Marvell Technology, Inc. (MRVL)

Here is What to Know Beyond Why Marvell Technology, Inc. (MRVL) is a Trending Stock

Recently, Zacks.com users have been paying close attention to Marvell (MRVL). This makes it worthwhile to examine what the stock has in store.

Marvell Technology: The Turnaround We Have Been Waiting For Is Finally Here

Marvell's diverse end markets provide diversification, but until this last quarter, the strong data center growth has been more than offset by weakness in other end markets. With management confidently stating that enterprise networking and carrier markets have bottomed and sequential growth anticipated, most of Marvell's business is now moving in the same positive direction. I see strong upside for the second half due to better-than-expected custom silicon ramps and optics business.

Marvell Technology Inc (MRVL) Trading 3.26% Higher on Oct 2

Shares of Marvell Technology Inc (MRVL, Financial) surged 3.26% in mid-day trading on Oct 2. The stock reached an intraday high of $72.87, before settling at $72.60, up from its previous close of $70.31.

Marvell Technology: It's Time To Get More Constructive (Rating Upgrade)

Marvell Technology's stock has not made a great deal of progress since we last covered it and is effectively down by 9%. We are now revising our rating from a HOLD to a BUY. The AI-related momentum is proving to be better than expected, whilst the non-data center related segments have stabilized and are looking to grow from a low base.

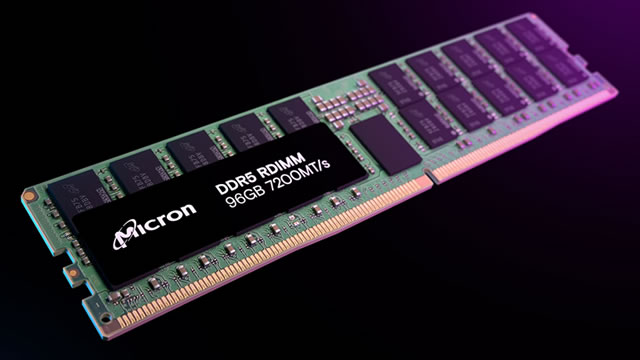

Micron data center strength a positive signal for chipmaking industry peers: analysts

Micron Technology Inc (NASDAQ:MU)'s data center strength demonstrated in its latest quarterly results is a “positive read across” for other chipmakers, including NVIDIA Corp (NASDAQ:NVDA, ETR:NVD), Broadcom Inc (NASDAQ:AVGO, ETR:1YD), Marvell Technology Group Ltd. (NASDAQ:MRVL) and Advanced Micro Devices Inc (NASDAQ:AMD, ETR:AMD), analysts at the Bank of America believe.

Marvell Technology: All Clear For EBITDA Growth To Take Off

I reiterate a buy rating for Marvell Technology (MRVL) due to expected growth acceleration and EBITDA margin expansion. The Data Center segment's revenue grew 7.9% sequentially, and with no signs of slowdown in data center investments, I expect to continue leading MRVL's growth. Margin expansion is supported by strong operating leverage, which should result in increased cash generation, enabling more capital returns to shareholders.

Marvell (MRVL): Strong Industry, Solid Earnings Estimate Revisions

Marvell (MRVL) has seen solid earnings estimate revision activity over the past month, and belongs to a strong industry as well.

Is Trending Stock Marvell Technology, Inc. (MRVL) a Buy Now?

Marvell (MRVL) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Marvell Technology's billionaire co-founder, Sehat Sutardja, has died

The Indonesia born billionaire led Marvell Technology to become one of the world's largest chipmakers before stepping down from the company he co-founded after being accused of fraud

Marvell Technology, Inc. (MRVL) Goldman Sachs Communacopia + Technology Conference (Transcript)

Marvell Technology, Inc. (NASDAQ:MRVL ) Goldman Sachs Communacopia + Technology Conference Call September 11, 2024 6:45 PM ET Company Participants Matthew Murphy - Chairman and Chief Executive Officer Conference Call Participants Toshiya Hari - Goldman Sachs Group, Inc. Toshiya Hari Okay. Great. I think we're live.

Marvell Dips 13% in a Week: Should You Buy, Sell or Hold MRVL Stock?

MRVL's improving profitability, strong pipeline and strategic positioning in the AI revolution justify holding the stock through the current volatility.

Why Analysts Are Bullish on Marvell Despite Sector Weakness

Marvell Technology MRVL is a semiconductor stock gaining hype due to its fast data center revenue growth. It has performed well over the past 52 weeks but is underperforming in its sector.