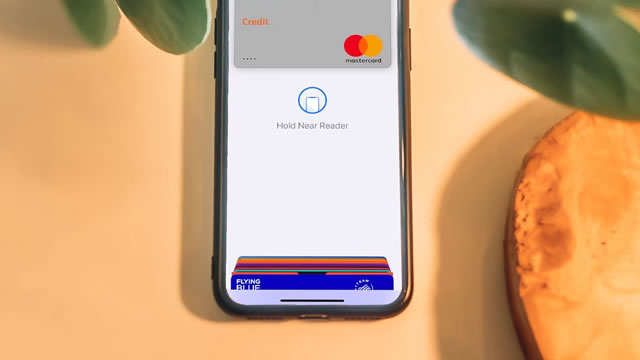

Mastercard Inc. (MA)

MasterCard (MA) Beats Q3 Earnings and Revenue Estimates

MasterCard (MA) came out with quarterly earnings of $4.38 per share, beating the Zacks Consensus Estimate of $4.31 per share. This compares to earnings of $3.89 per share a year ago.

Mastercard Profit Rises as Consumers Continue to Spend

Mastercard reported higher third-quarter profit and sales, citing strong consumer and business spending.

Will Mastercard Stock Rise On Its Upcoming Earnings?

Mastercard (NYSE:MA) is scheduled to announce its earnings on Thursday, October 30, 2025. Revenue is projected to increase by approximately 16% year-over-year to reach $8.54 billion, according to consensus estimates, while earnings are expected to grow 11% to $4.32 per share.

Mastercard's Pre-Earnings Reality Check: Buy, Sell or Hold Before Q3?

MA prepares for its Q3 results with double-digit growth forecasts, rising costs and a premium valuation testing investor confidence.

Mastercard's Earnings Preview: The Bar Is Set Quite High

Mastercard remains a top dividend grower, consistently delivering double-digit revenue growth and maintaining exceptional profitability. MA outpaces Visa in growth, with Q2 2025 revenue up 16.8% year-over-year and EBITDA margin nearing 66%, reflecting operational strength. Management reports healthy consumer spending trends and resilient macroeconomic conditions, supporting continued robust performance for MA.

MasterCard (MA) Q3 Earnings on the Horizon: Analysts' Insights on Key Performance Measures

Looking beyond Wall Street's top-and-bottom-line estimate forecasts for MasterCard (MA), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended September 2025.

MasterCard (MA) Reports Next Week: Wall Street Expects Earnings Growth

MasterCard (MA) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Why MasterCard (MA) is Poised to Beat Earnings Estimates Again

MasterCard (MA) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Mastercard Incorporated (MA) Is a Trending Stock: Facts to Know Before Betting on It

MasterCard (MA) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Mastercard Debuts POP to Improve Merchant Approval Rates

Mastercard has introduced a service aimed at improving approval rates for merchants. The Payment Optimization Platform (POP) uses data to make “intelligent decisions about transactions,” the company said in a Monday (Oct. 13) announcement.

Here's Why MasterCard (MA) Fell More Than Broader Market

MasterCard (MA) concluded the recent trading session at $564.55, signifying a -2.06% move from its prior day's close.

Should You Buy Mastercard Despite Its Rich Valuation of 31.54X P/E?

MA trades at a premium, but strong growth, cash flow and digital expansion support its long-term leadership in the payments space.