Merck & Co., Inc. (MRK)

Here's Why Merck (MRK) Gained But Lagged the Market Today

Merck (MRK) closed at $115.25 in the latest trading session, marking a +0.47% move from the prior day.

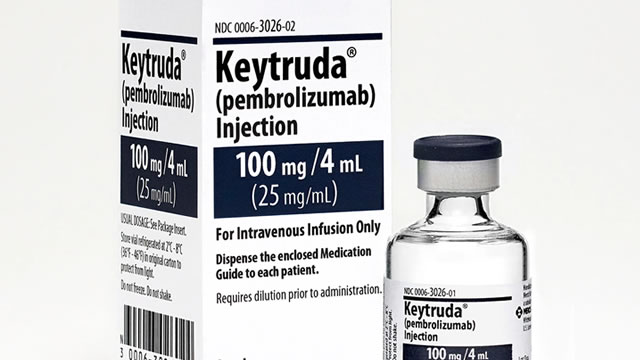

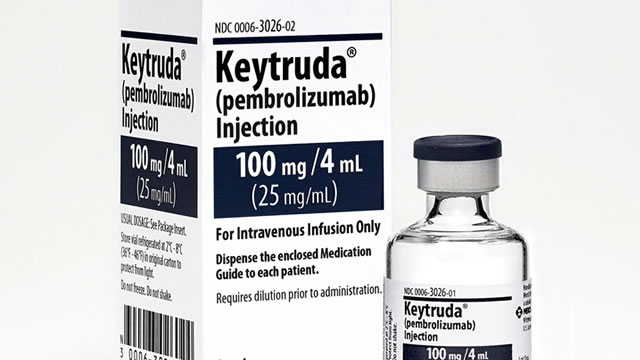

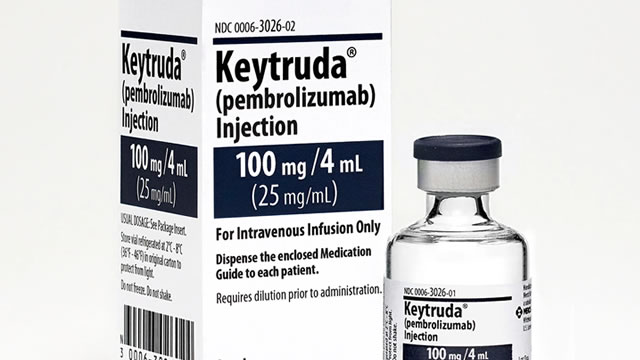

MRK Stock Dips After SMMT's Cancer Drug Outshines Keytruda in Study

Merck's Keytruda is the standard of care for NSCLC. Ivonescimab, however, shows clinically meaningful benefit over Keytruda in a phase III study in NSCLC.

Merck (MRK) is a Top Dividend Stock Right Now: Should You Buy?

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Merck (MRK) have what it takes?

Summit Therapeutics' stock pops as lung-cancer treatment beats Merck blockbuster in late-stage trial

Shares of Summit Therapeutics Inc. jumped more than 30% premarket on Monday after the biotech company released late-stage trial data showing that its experimental lung-cancer treatment topped Merck's blockbuster Keytruda.

Merck Stock Falls After Rival Beats Keytruda Cancer Drug in Trial

Summit Therapeutics said its Ivonescimab treatment reduced the risk of disease progression or death by 49% compared with the market leader.

Merck & Co., Inc. (MRK) CEO Rob Davis presents at Morgan Stanley 22nd Annual Global Healthcare Conference (Transcript)

Merck & Co., Inc. (NYSE:MRK ) Morgan Stanley 22nd Annual Global Healthcare Conference September 5, 2024 2:35 PM ET Company Participants Rob Davis - Chairman and CEO Dean Li - President of Merck Research Laboratories Conference Call Participants Terence Flynn - Morgan Stanley Terence Flynn Good afternoon, everybody. Thanks for joining us.

Why Did Merck Stock Rise 65%?

Merck stock (NYSE: MRK) has gained over 65% in value since early January 2021 – jumping from levels of $70 then to around $115 now – vs. an increase of about 50% for the S&P 500 over this period.

Merck Starts Late-Stage Study on Recently Acquired Ophthalmology Drug

The clinical study will evaluate MRK's experimental antibody treatment in patients with diabetic macular edema, a major cause of vision loss.

What's Wrong With Merck's Stock?

Merck's business is growing, but the stock's gains have been modest this year. The drug manufacturer remains heavily reliant on Keytruda, which accounts for nearly half of its revenue.

Merck's Keytruda & Padcev Combo Gets EU Nod for Urothelial Carcinoma

MRK's Keytruda gets approval in combination with Astellas and Pfizer's Padcev for treating first-line advanced urothelial carcinoma.

Merck's Change To Profit Guidance Provides An Opportunity

Merck's reduced profit guidance is primarily due to recent acquisitions, but the company remains strong with potential for future growth, especially in 2024. Keytruda continues to be a key revenue driver, contributing 45% of Merck's total revenue, with potential for sustained double-digit growth. Strategic acquisitions, like Acceleron, are broadening Merck's pipeline, with new drugs like Winrevair showing promising revenue growth.

Merck (MRK) Advances But Underperforms Market: Key Facts

In the most recent trading session, Merck (MRK) closed at $118.45, indicating a +0.84% shift from the previous trading day.