Marvell Technology, Inc. (MRVL)

Marvell's stock is falling as its earnings didn't live up to the AI hype

The chip company said its record revenue of $2 billion was driven by AI demand for its custom chips, but Marvell didn't deliver upside on its top line.

MRVL's Q2 Earnings Likely to be Powered by AI Silicon & Data Center Boom

Marvell Technology's second-quarter earnings are likely to be driven by surging demand for custom AI silicon, electro-optics and data center.

MRVL to Post Q2 Earnings: Time to Buy, Sell or Hold the Stock?

Marvell Technology's second-quarter fiscal 2026 results hinge on data center strength, AI partnerships, and a rebound in networking and carrier segments.

Wall Street's Insights Into Key Metrics Ahead of Marvell (MRVL) Q2 Earnings

Evaluate the expected performance of Marvell (MRVL) for the quarter ended July 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Nvidia & Marvell Technology: AI Chip Stocks Ahead of Earnings

Few companies embody the AI-driven semiconductor boom more than Nvidia ( NVDA ) and Marvell Technology ( MRVL ). Nvidia has been the undisputed leader in AI GPUs, powering nearly every major AI application, while Marvell has carved out a niche in custom chips for hyperscalers and critical networking infrastructure.

Marvell Tech Reports After The Close 8/28-Options Expire The Next Day

According to NextEarningsDate.com, the Marvell Tech next earnings date is projected to be 8/28 after the close, with earnings estimates of $0.61/share on $2.01 Billion of revenue. Looking back, the recent Marvell Tech earnings history looks like this:

Here's Why Marvell Technology (MRVL) is a Strong Growth Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Here is What to Know Beyond Why Marvell Technology, Inc. (MRVL) is a Trending Stock

Zacks.com users have recently been watching Marvell (MRVL) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Is MRVL's AI Strategy the Key to Data Center Revenue Growth?

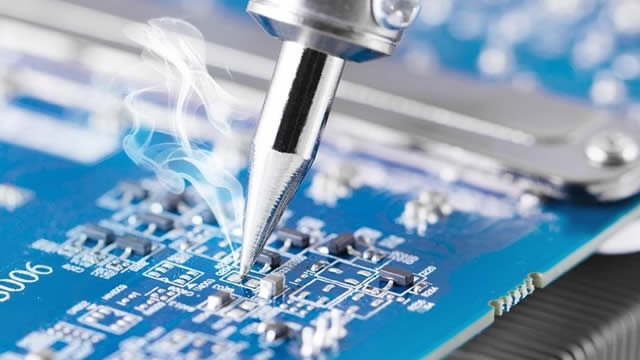

Marvell Technology's surging Data Center revenues are fueled by custom AI XPUs, optics advances, and cutting-edge chip packaging innovations.

MRVL vs. ALAB: Which AI-Connectivity Stock is a Better Buy?

Astera Labs gains edge over Marvell Technology with AI-focused innovations, partnerships, and market momentum in next-generation connectivity.

Marvell: This AI Winner Is Trading At A Bargain

Marvell is a leading fabless chip designer, benefiting from surging data center demand, especially in AI-driven applications. Key growth catalysts include major supply agreements with AWS and Microsoft, positioning Marvell alongside industry giants like Broadcom. The company is improving profitability through cost-cutting and margin expansion, while hyperscaler concentration and trade risks remain watchpoints.

Could Marvell Technology's Stock Price Triple By 2027?

Massive Revenue Projections: A recent Wall Street estimate suggests that Marvell's deal with Microsoft could generate $2.4 billion in revenue by 2026 and $10 to $12 billion by 2027, potentially exceeding the company's overall revenue expectations with just one custom chip deal.