Lyft Inc. (LYFT)

Lyft and China's Baidu look to bring robotaxis to Europe next year

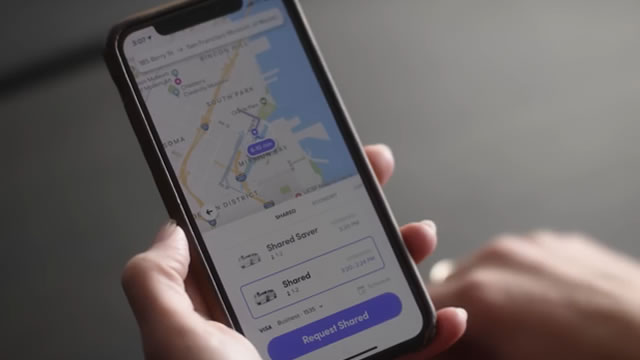

Lyft's European expansion will include Chinese-made robotaxis.

Lyft and Baidu Plan to Launch Robotaxis in Europe Next Year

Lyft recently entered the European market with its acquisition of Freenow.

Robotaxis for UK and Germany under Lyft JV with China's Baidu

Lyft Inc (NASDAQ:LYFT) has announced a partnership with China's Baidu to launch robotaxi services across Europe, marking Baidu's debut in the region's self-driving taxi market, according to Reuters. The collaboration will begin in Germany and the UK next year, pending regulatory approval, with Baidu supplying its electric RT6 autonomous vehicles and Lyft managing the customer platform and fleet operations.

Lyft's Margin Makeover: Will Investors Ride the Upside?

Lyft (LYFT -3.13%) is a ride-hailing platform that has had a complete margin makeover in recent years. And it feels like nobody even noticed.

Lyft (LYFT) Sees a More Significant Dip Than Broader Market: Some Facts to Know

Lyft (LYFT) closed at $13.62 in the latest trading session, marking a -3.13% move from the prior day.

Why Lyft's Stock Volume Just Spiked—Is an EV Partnership Near?

Whenever sentiment changes for a stock, investors can typically spot the shift before the big move happens and a window of opportunity quickly closes. A subtle sign can be found in a stock's trading volume, as any significant increase above the typical or average volume is usually one of the first signs of positioning before a big move comes about.

Lyft to add autonomous shuttles in 2026 as Uber inks more self-driving deals

Lyft will add autonomous shuttles made by Austrian manufacturer Benteler Group to its network in late 2026, the company announced Friday. The shuttles will be deployed in partnership with U.S. cities and airports, according to Lyft, but could expand out from there if things go well.

Lyft: The AV Dark Horse With Breakout Potential

Lyft is building a scalable, vertically integrated platform, well-positioned to benefit from mainstream autonomous vehicle adoption and partnerships in the AV space. Recent financials show strong growth in riders, bookings, and profitability, with management signaling confidence via an expanded share buyback program. Lyft's Flexdrive subsidiary and AV partnerships provide a differentiated, durable business model versus Uber, especially for small fleet operators.

Lyft (LYFT) Stock Slides as Market Rises: Facts to Know Before You Trade

Lyft (LYFT) reached $14.76 at the closing of the latest trading day, reflecting a -1.14% change compared to its last close.

Lyft (LYFT) Stock Drops Despite Market Gains: Important Facts to Note

Lyft (LYFT) closed the most recent trading day at $15.32, moving 2.17% from the previous trading session.

3 Tech Stocks Poised for Explosive EPS Growth in 2025

The retail investment community has become saturated with indicators and sophisticated methods for attempting to predict future stock prices, almost completely forgetting the tried-and-tested methodologies that have worked for decades in fundamental investment strategies.

Lyft: Value Stock With Growth Dynamics

Lyft is now a value stock with growth dynamics, trading at a steep discount despite improving fundamentals and positive free cash flow. The company is expanding EBITDA margins and cash earnings at 25% annually, supported by a $750M buyback and strong net cash position. Risks include potential Uber price wars and regulatory changes, but Lyft's scale and market share make it resilient.