Lockheed Martin Corporation (LMT)

Lockheed, Northrop, Other Defense Stocks Rise After Iran Strikes. Why Gains May Not Last.

America struck three Iranian nuclear sites on Saturday in an impressive coordinated attack called “Operation Midnight Hammer.”

Forget The F-35: Here's Why Lockheed Martin Is Still A Buy

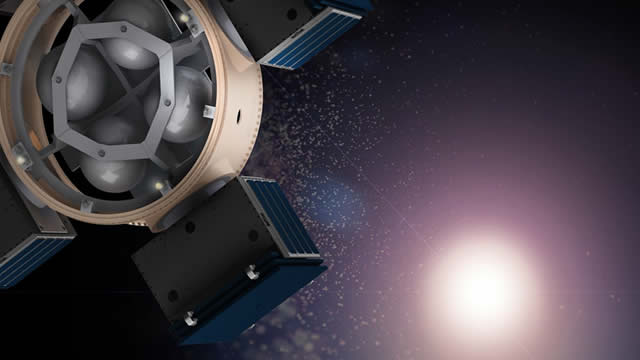

Despite recent setbacks, Lockheed Martin Corporation remains a buy due to strong financials, a robust backlog, AI, space, and missile defense initiatives. LMT faces risks from F-35 program cuts, increased competition, and heavy reliance on U.S. defense spending, but these concerns are largely priced in. LMT stock's 2.7% dividend yield, 22-year streak of increases, and reasonable payout ratio make it attractive for income-focused investors.

Israel-Iran Feud on the Rise: What Does This Mean for Lockheed?

LMT jumps 3.6% as Israel-Iran tensions reignite defense demand, raising hopes for fresh orders and upside potential.

Investors Heavily Search Lockheed Martin Corporation (LMT): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Lockheed (LMT). This makes it worthwhile to examine what the stock has in store.

Is LMT Stock A Good Defense Pick Amid Israel-Iran Tensions?

Defense stocks, especially Lockheed Martin (NYSE:LMT), are in the spotlight following the recent assault by Israel on Iran's nuclear initiative. As the primary missile supplier to the U.S. government, Lockheed Martin holds a crucial position.

These 3 war stocks rocket after Iran is attacked

Several war stocks surged today following news of the Israeli strike on Tehran, Iran.

Lockheed Martin shares sank as much as 7% after a report that the Pentagon is halving F-35 requests for the Air Force

Lockheed Martin shares initially fell 7% after a report that the US is reducing its F-35 requests. The Defense Department has reportedly dropped its ask from 48 fighters for the Air Force to 24, The request isn't final, but it could signify changing priorities within the Pentagon under Trump.

Here's Why Lockheed Martin (LMT) Fell More Than Broader Market

In the closing of the recent trading day, Lockheed Martin (LMT) stood at $456.60, denoting a -4.26% move from the preceding trading day.

Defense Stocks in Focus as Lockheed Martin Stock Drops

Aerospace manufacturer Lockheed Martin Corp (NYSE:LMT) stock is gapping lower today, after a U.S. Defense Department procurement request sent to Congress asked for 24 of the company's F-35 jets for the U.S. Air Force, compared last year's forecast of 48.

Lockheed Martin shares drop as US Air Force halves F-35 jet order

Lockheed Martin Corp (NYSE:LMT) shares fell after the Pentagon slashed its order for F-35 fighter jets, according to a Bloomberg News report. The US Air Force reduced its request for new F-35s to 24 jets in the upcoming fiscal year, down from 48 jets last year.

Why Lockheed Martin (LMT) stock is crashing

Lockheed Martin (NYSE: LMT) shares dropped on Wednesday as investors reacted to news that raises questions about the firm's future momentum of its flagship F-35 fighter jet program.

LMT's Rotary and Mission Systems Sales to Rise on Key Defense Deals

Lockheed Martin's RMS unit sees rising sales as key defense deals and global demand for radar and missile systems drive momentum.