The Coca-Cola Company (KO)

Coca-Cola Holds Value Share Lead Despite Latin America Flatline

KO's tech-driven efficiency, pricing strength and Latin America gains boost global value share despite flat volumes.

Here is What to Know Beyond Why CocaCola Company (The) (KO) is a Trending Stock

Coca-Cola (KO) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Ten-Year Tally: Coca-Cola Stock Delivers $85 Bil Gain

Over the past ten years, Coca-Cola (KO) stock has provided an impressive return of $85 Bil to its investors through real cash in the form of dividends and buybacks. Let's examine some figures and see how this distribution capacity compares to that of the market's leading capital-return entities.

Is Coca-Cola's Zero Sugar Momentum Reshaping Its Core Portfolio?

KO's Zero Sugar surge is redefining its sparkling strategy, fueling growth and reshaping the brand???s global portfolio.

Is Coca-Cola's Productivity Play the Secret to Margin Expansion?

KO boosts margins with tech-driven productivity, sharper marketing efficiency and strong global revenue growth.

Coca-Cola (NYSE: KO) Price Prediction and Forecast 2025-2030 (November 2025)

Shares of Coca-Cola ( NYSE:KO ) gained 4.10% over the past month after losing 5.10% the month prior.

Is Trending Stock CocaCola Company (The) (KO) a Buy Now?

Zacks.com users have recently been watching Coca-Cola (KO) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

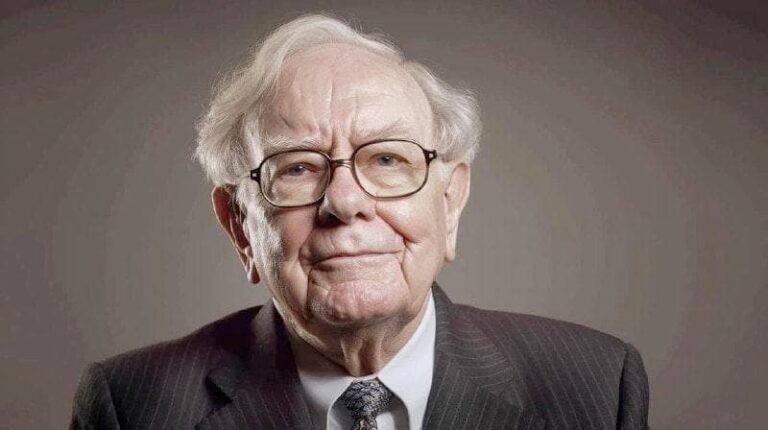

Monster insider trading alert for this Warren Buffett stock

Coca-Cola (NYSE: KO), one of Warren Buffett's largest and longest-held investments, has seen notable insider activity involving director Max Levchin.

Coca-Cola starts selling cane sugar soda after Trump demand

The company in July announced the new soda was coming to the US, after Trump claimed the company had “agreed” to start adding “REAL cane sugar” in American Coke.

The Coca-Cola Company: A Defensive Stock Still At A Reasonable Price

The Coca-Cola Company dominates the global non-alcoholic beverage market with over 200 brands and an asset-light, high-margin business model. KO's unique distribution system leverages local bottlers, enhancing customer satisfaction and creating a formidable competitive advantage through unmatched global reach. Brand strength, distribution network, and scale provide KO with a durable moat, supporting premium pricing and customer loyalty.

Coke & Pepsi Earnings to Lift Consumer Staples ETFs?

Coke (KO) & Pepsi (PEP) posted strong earnings, sparking likely gains in consumer staples ETFs like XLP, FSTA & VDC.

Coke Is Leaning Into the Protein Craze as It Lands in More Drinks, Snacks—and Pet Foods

Coke is bulking up on protein.