNPM1 AML.

Kennametal's Q1 Earnings Surpass Estimates, Revenues Decline Y/Y

KMT's fiscal first-quarter 2025 revenues decrease 2% due to the lackluster performance of the Metal Cutting segment.

Kennametal Inc. (KMT) Q1 2025 Earnings Call Transcript

Kennametal Inc. (NYSE:KMT ) Q1 2025 Earnings Conference Call November 6, 2024 9:30 AM ET Company Participants Michael Pici - Vice President of Investor Relations Sanjay Chowbey - President and Chief Executive Officer Pat Watson - Vice President and Chief Financial Officer Conference Call Participants Steven Fisher - UBS Julian Mitchell - Barclays Steve Barger - KeyBanc Capital Markets Angel Castillo - Morgan Stanley Tami Zakaria - JPMorgan Chris Dankert - Loop Capital Markets Joe Ritchie - Goldman Sachs Operator Good morning. I would like to welcome everyone to Kennametal First Quarter and Fiscal 2025 Earnings Conference Call.

Kennametal (KMT) Q1 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for Kennametal (KMT) give insight into how the company performed in the quarter ended September 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Kennametal (KMT) Surpasses Q1 Earnings and Revenue Estimates

Kennametal (KMT) came out with quarterly earnings of $0.29 per share, beating the Zacks Consensus Estimate of $0.25 per share. This compares to earnings of $0.41 per share a year ago.

Analysts Estimate Kennametal (KMT) to Report a Decline in Earnings: What to Look Out for

Kennametal (KMT) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Reasons Why You Should Hold Kennametal Stock in Your Portfolio Now

KMT gains from strength in aerospace, defense and transportation end markets. However, softness in the Infrastructure unit remains concerning.