Merck & Co., Inc. (MRK)

Will Declining Gardasil Sales Ail MRK's Top Line in Q3 Earnings?

Merck faces a sharp Gardasil slowdown as weak demand in China and Japan affects sales of the vaccine.

Trump strikes deal with Merck to cut IVF drug prices in return for tariff relief

President Donald Trump has unveiled an agreement with Germany's Merck KGaA to lower the cost of its fertility medicines in the United States in exchange for exemptions from threatened tariffs, part of his drive to make in vitro fertilisation (IVF) more affordable. Under the deal, Merck will sell its full range of IVF drugs through Trump's direct-to-consumer platform, TrumpRX, and expand manufacturing in the US.

Merck: Earnings Outlook Steady, Keytruda Now Has Some Breathing Room

Merck & Co., Inc. remains the largest U.S. pharma company in 2025, driven by oncology and Keytruda, despite looming patent expiration risks. Keytruda accounts for over half of MRK's pharmaceutical revenue, making its 2028 patent loss a significant challenge for future growth. MRK management is actively working to offset the Keytruda revenue gap, laying a foundation for post-2028 recovery.

Merck: A Golden Buying Opportunity

Keytruda continues to dominate, driving 50% of revenue, with new approvals and delivery methods strengthening MRK's oncology leadership. The company's long-term outlook is also promising, with a full pipeline of new final-stage drugs, an expanding vaccine portfolio, and breakthroughs in animal health products. Despite patent and regulatory risks, MRK's low valuation, strong balance sheet, and 3.8% dividend yield make it appealing for long-term investors.

Merck (MRK) Declines More Than Market: Some Information for Investors

In the closing of the recent trading day, Merck (MRK) stood at $84.81, denoting a -1.04% move from the preceding trading day.

Will Merck (MRK) Beat Estimates Again in Its Next Earnings Report?

Merck (MRK) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Here's Why Merck (MRK) is a Strong Momentum Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Will Keytruda Continue to Aid Merck's Top Line in Q3 Earnings?

MRK's Keytruda remains its dominant growth engine and is expected to have boosted its top line in the third quarter.

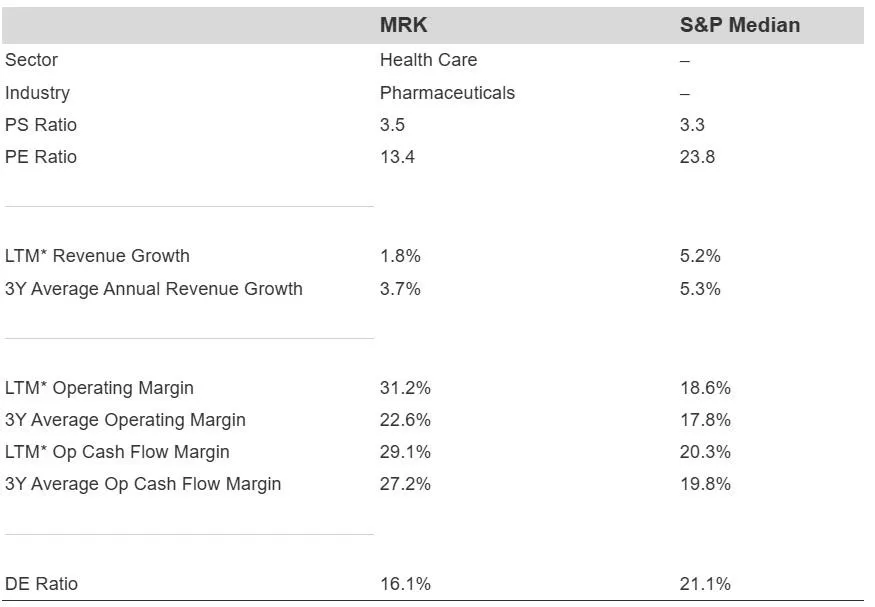

High Margins, Lower Price: Is This Merck Stock's Buying Window?

Merck (MRK) stock merits your attention. Why? Because it offers monopoly-like high margins at a discounted price.

Merck (MRK) Declines More Than Market: Some Information for Investors

Merck (MRK) closed the most recent trading day at $87.61, moving 1.34% from the previous trading session.

Merck Rises 13% in a Week: Should You Buy, Sell or Hold the Stock?

MRK's stock witnesses an upside after Pfizer's pricing deal, but Gardasil's slump and Keytruda's looming LOE keep investors cautious.

Merck: A Race Against The Keytruda Clock

Merck (MRK) is attractively valued, boasting strong free cash flow, robust margins, and a leading position in oncology with Keytruda. MRK faces a looming patent cliff for Keytruda in 2028, but a strong late-stage pipeline and R&D investments offer long-term growth potential. Recent political developments reduce regulatory risks, and the company's diversified operations and pipeline help buffer near-term uncertainties.