Micron Technology Inc. (MTE)

Summary

MTE Chart

Why Micron (MU) is a Top Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

Unlocking Q1 Potential of Micron (MU): Exploring Wall Street Estimates for Key Metrics

Get a deeper insight into the potential performance of Micron (MU) for the quarter ended November 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

Here is What to Know Beyond Why Micron Technology, Inc. (MU) is a Trending Stock

Zacks.com users have recently been watching Micron (MU) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Micron Technology Inc. (MTE) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has Micron Technology Inc. ever had a stock split?

Micron Technology Inc. Profile

| Semiconductors & Semiconductor Equipment Industry | Information Technology Sector | Sanjay Mehrotra CEO | XMUN Exchange | US5951121038 ISIN |

| US Country | 48,000 Employees | 3 Oct 2025 Last Dividend | 2 May 2000 Last Split | 1 Jun 1984 IPO Date |

Overview

Micron Technology, Inc. is a global leader in the design, development, manufacture, and sale of memory and storage products. Founded in 1978 and based in Boise, Idaho, Micron operates through four main business units: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. The company's products play integral roles across various markets, including cloud server, enterprise and client computing, graphics, networking, industrial, automotive, smartphone, and other mobile devices. Micron markets its products globally through a combination of direct sales forces, independent sales representatives, distributors, and retailers. It also utilizes a web-based direct sales channel, alongside channel and distribution partners, under the Micron and Crucial brands, as well as private labels.

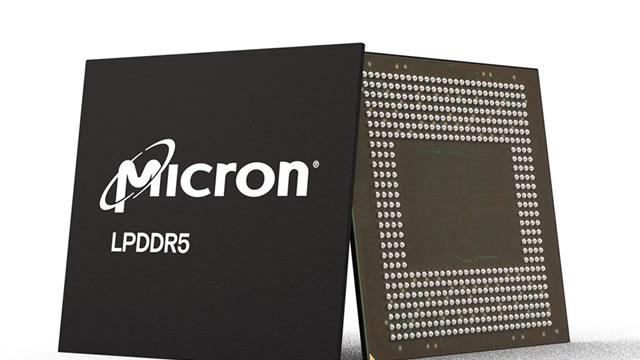

Products and Services

- Dynamic Random Access Memory (DRAM):

These semiconductor devices are known for their low latency, offering high-speed data retrieval. They are used across various applications, including cloud server, enterprise, client computing, graphics, networking, and automotive markets.

- Non-Volatile Memory:

This category includes both re-writable semiconductor storage devices and re-writable semiconductor memory devices that offer fast read speeds. These products are critical for smartphone and other mobile-device markets, providing persistent data storage.

- Solid State Drives (SSDs) and Component-Level Solutions:

Micron offers SSDs and component-level storage solutions for the enterprise and cloud, client, and consumer storage markets. These products are essential for enhancing data storage capabilities and performance in various computing environments.

- Discrete Storage Products:

The company provides discrete storage products in components and wafers. These products cater to the specific needs of the automotive, industrial, and consumer markets, where tailored storage solutions are often required.

- Memory and Storage Products for Specialized Markets:

Micron's memory and storage solutions also extend to automotive, industrial, and consumer markets, demonstrating the company's versatile application of its technologies to meet the diverse needs of these sectors.