Microsoft Corp. (MSFT)

ETFs Poised to Win in the MSFT vs. NVDA Market Cap Battle

The MSFT-NVDA market cap battle heats up, and ETFs holding both tech giants may be the real winners in this AI-fueled rally.

Microsoft enters portable gaming with new ROG Xbox Ally devices

Xbox players will soon be able to take their favorite games anywhere with the launch of the new ROG Xbox Ally handhelds.

ETFs to Surge as Microsoft Tops $3.5T, Reclaims Top Spot

MSFT hits $3.5T market cap on cloud and AI momentum, fueling gains in ETFs with top exposure to the tech giant.

Microsoft (NASDAQ: MSFT) Stock Price Prediction and Forecast 2025-2030 (June 2025)

Microsoft Corp. (NASDAQ: MSFT) is one of the Magnificent 7 tech stocks and has been a millionaire maker for decades.

Microsoft: Financial Strength Personified, Remain Strong Buy

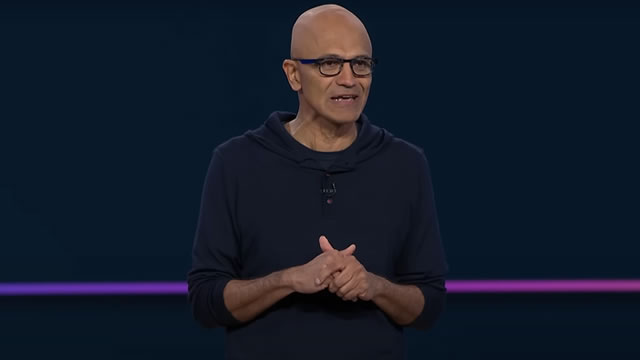

Microsoft remains a strong buy due to its unmatched business strength, diversified revenue streams, and visionary leadership under Satya Nadella. The company boasts dominant moats in enterprise software and operating systems, ensuring recurring revenue and high customer retention. Azure cloud growth, especially from AI workloads, is a key driver, with robust demand and quantifiable returns justifying continued high capex.

Should I invest $100k in dividend stocks like Microsoft for growth and yield?

A Reddit user is thinking about investing $100K in Microsoft. The poster is interested in earning dividends and investing for growth.

Microsoft Stock Proves It Still Has What It Takes

Microsoft stock reached a record high and is in a buy zone. And an internet infrastructure name has doubled during the last nine weeks.

Microsoft shares hit a record. Here's how far other Big Tech stocks are from their highs.

“Magnificent Seven” stocks have been storming back from this year's lows but some have significant room to climb before achieving new records.

Microsoft Expands Security Footprint: Is it the Next Revenue Pillar?

MSFT's cybersecurity push gains speed with AI-driven tools, a growing customer base and a strategic EU initiative.

Microsoft (MSFT) Surpasses Market Returns: Some Facts Worth Knowing

In the closing of the recent trading day, Microsoft (MSFT) stood at $463.87, denoting a +0.19% change from the preceding trading day.

Microsoft Stock Near Peak, Pullback Seen as Opportunity

After moving to within a few dollars of its all-time high on June 3, Microsoft Corporation NASDAQ: MSFT stock fell back a little. It could be a sign of a larger pullback to come.

Thousands of Microsoft Layoffs: What Could They Mean?

24/7 Wall St Microsoft has laid off thousands of workers in recent months.