Mastercard Inc. (MA)

Payments giant Mastercard cutting global headcount by 3%

Payments processor Mastercard is reducing its global headcount by 3% as part of a reorganization it unveiled earlier this year to sharpen its focus on core businesses, a spokesperson said on Friday.

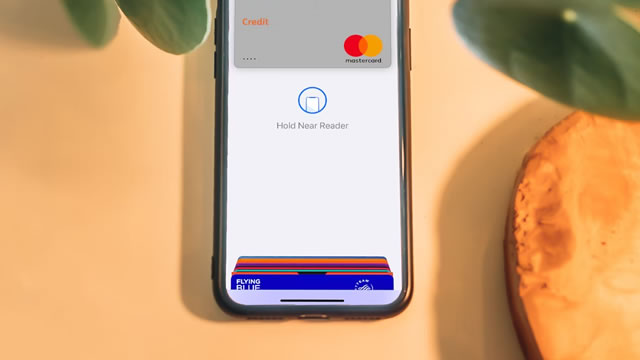

Mastercard and MetaMask Team to Launch Crypto-to-Fiat Card

Mastercard has launched a crypto-to-fiat card with Web3/blockchain platform MetaMask and cryptocurrency payments firm Baanx. The MetaMask Card, announced Wednesday (Aug. 14), lets MetaMask wallet customers use crypto for everyday purchases in fiat currency wherever Mastercard is accepted.

Mastercard Debuts Enhancements to Open Banking Program

Mastercard is upgrading its open banking for lending program, powered by employment/income verifier Argyle. The new features, announced Tuesday (Aug. 13), lets Mastercard offer income and employment coverage to the estimated 95% of the U.S. workforce who are paid through direct deposit.

Mastercard Stock Is Underperforming S&P500 In YTD Returns, What's Next?

Mastercard's stock (NYSE: MA) is up approximately 8% YTD as compared to the 12% rise in the S&P500 index over the same period. In sharp contrast, Mastercard's peer Visa (NYSE: V) has given near zero return YTD.

What is the Dividend Payout for Mastercard?

Mastercard has a below-average 0.6% dividend yield. Despite the low yield, Mastercard has an excellent track record of annual dividend increases.

3 Undervalued Stocks Set to Skyrocket: August Edition

Investing wisely requires understanding a company's fundamentals, ensuring a sound foundation for potential growth. This August, three stocks stand out in the consumer discretionary, technology and financial services sectors, each poised for significant gains.

How Should You Play Mastercard (MA) Stock Post Q2 Earnings?

Mastercard (MA), being a highly profitable company, keeps boosting its shareholder value, reflecting operating strength.

3 Dividend Stocks to Buy Now for a Winning Portfolio

Betting on dividend stocks, especially in the long run, can strengthen your portfolio. To begin, dividend-paying companies offer stable returns, ensuring sustainable cash flow even in volatile markets.

Is Trending Stock Mastercard Incorporated (MA) a Buy Now?

MasterCard (MA) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Is It Too Late to Buy Mastercard Stock?

Mastercard posted double-digit revenue and net income growth in the latest quarter. The key to the company's competitive position is powerful network effects.

3 Blue-Chip Stocks on the Rise After Strong Q2 Earnings

Financial results for this year's second quarter are coming in quite strong. According to data from FactSet, with 75% of companies listed in the S&P 500 index having reported Q2 results, 78% reported better-than-expected earnings, and 59% of companies reported revenue that exceeded expectations.

3 Payments Stocks That Are Screaming Buys in August

Visa has grown for years, and that's likely to continue. PayPal's current valuation makes no sense, given its strong fundamentals.