Merck & Co., Inc. (MRK)

Is Merck Stock a Bargain Buy?

Merck (MRK 0.32%) is a top healthcare company with one of the best drugs ever made in its portfolio: Keytruda. While there are concerns about its patent losses in the future, its sales are still growing.

Merck Inks $2B Licensing Deal With Chinese Biotech for Oral Heart Drug

MRK in-licenses an experimental lipoprotein(a) inhibitor from China's Jiangsu Hengrui. This transaction is expected to be closed in the second quarter of 2025.

Merck signs deal with Jiangsu Hengrui worth up to $2 billion for access to heart drug

Merck has signed a deal with Jiangsu Hengrui Pharmaceuticals worth up to $2 billion, the companies said on Tuesday, giving the U.S. drugmaker access to an experimental heart disease drug.

Merck (MRK) Stock Slides as Market Rises: Facts to Know Before You Trade

In the closing of the recent trading day, Merck (MRK) stood at $94.02, denoting a -0.74% change from the preceding trading day.

Merck Loses Almost $52B in 6 Months: How to Play MRK Stock

We believe investors with a long-term horizon should stay invested in MRK stock, while short-term investors should consider selling the same.

Merck (MRK) Advances While Market Declines: Some Information for Investors

In the closing of the recent trading day, Merck (MRK) stood at $94.71, denoting a +1.46% change from the preceding trading day.

Merck (MRK) Is Considered a Good Investment by Brokers: Is That True?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Merck prevails in Gardasil safety litigation

A federal judge has ruled in favor of Merck in litigation accusing the drugmaker of concealing the risks of Gardasin, a vaccine to prevent cervical and other fatal cancers.

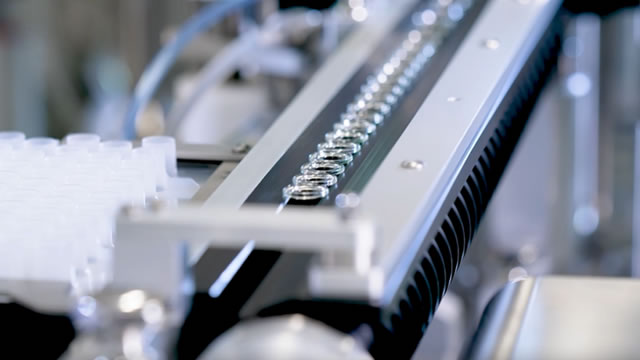

Merck opens vaccine manufacturing facility in North Carolina

Merck said on Tuesday it has opened a new $1 billion, 225,000-square-foot facility dedicated to vaccine manufacturing at its Durham, North Carolina, site.

Merck (MRK) Ascends While Market Falls: Some Facts to Note

Merck (MRK) closed at $94 in the latest trading session, marking a +0.87% move from the prior day.

Merck (MRK) Up 3.9% Since Last Earnings Report: Can It Continue?

Merck (MRK) reported earnings 30 days ago. What's next for the stock?

New version of Merck's cancer drug faces patent battle, WSJ reports

Merck has asked the U.S. patent office to reconsider patents that could prevent it from selling a new version of its cancer drug Keytruda, the Wall Street Journal reported on Wednesday.